-

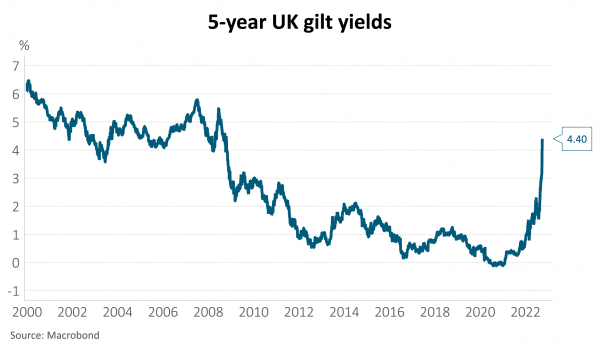

UK bond yields soared after aggressive tax cuts, to be funded with increased debt, were announced by Liz Truss’s new Chancellor, Kwasi Kwarteng.

-

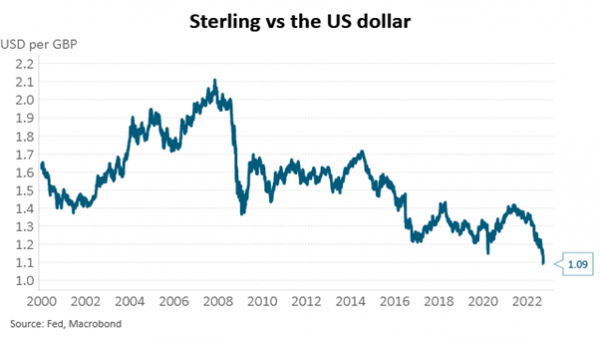

In just 72 hours, the UK 5-year government bond (gilt) yield rose by 1.2 percentage points to 4.7% and the British pound (sterling) dropped by 6% against the US Dollar.

-

The harsh market reaction highlights how far the market has moved from the Covid-era ideas of Modern Monetary Theory, where debt-driven stimulus was championed. In the current environment inflation fighting and more prudent fiscal policy are again at the centre of responsible economic management.

The United Kingdom shares economic challenges facing much of the developed world, but arguably even more intensely. Retail price inflation is running at 12.3% YOY, the labour market remains tight and confidence is weak. Government finances have deteriorated, with the debt/GDP ratio at 99% and the current account is in deep deficit. The Bank of England has been hiking interest rates to dampen demand.

In this context, the decision to provide stimulus by cutting household and business taxes, especially the move to additionally cut the is hard to fathom. Financial markets were not impressed, especially as it was revealed the decision was made without advice from the UK Treasury. The market reaction has been intense.

The weakness in sterling is arguably the most notable. While central banks have embarked on a rate hike path, the US Dollar has strengthened as it has been relatively less affected by the Ukraine war and has adapted to Covid more rapidly than many other countries. Meanwhile, sterling has been beset with Brexit challenges. This backdrop, combined with the latest policy stumble, leaves global investors with a difficult decision with regards to their willingness to own either the British pound or gilts.

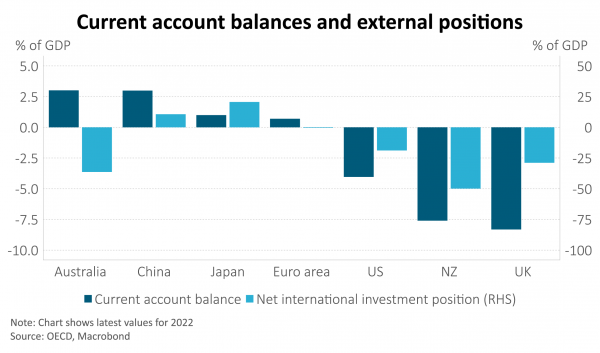

In this regard, the current account balance, which has been a perennial red herring for financial markets, is getting more attention. Running a large current account deficit has been enabled by a willing global appetite to fund Britain’s spending. Investors have to like the sterling, or find British bonds at a yield sufficiently attractive to choose to invest. Unfortunately for British firms, mortgagors, and the government, that funding now comes at a much higher interest rate.

A new (old) focus for financial markets?

Ever since central banks started assertively hiking rates to combat the recent surge in inflation, there has been a question mark about who is the least able to cope with higher interest rates. That question hasn’t yet been clearly answered. This latest episode in the UK hints that current account deficits and countries’ net debt positions may become metrics that get closer scrutiny.

At present, headline inflation around the world looks to be peaking, albeit with uncertainty about where inflation eventually settles. One can argue that the broad inflation outlook is now priced into markets, to a greater or lesser extent. Accordingly, financial markets which are forever looking for new themes to obsess over, may be ready for a shift in their focus for risks.

We can also reasonably conclude that Modern Monetary Theory, which was fashionable during the Covid-19 pandemic, is fully debunked. That theory suggested that governments could finance a massive increase in debt via QE programs and money printing. The world’s recent experience with inflation and volatility this latest week in UK markets, strongly suggests otherwise. Cutting taxes for the right reasons may be the correct long-term answer to develop the supply-side response to reduce inflation, however timing is everything with macro-policy.

Where does New Zealand stand?

The New Zealand current account deficit has deteriorated to -7.7% of GDP as at June 2022, from an average of a deficit of around 3% over the previous decade. Covid factors have driven this deterioration. Excessive stimulation has meant that Kiwis have been importing goods frenetically, while tourist receipts have been non-existent. Both metrics should improve. Government spending was very vigorous over the last two years and was more aggressive than most other developed countries. The government debt/GDP ratio has lifted to 45%, which is still healthy by global standards, albeit successive New Zealand governments have recognised the vulnerability of the economy to shocks and the under-funded nature of many future liabilities. Hence there has been a built in political and economic preference to run relatively low debt/GDP metrics. But the UK experience this week does provide a message to other governments as we move to a higher interest rate environment. That message is to take fiscal issues seriously; there is a limit to the stimulus you can provide and the borrowing you can do. And we also need to remember in New Zealand that our debt is mainly held by households, in the form of mortgages, which in turn are funded by banks, who must go to offshore markets for a large share of that financing.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.