From doing no harm to doing good

The future of wealth is shaped by a new generation of investors - bringing new thinking, expectations, and standards. Across this four-part series, Harbour delves into the evolving landscape and strategies for generating customer value, poised to be the primary catalyst for both present and future transformations in the sector.

In part three, Senior Credit Analyst, Simon Pannett, explains the responsible investment spectrum and the growing need for the industry to possess expertise in ethical and responsible investment choices for investors.

A survey[1] of over 1000 Kiwis confirmed what many in the industry have long suspected: investors increasingly want their savings to be invested ethically or responsibly. Interestingly, the survey showed substantial growth in the portion willing to do something about it if their current choice didn’t cut the mustard, with 59% of respondents indicating a willingness to change funds. This tells us that investors don’t just feel responsible investing is a nice-to-have. They truly want substance from their fund managers, and the advice they receive, leading to growing pressure on the industry to catch up.

Consumer expectations

According to the Mindful Money survey, despite high levels of financial uncertainty and volatility, the demand for ethical investment options continues to gain momentum, particularly amongst women and the Millennial and Gen Z generations. In addition, New Zealanders increasingly expect ethical and responsible investments to perform better than traditional funds in the long term.

This brings growing demand for us as an industry to possess expertise in ethical and responsible investment choices and the ability to integrate different values into investment recommendations. As responsible investing becomes more mainstream, financial advisers will undoubtedly benefit from providing investment strategies that generate both financial returns and the positive social and environmental outcomes their clients now demand.

In a market with changing expectations, fund selection becomes more challenging. There is no one-size-fits-all approach to responsible investing – it’s about seeking to understand investors’ needs and providing responsible investing advice that best matches their needs.

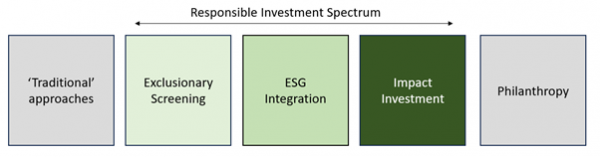

Responsible investing sits on a spectrum, from an exclusionary approach, whereby investments in sectors that clash with investors’ values are omitted, all the way to impact investing that seeks out investments where positive change is actually being made.

Exclusions:

Once the hard part of charting an investor’s values is done, evaluating a fund that follows an exclusionary approach is relatively straightforward, much like the approach itself. But, as with all things ESG (environmental, social and governance), ‘relatively’ must prefix straightforward as it is wise to check the fine print of a fund’s exclusions. For example, differences can be found in how various sectors that are excluded are defined and in the materiality thresholds that are being used to exclude companies.

Mindful Money’s website provides an excellent repository of fund exclusions and useful comparison tools, but you will need to consult a fund manager’s website for the nuance.

Integration:

Integration approaches incorporate ESG into investment decision-making processes, including engaging with companies to effect change. This category isn't as absolute as an exclusionary approach and this grey area complicates a prospective investor's appraisal of a fund. We suggest getting to know a fund manager and forming a view on their authenticity: are they engaging to improve outcomes or as a marketing ploy; do portfolio holdings represent a process that is allocated more towards strong or improving ESG performers; is the fund manager's own corporate behaviour consistent with taking ESG seriously?

RIAA certification and publicly available UN PRI reports can aid this due diligence process. We would note UN PRI submissions are self-reported and not verified, so sighting examples of the manager's ESG process will give depth to an appraisal.

Impact Investing:

Impact investing flips the exclusionary approach around and allocates capital to support companies making a positive difference. Impact funds tend to invest in securities which make an impact in either the environmental or social arena. Examples could be companies focusing on equitable healthcare, critical infrastructure, waste reduction or renewable energy. These investments also seek financial returns, thus stopping short of philanthropy. While impact fund managers may undertake engagement and hold transformed businesses, investments are less likely to be undertaken based on a thesis of improvement from poorly performing companies. This means impact is more self-evident when viewing portfolio holdings.

Barriers

The most common barrier when it comes to responsible investing is consumers not having the time or know-how to navigate the different investment options available to them, so it’s essential that investors have information on ethical and ESG issues.

This barrier at least partly reflects that lack of consistent and comparable metrics for investors to be able to easily do their own research. As consumers are increasingly concerned about greenwashing, they are looking for information that is independent, clear, trustworthy and comparable. Transparency from fund managers is key.

Impact funds should provide reporting to quantify the impact that investors' capital is making and provide case studies bringing the process to light. Impact fund certification remains nascent and Mindful Money is evolving to provide prospective investors greater detail and fund comparison tools.

When appraising all funds, and particularly impact funds, investors must also consider diversification and liquidity.

At Harbour, we believe a solely exclusionary approach, whereby some sectors are barred from investment, is not sufficient. The environmental, health and social challenges the world faces cannot be solved by allocating away from companies, but rather by allocating towards change makers. It is with this belief that the Harbour Sustainable Impact Fund was born. More investors are sharing this view and edging to the right of the responsible investing spectrum. This, in turn, brings opportunities for advisers to play a crucial role in guiding them towards meaningful and profitable investment solutions.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.

[1] Voices of Aotearoa: Demand for Ethical Investment in New Zealand 2023. Responsible Investment Association Australasia, Mindful Money.