Key Points

- Overnight, the US Federal Reserve executed an out-of-cycle 50 basis point cut as financial conditions have deteriorated sharply over the last week.

- The closed circuit of declining confidence driving lower risk appetite, leading to increased financial stress and back to declining confidence, can be broken by government fiscal policy and monetary policy stimulus.

- We expect a concerted global effort across governments and central banks to support economic growth. New Zealand will be part of that effort.

What will this achieve?

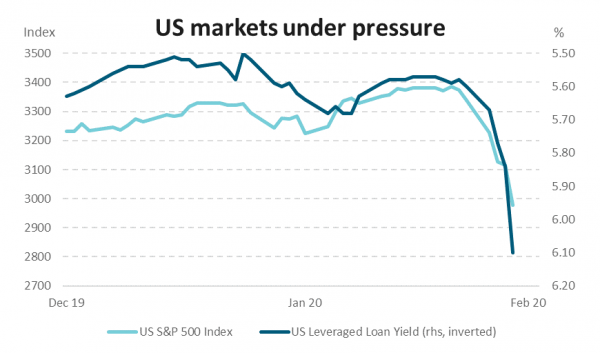

Financial conditions have deteriorated sharply over the last week. The US S&P index fell 15.8% from the record highs seen in February, though a bounce now leaves it down 11.5%. Borrowing costs of lower quality loans in the US have risen by 0.8%.

Source: Bloomberg

Cuts in interest rates will obviously have no effect on the public’s health. However, there are large economic uncertainties that the supportive action by governments and central banks can partially mitigate.

A lack of confidence poses an imminent risk.

Specifically, sharp declines in consumer and business activity, as individuals are either forced to quarantine or choose to do this themselves, has occurred in China and is a likely outcome in other regions. This reaction, accompanied by a lack of business and market confidence, reduces activity and creates financial stress, leading to increased defaults and bankruptcies. Unnerved markets, in anticipation of this stress, can exacerbate this situation by reducing lending and increasing interest rates. This closed circuit of declining confidence driving lower risk appetite, leading to increased financial stress and back to declining confidence, can be broken by government fiscal policy and monetary policy stimulus.

Are interest rates the right tool?

There is an argument that lower interest rates are not appropriate in this environment and other means of support are needed. This is partially correct but, to the extent that lower interest rates can dampen some of the negative consequences, they are useful. Furthermore, failure to lower interest rates runs the risk of further stoking the fear in markets as the chances of economic recovery diminish. From the central bank’s standpoint, the economic shock will be exacerbated if confidence deteriorates, so any support they can offer will reduce negative outcomes and help them reach their inflation targets.

What do we expect in New Zealand?

We expect a concerted global effort across governments and central banks to support economic growth. New Zealand will be part of that effort. From the Government, we are already seeing support packages being drawn up; from the Reserve Bank of New Zealand we expect rate cuts. While there is uncertainty over the size of any moves, we currently expect the Official Cash Rate (OCR) to be reduced from 1.0% to 0.5%. Timing is also uncertain, but most likely is a cut at the March OCR review.

What are we monitoring?

The scientific communities understanding of COVID-19 is developing fast and we monitor this closely. Economic scenarios vary widely and are very dependent on consumer behaviour and confidence. Valuation declines in risk assets, as investors become unwilling to accept risk, can be self-fulfilling and we look to see if the circuit breakers of fiscal stimulus and interest rate cuts are effective. We also are assessing if valuations capture a scenario of widespread infection rates (typical of those of the seasonal flu) as this outcome is appearing increasingly likely.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.