Key points

- The MSCI All Country World (global shares) Index rose 6.1% over the month in NZD-unhedged terms, and 7.1% in NZD-hedged terms.

-

The New Zealand equity market (S&P/NZX 50 Gross with imputation) finished the month up 5.7%, whilst the Australian equity market (S&P ASX 200) rose 5.7% in AUD terms in the month, and 6.3% in NZD terms.

- Bond yields declined over the month with New Zealand 10-year government bond yields ending the month at 3.42%, representing a 0.45% decrease for July. The story was similar in the US where 10-year yields ended at 2.65%, a decrease of 0.36% for the month.

Key developments

Markets have absorbed significant monetary policy tightening and some of the expected downgrade in earnings forecasts as economic activity slows. Bond and equity markets are sufficiently forward looking to consider the outlook for inflation and economic growth well into 2023. And the expectation has switched from the need for central banks to take interest rates well beyond neutral, to a modest tightening in monetary policy.

This modest easing in interest rate increase expectations seemed to be enough for both bond and equity markets to stage a very large rally in July. July is typically a time of nervousness in equity markets as investors wait for ‘confessions’ from Annual General Meetings (AGMs) and earnings reports for the period to June.

The rally in July could be explained by a confluence of factors. A partial reduction in interest rate rise expectations, better-than-expected results ‘confessions’ for the June period, solid AGM reports, and a shift in positioning as short bond duration positions were reversed and cash injected into equity markets. A side effect for equities was also a large sector rotation emerging out of cyclicals and value stocks back into growth-oriented stocks which had been de-rated significantly in the prior six months.

Fixed income markets were relatively stable through the first half of the month, with economic data both globally and domestically steadily building a picture of growth slowing, while inflation continues to persist at a very high level. Late in the month the US Federal Reserve hiked the Fed Funds Rate by 0.75%, but the tone of communications prompted a further fall in bond yields, as a slower pace of hikes at future FOMC meetings was anticipated by the market. This flowed directly into the New Zealand market, with domestic data having only a modest impact.

What to watch

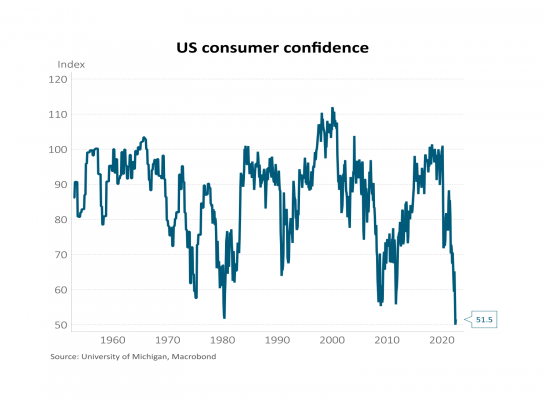

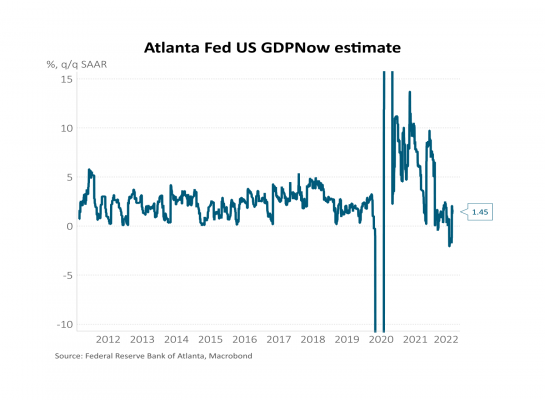

Slowing global growth is replacing high inflation as the key concern in financial markets. The US economy contracted for the second consecutive quarter in Q2. While this is unlikely to be labelled a recession given ongoing labour market strength (almost 3 million jobs were added in H1), forward activity indicators have deteriorated. The property sector looks particularly weak with large declines in building permits, housing starts and sales. Consumer confidence remains close to all-time lows and financial conditions are now tight. The US economy is expected to grow just 2% this year and 1.3% next year. Elsewhere, European Q2 growth was stronger than expected but record-high energy prices are likely to push the economy close to recession in the second half of the year. Chinese economic activity continues to be hampered by rolling COVID lockdowns and a troubled property sector.

Market outlook and positioning

Is this equity rotation and period of outperformance of quality growth likely to continue? If corporate profit trends for growth companies positively surprise in August, and bond yields remain rangebound, we consider that growth sectors may continue to perform well. In part this reflects that the balance of risks suggests that economic data continue to deteriorate and negatively influence earnings forecasts for cyclical stocks, especially consumer, housing and perhaps resource sectors.

Where we differ from some analysts is that, on the balance of risks, it is not the time to take a bearish view of equity markets. A real growth recession may not deliver an overall decline in profits. Company revenues are more correlated with nominal GDP, and a collapse in earnings is typically more highly correlated with a fall in nominal GDP. If inflation is peaking, markets may broadly be able to look through the actual tightening of monetary conditions and hence the long-term bond yield anchor for equity market valuations can remain in place. The rally in bond yields has provided a solid base for confidence in equity markets.

In terms of sector positioning, we remain less confident in the New Zealand economic outlook relative to Australia, and perhaps the US economy. This view has increasingly become a consensus perspective as the valuation of the New Zealand equity market has de-rated significantly. Several larger New Zealand companies have also delivered excellent trading updates, and the New Zealand market is less reflective of the underlying economy. A recession in New Zealand is less likely to be correlated with the underlying earnings of the equity market compared to many other markets. Hence it is a time to be active and selective. In our opinion the case for a large under-weighting of the New Zealand equity market either on valuation or economic growth grounds is in the rear-view mirror.

Within equity growth portfolios, our strong bias is to retain a large sector position in the healthcare sector. Recent active changes include eliminating exposure to base metals and reducing resource exposures given ongoing concerns regarding Chinese demand. Additionally, we remain cautious on Australian and New Zealand consumer and housing exposures which, by implication, provide some uncertainty for momentum in bank lending growth and financial exposures.

Within fixed interest portfolios, our current strategy continues to be focused on the New Zealand macroeconomic situation and the approach the RBNZ is expected to take to drive inflation back towards the target range. We expect the RBNZ to continue to hike the OCR to at least 3.5%. As with the US Federal Reserve, the pace of hikes may slow down as the OCR reaches restrictive territory, but we don’t expect the RBNZ to drop its focus on inflation. As bond yields have fallen back from the elevated levels seen several weeks ago, we have reduced the size of our long duration position.

Within the Active Growth Fund, we made no major changes to positioning in July after entering the month overweight equity markets. Our equity exposure remains diverse, though is tilted away from cyclical and value strategies which may find it tough to navigate a slowdown in economic growth.

Within the Income Fund, in early August we reduced equity exposure, cutting back investments in global equities and Australasian listed property. Both have rallied meaningfully in July and are now getting somewhat expensive. The combination of reduced equity exposure and shorter duration in fixed income has meant the Fund’s overall market exposure and riskiness has been reduced. Our expectation is that repricing of rate hike expectations can provide better levels to reinvest in the weeks to come.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.

This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.