Key market movements

- The MSCI All Country World Index (ACWI) increased 3.1% last month, in New Zealand dollar-unhedged terms. The gain, however, was entirely due to a sharp drop in the NZD with the index falling 1.7% in NZD-hedged terms in December – so much for the Christmas rally!

- Locally, the New Zealand equity market eked out further gains in December with the S&P/NZX 50 Gross Index (including imputation credits) up 0.4%. Australian equities had a disappointing month with the S&P/ASX 200 Index down 3.2% (-2.6% in NZD terms).

- NZ bonds registered notable outperformance versus their global counterparts in December. The Bloomberg NZ Bond Composite 0+ Yr Index gained 0.6%, despite a 3bp lift in 10-year NZGB yield to 4.41%. The Bloomberg Global Aggregate Bond Index (hedged to NZD) fell 0.9% as US 10-year Treasury yields gained 40bp in the month to finish at 4.57%.

Key developments

The Fed is likely close to the end of its easing cycle as growth remains resilient and progress on returning inflation to 2% has stalled. At its December meeting the Fed cut rates by 25bp to 4.5% but forecast just 50bp of further easing through next year, 50bp less than the previous projections made in September. In the press conference, Fed Chair Powell emphasised a cautious approach to further rate cuts as progress on getting inflation back to the 2% target had stalled. The Fed’s preferred measure of core inflation turned higher in recent months and currently sits at 2.8% y/y – perhaps not surprising given the labour market remains healthy, and the economy continues to grow above trend. Trump policies represent additional inflation risks that some Fed official have started to incorporate into their thinking.

The Australian economy may finally be cracking, bringing forward expectations of RBA easing. Australian GDP grew just 0.8% y/y in Q3, vs. RBA expectations of 1.1%, as households continue to feel the pinch of lower real wages and high mortgage rates. Pressure is also building in the housing market as these dynamics combine with declining population growth to cause some of the first house price declines in Sydney and Melbourne that we have seen this cycle. While the unemployment rate unexpectedly dropped to 3.9% in November, from 4.1%, the market still prices a better than 50% chance of the first RBA rate cut to happen in February.

The latest NZ GDP numbers showed economic momentum took a sharp downward turn in the middle of 2024, likely encouraging faster RBNZ easing. GDP dropped by more than 2% over Q2 and Q3, versus RBNZ estimates of 0.4%. The weakness was relatively broad based with primary industries the only area of strength. While upward revisions to the prior two years mean the level of GDP is not all that different to RBNZ expectations, the rapid loss of momentum is likely to raise alarm and encourage a faster easing cycle than forecast in the November MPS. The market now prices a small chance of a 75bp rate cut in February, conscious that the current OCR of 4.25% is still well above neutral and looking increasingly inappropriate for a weak economy with inflation close to target.

What to watch

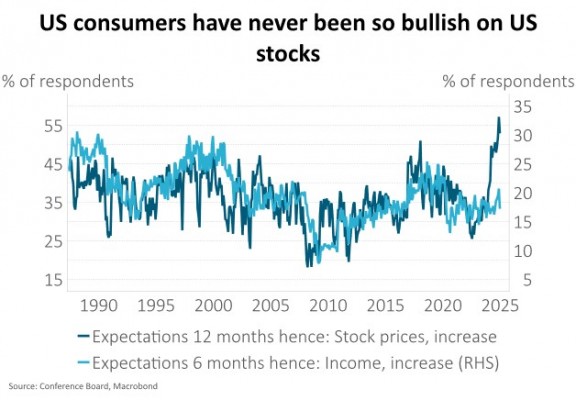

In December, Deutsche Bank pointed out that US consumers have never been so optimistic about US stock market gains over the next year and that this view sits in stark contrast to their optimism about income gains. Retail investors tend to form the final part of a speculative move higher in asset prices and this could be one of those moments. Deutsche Bank notes that aggregate US equity positioning is currently sitting at the 90th percentile and most market participants and analysts are bullish US stocks for 2025. It goes on to say that often when there is such an overwhelming consensus, corrections can occur more easily, making this one of the most obvious market-related risks for 2025.

Market outlook and positioning

Just like a New Zealand summer break, investors should be ready for a range of investment weather in the near term. Expectations of slower and shallower interest rate cuts from the US Fed have already taken some exuberance out of capital markets, but the Fed and the Reserve Bank of New Zealand are likely to keep recalibrating official interest rates lower, providing support for parts of the share market.

The near-term risk for capital markets may be the impact of the Trump-led Republican Government’s ‘maganomics’, America first policies, and the rest of the world’s reaction to the policies. This could slow global growth and make inflation stickier. The key medium-term upside risk for equity markets remains margin expansion due to efficiency programs and tailwinds from secular trends such as the broad introduction of artificial intelligence which support earnings expectations.

Overall, the balance of factors points to more caution regarding the potential for significant global share market returns. There is a wider range of potential global policy settings that may influence the share market and valuations remain extended. However, Actual earnings per share (EPS) results could beat consensus market expectations, partly offsetting risks from the recent move up in long term bond yields. NZ share market returns may be supported by a backdrop of conservative EPS expectations with upside potential, ongoing cuts to official rates boosting the relative attractiveness of NZ shares and low levels of investor positioning in NZ share’s relative to history. The New Zealand market currently offers a one-year prospective dividend yield of 4%, and earnings per share could grow at a high single digit compound annual growth rate over the next few years. The combination suggests the NZ share market could potentially deliver a high single digit, low double digit return in 2025 with earnings growth the main driver of returns. We remain selective in Australia noting earnings revisions moved to being positive over the month led by the utilities and financial sectors.

Within equity growth portfolios, Harbour’s strategy remains to be patient, position for a range of scenarios and to be selective, focusing on quality growth. We continue to focus on companies delivering earnings per share growth, particularly where that earnings growth has the potential to be higher and last for longer than consensus expectations allow for. We continue to see the secular tailwinds of digitisation, disruption, de-carbonisation, and demographic changes as supporting company earnings. We hold overweight positions relative to benchmark in companies with secular tailwinds in the defensive growth healthcare sector and the higher growth information technology sector, where businesses are supported by strong cashflows. We are also overweight selected materials and consumer staples shares that benefit from structural change and have pricing power. We continue to have a bias towards quality, well-capitalised businesses that are well positioned to fund value adding growth opportunities. We remain underweight lower growth utilities, telecommunications, infrastructure and real estate sectors.

In fixed interest portfolios, we are facing contrasting pressures from domestic and offshore. Headline inflation in New Zealand is now very close to 2% and with the domestic economy looking likely to only find a gradual path to economic recovery, we expect the Reserve Bank to lower the Official Cash Rate below 3%. That is supportive of market returns for the short end of the yield curve. In contrast, pressure exists for longer-term bond yields to rise, largely due to developments in the USA, where the combination of a resilient economy and proposed tariffs are adding to inflation concerns. Meanwhile in New Zealand and elsewhere, fiscal deficits are large, which also add to pressure on long-term rates. Our strategy is to favour shorter-dated securities until such time as we believe long-term rates sufficiently price in the risks described above.

Within the Active Growth Fund, we continue to be mindful of relatively full valuations within global equity markets, particularly the US and are minded to sell rallies more than buy dips and remain underweight growth assets. Bond yields, particularly within global fixed interest are looking more attractive in a relative sense. Currency wise, we are holding a higher level of hedging within our global equities, the NZ dollar’s plunge towards COVID lows has seen it undershoot our fair value models.

In the Income Fund, we are shifting emphasis towards risk management as opposed to opportunities at present. Risks within fixed interest markets, elevated equity markets and geopolitical/policy uncertainties are not a particularly conducive mix for investing for clients with limited tolerance for downside.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.