- The MSCI All Country World Index returned 3.2% over the month in New Zealand dollar-unhedged terms, and 6.0% in New Zealand dollar-hedged terms.

- The New Zealand equity market (S&P/NZX 50 Gross with imputation) finished the month up 2.5%, whilst the Australian equity market (S&P ASX 200) rose 6.0% in Australian dollar terms in the month, and 2.7% in New Zealand dollar terms.

- Generally, bond yields rose over the month with global rates, such as the US, where 10-year government yields ended the month at 4.02%, an increase of 0.22% for the month. New Zealand 10-year government bond yields bucked the global trend, ending the month at 4.18%, representing a 0.12% decrease for October.

Key developments

October saw a recovery in equity market returns as earnings announcements were better than expected and markets anticipated the peak of policy tightening. With elevated inflation data prints continuing, central banks remained hawkish (more interest rate increases likely) contributing to a further increase in longer-term bond yields early in the month. Equity markets firmed towards the end of the month as forward-looking investors focused on falling lead activity and inflation indicators, supporting a view that central banks are closer to the end than the beginning of their interest rate increase cycle. Additionally, the UK reversed its infamous announcement of fiscal stimulus and now promises austerity under its new leadership. This change relieved pressure on debt markets, leading to a further improvement in sentiment for the equity market.

Over the month, we saw further evidence of slowing global activity. The S&P Global US Composite PMI printed below 50 (indicating contracting economic activity) during October for the fourth consecutive month. Tighter monetary policy is feeding its way into economies, with US financial conditions close to the tightest they have been since the Global Financial Crisis, though households and the financial system are in a much stronger position to weather these conditions compared to 2008.

The New Zealand economy is beginning to respond to tighter monetary policy. Despite strong job security and rising wages, data released in October confirmed that households increased their rate of savings by reducing consumption in Q2. This behaviour is consistent with the increasingly challenging economic outlook and large wealth losses households have experienced this year. We think further reductions in consumption are likely. House prices have fallen 11% from their peak in November 2021. Further falls seem likely as mortgage rates continue to increase and more borrowers are exposed to higher rates. Potentially negative population growth due to net migration outflows may also lower further demand for housing and the outlook for residential investment.

Despite the challenging domestic outlook, inflation is not yet falling as quickly as the Reserve Bank of New Zealand (RBNZ) would like, encouraging markets to price a high chance of a 75bp rate hike at the November Monetary Policy Statement meeting and a further 100bps by the middle of next year. Annual CPI inflation only dropped 0.1 percentage point in Q3 to 7.2%, versus an RBNZ forecast of 6.4%. While most of the surprise was driven by tradable inflation, there were broad-based increases in prices that will likely irritate the RBNZ. The central bank's preferred measure of core inflation increased to 5.4% y/y, from 5.2% in Q2. New Zealand dollar weakness is providing an additional source of inflation for the RBNZ to consider, as the currency currently sits below the bank’s forecasts.

What to watch

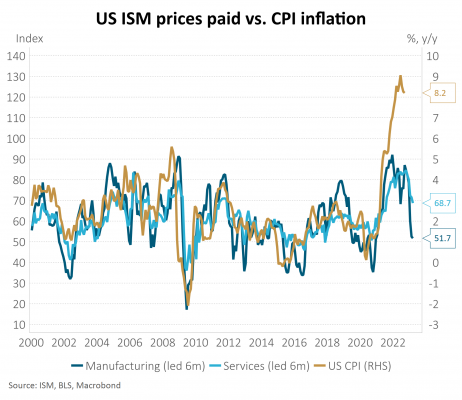

Some positive signs on inflation but plenty still to do. The prices paid component of the recent US ISM Manufacturing Survey, which has typically provided a good lead on future inflation outcomes, has trended downwards. Survey data have also shown improvement in supplier delivery times which backs up some of the data we are seeing from supply chain pressure indices which have been moving down rapidly. While it would be premature to declare victory over inflation, especially with such a strong labour market, there is significant positive progress in some areas.

Market outlook and positioning

The prevailing investment view so far in 2022 has been persistent inflation, hawkish central banks and slowing economic growth. This has led to very negative returns for bonds and one of the largest valuation drawdowns for equities in the post-World War II period. The level of interest rates priced into bond yield curves, in New Zealand in particular, appears right at the top end of reasonable expectations. As a result, when we look forward, we expect the focus of markets to shift away from macroeconomic factors and expect micro-economic, stock-specific factors to start having a larger influence on market returns, particularly in stock markets. The time for bonds to dominate corporate factors, in our view, is coming to an end.

Within equity growth portfolios, we continue to seek safety in quality of defensive growth stocks including those in the healthcare sector that can sustain and grow returns through a period of slower cyclical economic activity. The portfolio also has selected exposure to cyclical growth stocks including financial stocks that have pricing power to deliver higher earnings in a period of higher inflation and increasing interest rates. And the portfolio maintains a healthy investment in long-term, quality compound earnings growers that benefit from structural tail winds such as industry disruption, demographic change, digitisation and de-carbonisation. The portfolio retains a negative bias to cyclical stocks that need a strong economic tailwind. For example, consumer-facing stocks may provide 'ok' updates for historic periods, but they may yet to have faced the full impact of a consumer crunch as higher household costs outrun higher household incomes.

Within fixed interest portfolios, we hold a long duration position, based on an expectation that the RBNZ does not hike as far as the market expects, and that, as we head into 2023, we will see more tangible signs of weakness in household spending. That may entice the market to anticipate a slower pace of rate hikes and a pause during H1 2023. We continue to hold inflation-indexed bonds, as market pricing is consistent with CPI being around 2.5% over the next 10 years. We view this as optimistic, with the risk being that inflation persists at a somewhat higher level. These bonds also enjoy very strong effective yields at present, as they accrue the high inflation we are currently experiencing. Credit spreads in the corporate bond market have also been quite volatile. Notably, the high-grade issues from LGFA (Local Government Funding Authority) and Housing NZ have widened, as offshore selling has persisted for a while. Our assessment has been that valuations have shifted from expensive to fair, or mildly attractive. The portfolio has been underweight this sector and we have started to rebalance. The positioning has been beneficial, particularly in October. Overall, we are retaining a fairly cautious approach to corporate bonds, as risks of an extended period of economic weakness may cause investors to demand higher spreads on corporate bonds.

Within the Active Growth Fund, with investors continuing to hold below long-run levels of investment in equities and equities trading on better valuation multiples, a fall in overall capital market volatility and a refocusing on long-term earnings may support better returns over the medium term. Against this backdrop, we have closed our underweight position to equity markets over the month. The Fund also has a small overweight to interest rate duration.

Within the Income Fund, over recent months, we have taken a cautious approach to equity markets. In October we took a first step towards adding exposure, although we are still underweight the Fund's neutral 32% allocation. In early October we lifted exposure from 23% to 27%, buying into growth-styled exposure. Growth-styled equities are not core for the Income Fund, as the longer-term preference is for more stable, dividend generating stocks. However, the income securities sector had become fairly expensive, as risk aversion amongst equity investors has seen support shift to defensive equities. By contrast, investors have been reducing exposure to growth equities and these may be in the best position to rally. There is a tactical aspect to these decisions, and we feel this is an appropriate approach at present. Equities still face challenges, but our judgement is that this arises from earnings risk in the event of a sharp economic slowdown, rather than from the risk of higher inflation and higher interest rates. However, at present, we expect to be lifting equity exposure over time.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.