Key points

- The MSCI All Country World (global shares) Index fell -1.5% over the month in NZD-unhedged terms, and -2.9% in NZD-hedged terms.

- The New Zealand equity market (S&P/NZX 50 Gross with imputation) finished the month up 0.9%, whilst the Australian equity market (S&P ASX 200) rose 1.2% in AUD terms in the month, and 1.8% in NZD terms.

- Bond yields rose over the month with New Zealand 10-year government bond yields ending the month at 3.98%, representing a 0.56 percentage point increase for August. The story was similar in the US where 10-year yields ended at 3.19%, an increase of 0.54 percentage points for the month.

Key developments

Equity markets were generally buoyant for the first part of the month; however, hawkish comments from central bankers around the US Federal Reserve’s Jackson Hole meeting towards month end shook market sentiment. The renewed commitment from central bankers to battling high inflation leaned against prior market expectations of a pivot to a more moderate tightening process. This shift contributed to another tough month for bond markets with bond yields up globally. As a result, bond yield-sensitive and higher growth stock valuations fell in-step.

Fixed interest markets continue to be keenly focused on inflation, monetary policy signals from central banks and the state of the economy. Conversations about the economy are largely centred on two competing themes: supply-based constraints, especially in the labour market and forward-looking concerns about recession risks. In July, recession fears and the prospect of fewer rate hikes drove New Zealand 10-year government stock yields down to the lowest since April. In August focus shifted almost entirely to comments made by central banks. In synch with other central banks, the Reserve Bank of New Zealand (RBNZ) re-affirmed their resolute focus on getting inflation back down towards their target range.

Economic data points continue to show a peaking in price inflation. UBS’s proprietary global Inflation Bottleneck Tracker showed a fifth consecutive month of falling price pressures, after stalling in March/April (reflecting the Russia/Ukraine war and COVID restrictions in China). The decline in leading inflation trends is already relatively broad-based: delivery times and shipping costs are improving rapidly amidst the economic slowdown, backlogs of electronic components are back to long-run averages, and orders/inventory ratios have swung from historical highs to historical lows. China-related restrictions are still holding back part of the bottleneck indicator including air freight costs remaining elevated.

What to watch

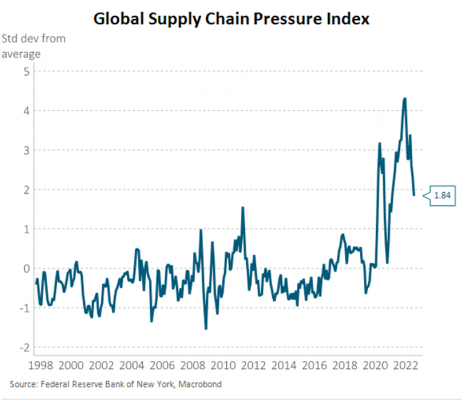

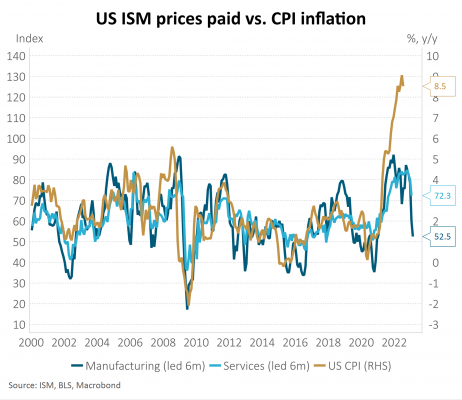

This slowdown in global demand has taken pressure off commodity prices and allowed supply chains to partly normalise. Oil prices, for example, are almost 20% lower than their mid-June peak. Aggregate measures of global supply chain pressure have more than halved since peaking in December of last year. US business surveys suggest headline inflation may approach 4% year on year over the next six months – less than half the current rate.

Market outlook and positioning

Going forward, the combination of softening economic and inflation data is likely to cap the rise in yields of longer maturity (10- and 30-year) government bond yields. However, the commitment by central bankers is likely to see short term interest rates moving higher via official interest rates leading to flat or inverted (near-term maturities higher than longer-term maturities) interest rate yield curves. This environment increases earnings downside risk for cyclical companies and is consistent with outperformance of quality defensives and growth stocks as long-term bond yield volatility reduces.

We see increasing risk to the earnings of companies that benefited from aggressive stimulus through 2020 and 2021, particularly consumer-facing companies (including durable goods). While we have seen valuation multiples fall for some cyclical stocks (their stock prices have not gone up as companies reported better results, with investors anticipating a fall in earnings) in our view these ‘cheap’ cyclicals and value stocks may prove to be not so cheap as actual earnings downgrades accelerate. The exception is selected financials that benefit from higher interest rates and demographic trends, and selected resource stocks that benefit from tight supply, stubborn inflation and structural trends such as de-carbonisation.

Within equity growth portfolios, we continue to seek safety in quality growth (particularly healthcare) and defensive stocks that can sustain and grow returns through a period of slower cyclical economic activity. The portfolio also owns selected financial and resource stocks that have pricing power to deliver higher earnings in a period of higher inflation and increasing interest rates. We retain a negative bias to cyclical stocks that need a strong economic tailwind, particularly housing, consumer and bank stocks.

Within fixed interest portfolios, we have reinvested in the market, adding duration as market yields have climbed. Market volatility is elevated, and larger market moves are occurring, so we are being more cautious about reinvestment levels and risk position sizes. We participated in the government’s issuance of 2035 inflation-indexed bonds, as they assume inflation averaging below 2% through to 2035. Our view is that risks lie to the upside from this level.

Within the Active Growth Fund, the movement of markets to price in interest rate hikes also gives us more confidence to hold quality growth companies and reduce our exposure to more cyclical and defensive areas of the market which have become, in our view, increasingly expensive. A (relatively) more stable interest rate environment may, in our view, take pressure off valuations which have increasingly moved in lockstep with moves in long end bond rates.

Within the Income Fund, in early August we reduced equity exposure, cutting back investments in global equities and Australasian listed property. Both rallied meaningfully in July and are now getting somewhat expensive. The combination of reduced equity exposure and shorter duration in fixed income has meant the Fund’s overall market exposure and riskiness has been reduced. Our expectation is that repricing of rate hike expectations can provide better levels to reinvest in the weeks to come.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.

This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.