Key points

- The MSCI All Country World Index returned 2.1% in New Zealand dollar terms, and 2.5% in New Zealand dollar-hedged terms. At the sub-sector level financials lagged after events in the US and European banking sectors early in the month. The aftermath saw investors shift towards ‘Big-Tech’ sectors such as information technology and communication services.

- The New Zealand equity market (S&P/NZX 50 Gross with imputation) returned 0.2% over the month. Communication services was the best performing sector over the month whilst consumer staples was the worst.

- Both New Zealand and global bonds delivered positive returns over the month with the Bloomberg NZ Bond Composite 0+ Yr Index up 1.9% and the Bloomberg Global Aggregate Index (New Zealand dollar-hedged) up 2.2%.

Key developments

Whilst equity markets were broadly positive, shockwaves were felt across all markets from events in the banking sector during the month, reflecting the interconnected nature of markets. While a strong response by regulators and central banks saw equity volatility reduce, expectations of tighter lending standards hit returns for parts of the equity market that are more dependent upon debt market funding, including banks and parts of the commercial real estate market. The bond market reacted swiftly to these events, with US 10-year government bond yields falling 45 basis points to end the month at 3.47%. The New Zealand market followed suit with 10-year government bond yields decreasing 37 basis points to end the month at 4.20%.

The recent failure of Silicon Valley Bank (SVB) and rescue of Credit Suisse have tightened global financial conditions and reduced the need for monetary policy to be as restrictive, whilst also possibly raising the probability of recession. This has been most pronounced in the US, where the Fed Funds rate is implied to be about 100 basis points lower than the market pricing that prevailed prior to SVB’s failure. A liquidity crisis, driven by a broad-based withdrawal of bank deposits, has likely been stopped in the US by an expansion of deposit guarantees and the creation of more favourable central bank borrowing facilities. In Europe, the European Central Bank has eased concerns by signalling it is ready to provide liquidity to banks if needed. But bank borrowing costs, relative to risk free rates, are now higher and banks are likely to be much more careful in their lending – particularly regional banks that are important lenders to small and medium-sized businesses. US banks' use of the Fed's liquidity facilities and deposit outflow are two key metrics used to judge the severity of US banking stress. Both suggest stress has eased in recent weeks.

In the New Zealand market, defensive growth sectors including communications services, healthcare, utilities and energy(which is made up of utilities like Channel Infrastructure), were the best performing industry groups over the month with investors favouring high earnings certainty investments that benefit from lower bond yields. Consumer staples were the worst performing sector over the month with milk processor Synlait delivering a disappointing update with negative implications for its key customer a2 milk. The materials sector also underperformed with concerns that Fletcher Building and Vulcan Steel are not immune to a cyclical slowdown. The New Zealand financial sector also underperformed, reflecting global bank stress concerns.

What to watch

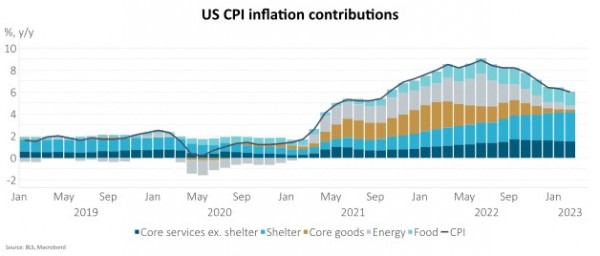

US inflation data (released Thursday 13 April) are likely to show a drop in headline inflation to 5.1% y/y, from 6.0% y/y, but core inflation to remain around 5.5% y/y or 4.8% on an annualised m/m basis – far too high to give the US Federal Reserve much comfort and likely to further challenge market pricing of near-term Fed Funds rate cuts.

Market outlook and positioning

Equity markets strengthened over the last quarter with investors reading lower inflation data as a sign that may lead to central banks holding official interest rates steady. This potential for central banks to pause may continue to support equity returns in the near term, with lower interest rate expectations improving valuation metrics for equities. Locally, the Reserve Bank of New Zealand faces stubborn inflation and may be later to pause relative to other central banks.

With the resulting tightening of financial conditions from the US / European banking crisis being the main reason for pausing, rather than inflation being back in target ranges, this may imply a greater risk of recession and for risk to earnings expectations in parts of the equity market. As a result, not all parts of the equity market will perform well – cyclical sector earnings may be at risk as the lagged impact of rate hikes hits economic activity and tighter lending standards may constrain more highly indebted businesses. Certainly, the potential mix of a banking crisis, an oil shock and rapidly declining lead economic indicators are not conducive for investor risk appetites. We expect investors will continue to be wary about investments exposed to an economic slowdown and retain a positive bias to investments in defensive growth and secular growth shares that can sustain and grow returns through an economic slowdown.

The reopening of the Chinese economy may provide one source of positive upside. Chinese non-manufacturing purchasing managers index (PMI) readings continue to point a solid recovery in Chinese economic activity from 2022’s COVID lockdowns. The China non-manufacturing PMI for March of 58.2 was well up from 56.3 in February, and much higher than consensus expectations of 55, with a reading above 50 being consistent with expansion. Importantly 2023’s recovery is running ahead of that seen after 2020’s China reopen post COVID lockdowns suggesting there may be a greater degree of confidence. March’s expansion shows spending on services and government investment in infrastructure driving the economy’s recovery. The Chinese economy is desynchronised from other economies and may provide an idiosyncratic force for equity portfolio returns.

Within equity growth portfolios we remain active, taking profits in investments when markets get ahead of fundamentals and adding on weakness where supported by stock specifics. Within the portfolio we continue to maintain a mix of investments in enduring growth stocks (including quality defensive growth stocks in the healthcare sector that can sustain and grow returns through a period of slower cyclical economic activity), selected cyclical growth stocks (including financial stocks that have pricing power to deliver higher earnings in a period of higher inflation and increasing interest rates) and stocks that benefit from secular trends including demographic change, digitisation, industry disruption, decarbonisation (greenablers) and deglobalisation.

Our assessment of markets at present has led us to be cautious with regards to taking large positions within fixed interest portfolios. We largely concur with the market view that we are approaching the end of the rate hike cycle in New Zealand. Market pricing in early April has the RBNZ cutting the OCR to 4% in 2025 and then heading a little lower. This seems reasonable to us and consequently we do not disagree with market pricing enough to justify a large position in the Fund with regards to duration positioning. We continue to have a bias towards expecting inflation over the medium term to be higher than that experienced over the previous 30 years, and it is our view that inflation-indexed bonds in New Zealand are not pricing this, so we have been adding to positions in these securities. In credit markets, as spreads widen, we are seeing value return to a market that became unattractive when investors clamoured for bonds when yields rose more quickly than term deposit rates. With the yield curve inverting and term deposit rates catching up, appetite for corporate bonds may diminish further, creating even better opportunities. We are being patient at present but can envisage a significant increase in allocation to credit in the Fund.

The Active Growth Fund is defensively positioned. The rally in share markets has seen equities trade at a narrow forward-looking risk premium relative to history, even considering recent falls in bond yields. While this is not a short-term indicator it does temper our medium-term outlook for equities. That said, we are excited about the prospects for growth equities going forward which were challenged in 2022 battling with yields which were up significantly. With central banks well into their tightening cycle, the headwinds for growth equities are likely to shift from bond yields to more idiosyncratic drivers making the operational performance of companies the key driver of returns. In early March we added a global bond fund managed by PIMCO to the portfolio and the fund remains overweight duration relative to its benchmark.

Within the Income Fund the core premise behind our investment strategy is that tightening monetary policy is starting to show more evidence of having traction, with activity data deteriorating and core inflation rolling over. It follows that bonds are less at risk of rising in yield and have scope to perform if the economy weakens quickly. On a medium-term basis there is still uncertainty about where inflation eventually settles, especially if one considers the risks from an aging population, climate change policies and deglobalisation across manufacturing sectors. These uncertainties warrant an ongoing significant holding in inflation-indexed bonds. While recession risks diminish the immediate appeal of inflation-indexed bonds, valuations are appealing on a medium-term basis and the current running yield, when current inflation is included, is exceptionally high. Equity markets still face some challenges, even though falling inflation and lower bond yields are helpful. The challenges mainly come from valuations and earnings risk. For these reasons, we are maintaining an underweight position in equities at present.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.