Key market movements

- Global equities were sharply lower in unhedged New Zealand dollar terms in March, with the MSCI All Country World Index (ACWI) declining 5.0%. With the NZD strengthening against the USD, returns in hedged terms were -4.5% for the month.

- Locally, the New Zealand equity market continued its poor start to the year with the S&P/NZX 50 Gross Index (including imputation credits) down 2.4% in March. Australian equities also struggled with the S&P/ASX 200 Index down 3.4% (-4.1% in NZD terms).

- NZ bond returns were positive in March (+0.2%), measured by the Bloomberg NZ Bond Composite 0+ Yr Index. Global bonds fared a little worse with the Bloomberg Global Aggregate Bond Index (hedged to NZD) falling a modest 0.5% with US 10-year Treasury yields flat for the month at 4.2%.

Key developments

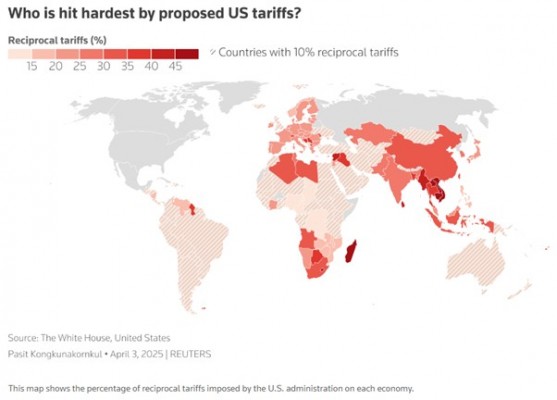

In early April, the US announced more aggressive than expected increases in import tariffs, which incorporate a reciprocal tariff programme with a minimum 10% on all countries, including Australia and New Zealand. If tariffs are maintained at these newly announced levels, we expect them to lower already-decelerating US GDP growth and increase inflation pressures. Global growth is likely to fall because of this US weakness and as economies elsewhere experience reduced US demand for their exports to varying degrees.

The Fed didn’t appear worried about tariffs in March, but these are likely much larger than it expected. It left rates unchanged at its March meeting, as widely expected, but indicated two more rate cuts this year. The Fed considered the inflation impact of tariffs to be largely "transitory" and described long-term inflation expectations as "well anchored", despite a decent pickup in the University of Michigan 5-year measure. While the member forecasts incorporated higher inflation and lower growth, Fed Chair Powell was at pains to emphasise that the economy remained in good shape.

US tariffs on European imports were increased 20% but there is likely to be a partial offset for growth from greater German government spending. In mid-March, Germany announced a relaxation of its strict debt rules to allow more defence and infrastructure spending. It would allow defence spending above 1% of GDP to be exempt from Germany's debt brake that is designed to limit borrowing and keep the structural fiscal deficit at 0.35% of GDP. The deal also includes the creation of a 10-year, EUR500bn infrastructure fund. Other European countries have also indicated appetite to increase defence spending, but not all have the fiscal room to do so.

NZ is now technically out of recession and most forecasters expect ongoing above-trend growth this year without stimulatory monetary policy, i.e. an OCR below 3%. The market is no different, implying the OCR troughs just below 3% (i.e. in line with our view of neutral) and there will be c. 0.20% of hikes next year.

What to watch

Asian economies are going to feel the brunt of Trump’s tariffs. The formula used to calculate reciprocal tariffs has been widely exposed in the media as simply relating to the size of a bilateral trade deficit with the US divided by the amount of goods imported from the country into the US. Of course, Trump made a big thing of being kind and so halved this number. The economic and trade flow adjustment is likely to be painful for many industries. Supply chains linked into China and Asia will face large economic disruption. Those impacts are already being factored into the share prices of stocks like Apple and Nike. A 10% tariff on Australian and New Zealand goods, in contrast is a challenge, but many primary products have substitute markets or are less price elastic.

Market outlook and positioning

Elevated trade tensions continued to weigh on global markets in March, as volatility in US trade policy further eroded investor confidence and clouded the outlook for global growth. Following February’s imposition of tariffs on Mexico, Canada, and China, the Trump administration applied additional tariffs targeting steel, aluminium, and autos. Market sentiment swung sharply in response to shifting expectations around the severity of further tariff announcements scheduled on 2 April, dubbed “Liberation Day”. With the global growth outlook already under pressure, an escalated trade war heightens the risk of economic stagnation or perhaps even a recession.

While it was a tough period for performance, it was not all bad in terms of potential future New Zealand share market returns. Commentary from company management and economic lead indicators continue to suggest a gradual economic recovery is underway in New Zealand, which provides a better backdrop for earnings growth than we have observed over the last few years. The ANZ business outlook survey for March, which provides a useful lead indicator for New Zealand economic activity was positive suggesting the gradual recovery in the economy is likely to continue. The slow pace of economic recovery means that the Reserve Bank of New Zealand may potentially cut the official cash rate (OCR) below the 3% level priced into capital markets and the OCR might stay at a lower level for longer than expected, providing valuation support for New Zealand shares with sustainable and growing earnings and dividend income.

The Australian share market fell over the month, weighed down by weaker than expected company earnings results and capital raisings/block sell downs, which required funding and dragged down market returns. These headwinds overshadowed a change to an easier monetary policy tone by the Reserve Bank of Australia, as well as a series of Australian economic data releases that pointed to a stable - not too hot, not too cold – domestic economy. Utilities, Materials, and Consumer Staples were the best performing sectors, supported by defensiveness and selective strength in commodities.

Within equity growth portfolios, Harbour’s strategy remains to be patient, position for a range of scenarios and to be selective, focusing on quality growth. We continue to focus on companies delivering earnings per share growth, particularly where that earnings growth has the potential to be higher and last for longer than consensus expectations allow for. We continue to see the secular tailwinds of digitisation, disruption, de-carbonisation, and demographic changes as supporting company earnings. We hold overweight positions relative to benchmark in companies with secular tailwinds in the defensive-growth healthcare sector and the higher-growth information technology sector, where businesses are supported by strong cashflows. We are also overweight selected materials and consumer staples shares that benefit from structural change and have pricing power. We continue to have a bias towards quality, well-capitalised businesses that are well-positioned to fund value-adding growth opportunities. We remain underweight lower growth utilities, telecommunications, infrastructure and real estate sectors.

In fixed interest portfolios, the focus of our active strategies has been on the domestic market. We had been of the view that the domestic economy recovery was likely to be fairly tepid through 2025, but that there was enough concern about inflation to make an OCR cut below 3% to be unlikely. We are now of the view that the negative global reaction to the hyper-aggressive tariff policies coming out of the White House makes weaker global growth much more likely. Damage has been done to the confidence of firms and markets that will be hard to reverse. This now opens the possibility that the RBNZ could cut the OCR below 3% and we have moved to reflect this view in portfolios. Corporate bond markets, which had been stable, are also being affected by the volatility in equity markets. We see greater cause for caution there as well.

Within the Active Growth Fund, we have been mindful of relatively full valuations, particularly in the US and have held an underweight position to global equities. We find ourselves at a critical juncture at present. While risks are escalating and things can get worse, it is crucial to remain open to the possibility of improvement. Equity markets have responded swiftly, with the recent sell-off reflecting rational repricing as analysts adjust earnings expectations in light of new tariffs. The impact of these tariffs is effectively a transfer from the private sector to the public sector, weighing on corporate profitability. Given elevated valuations coming into this event, it may take some time for stocks to look as attractive on a valuations basis as they did during the March 2020 COVID selloff. Unlike that period, where aggressive government intervention provided relief, this time, policy action is at the cause of the disruption. With forward price-to-earnings ratios still elevated - the MSCI ACWI trading at 16x versus 14x during the COVID selloff – we continue to target an underweight position to growth assets.

In the Income Fund, returns have been protected to a large degree by our high fixed interest weighting and the bias towards defensive equity sectors. At present, we judge that this is an approach to continue with for the Fund’s investor base, which has limited appetite for negative returns. Despite the decline in equity markets seen in early April, we are not yet sufficiently confident in the macroeconomic or geopolitical environment to add to exposures. This mindset is also being applied to our corporate bond strategy.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.