Key points

- Equities continued to bounce back with the S&P/NZX 50 returning 3.3%, S&P/ASX 200 (in AUD) up 4.4% and the MSCI ACWI Index up 4.1%.

- Government bond yields settled in a low range, as the Reserve Bank’s bond buying (QE) programme offset the pressure that would otherwise have come from increased issuance.

- Australian and New Zealand earnings season so far, on balance, has delivered more upside than downside surprises relative to expectations.

- Budget 2020 in New Zealand overwhelmed on spending but underwhelmed on detail.

Key developments

Equity markets continued to rally with investors looking towards the re-opening of economies, improving corporate news flow and better-than-expected COVID-19 news in many countries. Recent economic data, when taken in aggregate, has also surprised to the upside. China’s services sector confidence (Caixin PMI), came in at 55 versus an expected contraction of 47.6, which buoyed markets. US employment data also came in better than expected, showing 2.5mn jobs added versus an expected 8mn additional unemployed.

Markets have continued to be reassured by global policy makers, who continue to deliver stimulus and remain open to providing additional help. The European Central Bank (ECB) expanded its Quantitative Easing (QE) programme by EUR600bn to EUR1,350bn on June 4th. Recent communication from the US Federal Reserve (the Fed) suggests it is contemplating further stimulus via ongoing asset purchases, forward guidance and possibly yield curve control. China announced additional fiscal stimulus worth 8.4% of Gross Domestic Product (GDP) at its National People’s Congress in May, and Germany added EUR130bn (c.4% of GDP) of stimulus in early June to help its economy recover. Globally, the amount of fiscal stimulus announced so far is more than double that seen during the Global Financial Crisis (GFC).

In New Zealand, record monetary stimulus has been backed up by record fiscal stimulus with Budget 2020 overwhelming on every measure, except for detail. The Government created a $50bn COVID-19 Response and Recovery Fund (CRRF) to help manage its policy response. This is in addition to the $12.1bn stimulus package announced on March 17th. Prior to the Budget, the CRRF had allocated $13.9bn to additional stimulus announced after the 17 March package, and after allowing for the $15.9bn of additional spending initiatives announced in the Budget, around $20bn remains unallocated. If used in its entirety, the total fiscal stimulus delivered in response to COVID-19 would be $62.1bn, or 20% of GDP.

In Australia and New Zealand, companies provided updates on their businesses over the shutdown period and the mini reporting season for companies with March year-end balance dates. In many cases, updates have seen outcomes ‘less worse’ than what the market had been assuming. This has particularly been the case in Australia, where consumers have been more mobile during the lockdown than had been earlier expected. As both New Zealand and Australian economies open up, there are a wide range of potential outcomes.

What to watch

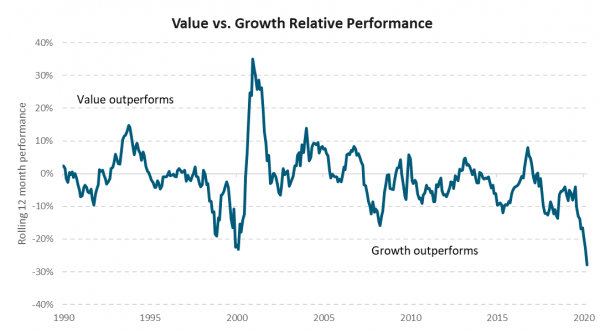

Value vs. Growth: Value investors have waited, largely in vain, for performance relative to growth stocks to turn around since the GFC. The deteriorating economic outlook, due to COVID-19, saw value continue to be left behind. However, in late May we saw value stocks catch a bid as signs the economic backdrop was improving quicker than expected emerged. In our opinion, this may only be a relief rally in value stocks. We remain wary that, while economic activity may prove ‘less worse’ and activity may bounce off COVID-19 lows, the robust economic growth environment needed to deliver a sustained period of value stock outperformance may be more challenging.

Source: Bloomberg, MSCI.

Valuations: Earnings forecasts, which continue to be cut, coupled with recovering equity prices have caused price-to-earnings ratios to reach high levels relative to history. However, this misses two key factors which are worth monitoring:

- The cost of capital used to discount stock earnings has been cut faster than earnings, meaning a strong equity risk premium still exists.

- While 12-month forward earnings forecasts have been cut (20% – 30% across developed market markets), on average it has taken 10 quarters for earnings to recover to pre-crisis levels. Valuations look a lot more reasonable when taking many recovery scenarios into account.

Market outlook and positioning

Within growth equity portfolios, earnings for markets may continue to fall as analysts factor in the actual impact of COVID-19 containment, contributing to increased volatility. In this environment, selectively taking advantage of opportunities to invest in companies with structural growth during stock price weakness may contribute to outperformance. A risk for our equity portfolio positioning would be a surprising and very robust recovery in economic activity, which could significantly lift many cyclical and value stocks.

The portfolio continues to have three anchor sector exposures, consumer staples, healthcare and materials. We believe these are likely to have more resilient earnings profiles and balance sheet strength over time. There will also be further opportunities to support business in recapitalising balance sheets, albeit we will continue to be selective. Being active and selective in our research and portfolio insights ought to provide superior returns for client portfolios.

Within fixed interest portfolios, our strategy is being targeted to the specific near-term drivers at play in the market. We think it is very hard to take a confident view as to where the economy and markets will be in 2021. Consequently, we have shortened our horizon to focus on events we can more realistically anticipate and are taking a more tactical approach to position-taking. The exception to that is our emphasis towards very high-grade credit, given the scope for downside developments. Our view is that the weak economic environment will persist and that there is a risk that we see waves of market weakness in the future

In multi-asset portfolios, we have moved to a small overweight equities position in early May. While risks remain to the shape of the economic and earnings recovery, abundant fiscal packages and monetary policy support have clearly signalled that some of the downside economic risks are being mitigated. While equities are around fair value using normalised price to earnings measures, they do still offer a strong risk premium over bonds.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.