Key market movements

- Global equities rebounded in January. The MSCI All Country World Index (ACWI) increased 2.4% last month, in New Zealand dollar-unhedged terms. With the NZD strengthening through January, returns in hedged terms were 3.3% for the month.

- Locally, the New Zealand equity market weakened with the S&P/NZX 50 Gross Index (including imputation credits) down 0.9% in January. In contrast, Australian equities had a cracking month with the S&P/ASX 200 Index up 4.6% (4.1% in NZD terms).

- NZ bond returns were flat in January, measured by the Bloomberg NZ Bond Composite 0+ Yr Index. Global bonds did better with the Bloomberg Global Aggregate Bond Index (hedged to NZD) up 0.4% as US 10-year Treasury yields dropped slightly in the month to finish at 4.54%.

Key developments

The Fed is in no hurry to cut rates as the US economy continues to grow above trend and inflation progress to target has stalled. At the January meeting press conference, Fed Chair Powell described the policy rate as “very well calibrated”, acknowledging it was “meaningfully above neutral” and wanting to see further progress on inflation. US GDP expanded at an annualised 2.3% in Q4 and is tracking at almost 3% this quarter. The labour market remains healthy and, as a result, inflation progress towards the Fed’s 2% target has stalled in recent months with core services and shelter prices remaining sticky. Higher energy prices also haven’t helped.

Looking ahead, tariffs are an increasingly important part of the Fed’s thinking, with Powell noting the range of possibilities is “very, very wide”. Trump has delayed the imposition of 25% tariffs on imported goods from Canada (10% for Canadian energy) and Mexico until 1 March, from 1 February, as both countries promised more border control support to limit the flow of Fentanyl and illegal migrants into the US. China, however, had an additional 10% tariff applied to its exports to the US for which it responded with largely symbolic tariffs of its own, perhaps suggesting China has more to lose from a trade war. The tariffs for the three countries are estimated to impact US$1.4trn of imported goods, three times the value of mainly Chinese goods that Trump targeted in 2018. Barclays estimate the new tariffs may reduce US GDP by 25-50bp and increase inflation by 35-40bp, excluding second order effects.

The RBNZ remains on track to take the OCR a lot lower with inflation at target and growing spare economic capacity. Headline inflation remained at 2.2% y/y in Q4, and core measures are now either inside the target band (CPI ex food and fuel, trimmed mean, weighted median and 2-year expectations) or very close (sectoral factor model). The NZ labour market continued to loosen in Q4 with the unemployment rate increasing to 5.1%, from 4.8%, driven by further job losses. Productivity-adjusted wages are running at 3.0% y/y, continuing to converge on their long-run average of 2.2%. All up, the data suggest there is plenty of spare economic capacity that should ensure core inflation will soon be at the RBNZ’s 2% target. The market currently implies a 50bp cut at the February MPS meeting, taking the OCR to 3.75% and a terminal OCR of less than 3%, close to our view of 2.75%.

What to watch

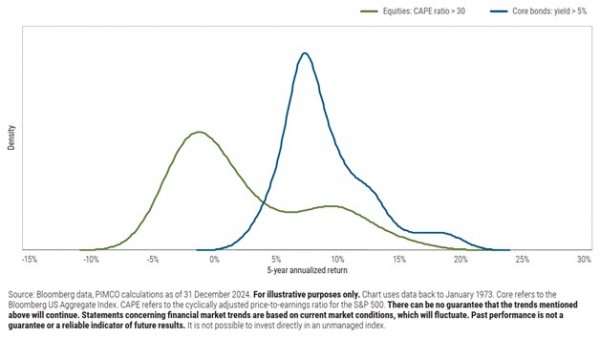

This month, we have a guest chart from PIMCO. As covered in our top 10 risks and opportunities, valuations are looming as a limiting factor for forward returns. This piece of analysis compares how equities and bonds have fared historically from these valuation starting points. This analysis uses the Cyclically Adjusted Price-to-Earnings (CAPE) ratio, which is also known as the Shiller PE ratio. A criticism of this for valuing modern companies is that it utilises ten-year inflation-adjusted earnings which does not explicitly consider a company’s growth rate. That said, the below chart highlights that, in contrast to equities, bonds’ starting yields hold them in good stead for future returns.

Market outlook and positioning

The investment landscape remains highly uncertain, driven by disruptive AI advancements and evolving US trade policies under Trump. Investors should prepare for volatility by maintaining diversification and exposure to structural trends that are less dependent on economic activity. The arrival of third-phase AI models like DeepSeek challenges conventional investment assumptions, while uncertainty around US tariffs could impact global trade, slowing growth and sustaining inflation. Despite turbulence, economic fundamentals—moderate growth and easing inflation—support share markets and AI’s rapid evolution, with lower-cost models improving accessibility, could accelerate growth in the sector.

New Zealand’s upcoming corporate earnings season is expected to be underwhelming, particularly for firms tied to the domestic economic cycle, such as communications and building materials. However, companies exposed to Australian and US markets may perform better. The NZ market could see mid-single-digit earnings growth in 2025, with stronger performance expected in 2026 and 2027 due to easing interest rates and cost-cutting initiatives. Stock selection will be crucial as performance dispersion among shares is likely to remain wide.

Australia’s profit season will be shaped by global trade uncertainty and the upcoming federal election, that will focus on inflation, immigration, and cost-of-living issues. Despite external risks, Australia’s strong economic ties with the US and China provide resilience. While earnings expectations have adjusted lower, some sectors, such as energy and mining, may still underperform.

Amid this uncertainty, long-term investment opportunities remain. Market reactions may present buying opportunities in high-quality companies with sustainable earnings growth. While volatility is expected, companies that can outgrow market expectations should continue to drive returns in 2025’s increasingly non-linear investment environment.

Within equity growth portfolios, Harbour’s strategy remains to be patient, position for a range of scenarios and to be selective, focusing on quality growth. We continue to focus on companies delivering earnings per share growth, particularly where that earnings growth has the potential to be higher and last for longer than consensus expectations allow for. We continue to see the secular tailwinds of digitisation, disruption, de-carbonisation, and demographic changes as supporting company earnings. We hold overweight positions relative to benchmark in companies with secular tailwinds in the defensive growth healthcare sector and the higher growth information technology sector, where businesses are supported by strong cashflows. We are also overweight selected materials and consumer staples shares that benefit from structural change and have pricing power. We continue to have a bias towards quality, well-capitalised businesses that are well-positioned to fund value-adding growth opportunities. We remain underweight lower growth utilities, telecommunications, infrastructure and real estate sectors.

In fixed interest portfolios, our investment strategy has focused on the weak domestic economy, which is only now showing signs of stabilising. We had held a long duration position in the 1– to 5-year maturity range, reflecting expectations for monetary policy easing. The market prices the OCR to drop just below 3%, and we see potential for it to reach 2.75% or 3% faster than expected. However, banks have recently cut 2- and 3-year mortgage rates, encouraging households to refix. This may push swap rates higher as banks hedge their interest rate exposure, prompting us to shorten portfolio duration. NZ swap rates have fallen more than government bond yields due to high fiscal deficits. Mortgage market dynamics may partially reverse this, which could see corporate bonds (which are largely priced off the swap curve) underperform government bonds. At the long end of the yield curve, global uncertainty—especially from US trade policies—makes it difficult to hold strong convictions, so we are keeping active positions light.

Within the Active Growth Fund, we continue to be mindful of relatively full valuations within global equity markets, particularly the US, and are minded to sell rallies more than buy dips, remaining underweight growth assets. Bond yields, particularly within global fixed interest are looking more attractive in a relative sense. Currency wise, we are holding a higher level of hedging within our global equities; the NZ dollar’s plunge toward COVID lows has seen it undershoot our fair value models.

In the Income Fund, we are shifting emphasis towards risk management as opposed to opportunities at present. Risks within fixed interest markets, elevated equity markets and geopolitical/policy uncertainties are not a particularly conducive mix for investing for clients with limited tolerance for downside.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.