Weak QSBO points to lower rates ahead

- The Q2 QSBO was a sobering read as it corroborated other indicators that suggest the New Zealand economy has taken a sharp turn for the worse in recent months.

- The survey indicated a trifecta of rapid labour market easing, contracting economic activity and markedly reduced inflation pressure.

- We expect the RBNZ to take note, likely delivering a more balanced message at next week’s July Monetary Policy Review and bringing forward the timing of easing when we next see forecasts as part of the August Monetary Policy Statement. We continue to expect the first rate cut to happen at the November MPS meeting and for the OCR to trough around 3%, roughly 100bp below current market pricing.

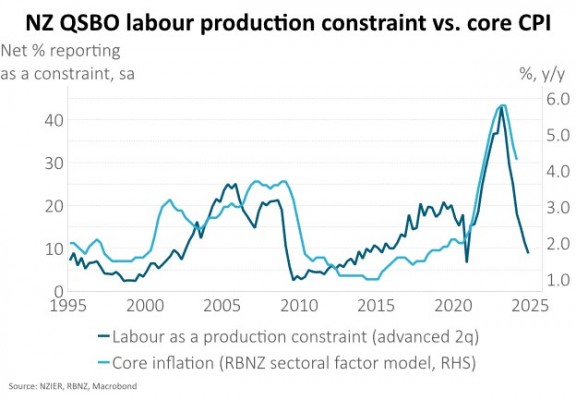

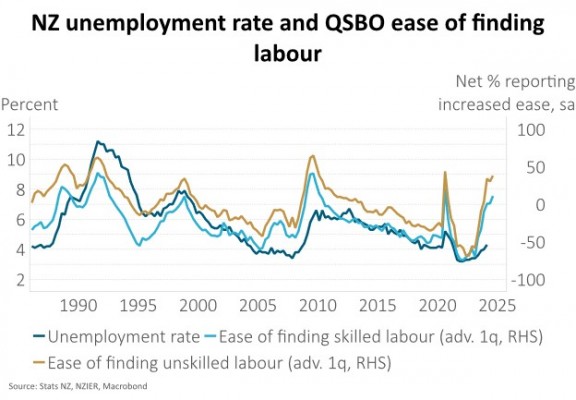

The Q2 Quarterly Survey of Business Opinion (QSBO) indicated a trifecta of rapid labour market easing, contracting economic activity and markedly reduced inflation pressure. Of most importance, in our view, was the further decline in reports of labour as a constraint to production with just 9% of businesses citing this a major constraint. This is likely to get the RBNZ’s attention after it recently found this “less conventional” measure of economic slack has a better relationship with inflation than the unemployment rate[1] and implies inflation should soon return to target (see chart above). Other labour market indicators were similarly weak with firms noting it was particularly easy to find labour, a net 24% reduced the number of people they employed in the past three months and a net 6% expect to reduce these further in the next three months. These data suggest the unemployment rate is likely to pick up much more quickly than the RBNZ assumed at its May MPS, where the unemployment rate wasn’t expected to reach 5% until the end of the year, from 4.3% in Q1 (see chart below).

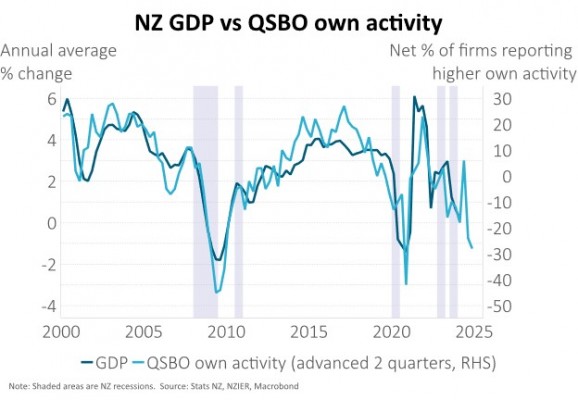

Activity indicators were dire, suggesting the economy likely contracted in Q2 after barely exiting recession in Q1 and making the RBNZ’s forecast of 0.1% q/q GDP growth for Q2 now look too optimistic. A net 28% of firms reported lower activity in Q2, vs. Q1, suggesting a downturn in activity like that seen in the Global Financial Crisis (GFC) and COVID-19 (see chart below). Adjusting for population, the story only worsens given Q1 GDP data have already confirmed the per capita contraction in GDP this cycle is larger than that experienced in the GFC. Other recent data have painted a similar story. Our composite (manufacturing and services) PMI, for example, dropped to 43.4 in May, led by weakness in the services component. This is the lowest level since the survey started, excluding COVID lockdown months. Recent company announcements have provided more evidence of the sharp decline in domestic activity. Steel and Tube delivered a sharp earnings warning during June, indicating earnings that were 37% below consensus and noting “demand for steel is at even lower levels than during the GFC”. The Warehouse Group forecast earnings to drop 65% over the next 12 months and Kathmandu noted that New Zealand trade remains challenging with the first three weeks of its winter sale 11.5% below last year.

Price pressures continue to abate. A net 23% of firms reported higher selling prices, very close to the average since 2000 and consistent with inflation soon returning to the RBNZ’s 1-3% target band (see chart below). Pricing intentions painted a similar story. This is likely to support further declines in business inflation expectations, which are already inside the target band and tend to follow headline inflation. While non-tradable inflation is likely to take more time to fall, due to sticky factors outside of monetary policy influence (such as insurance, council rates, and tobacco taxes), the QSBO suggests services inflation is likely to drop quickly over the coming quarters.

We expect the RBNZ to take note, likely delivering a more balanced message at next week’s July Monetary Policy Review and bringing forward the timing of easing when we next see forecasts as part of the August Monetary Policy Statement. We continue to expect the first rate cut to happen at the November MPS meeting and for the Official Cash Rate to trough around 3%, roughly 100bp below current market pricing.

[1] See RBNZ Analytical Note - The resurgence of the New Zealand Phillips curve, 19 June 2024

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.