In 2011 Andreessen Horowitz, founder of a16z, famously said “software is eating the world”, making the prediction that, over the next decade, the world would see many industries be disrupted by software. Perhaps some of the more prominent examples were how Netflix gutted Blockbuster and the suicide of Borders as it handed over its online business to Amazon under the theory that online book sales were unimportant.

Today, software companies are competing much more among themselves, with established players having to defend their market positions. Zoom overtook Skype by offering an intuitive interface, high-quality video, and seamless scalability. Salesforce became the dominant global Customer Relationship Management (CRM) player delivering scalability and accessibility that on-premise solutions like Siebel Systems simply could not match. This shift to Software-as-a-Service (SaaS) didn't just disrupt the traditional CRM market, it fundamentally transformed it, enabling businesses of all sizes to leverage powerful CRM tools without the hefty upfront costs.

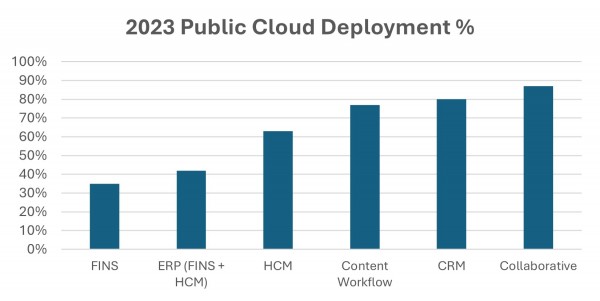

Today we see overwhelming adoption of cloud-based applications across industries. Collaborative tools and CRM systems are leading with more than 80% penetration as they leverage the cloud's capacity to integrate and scale with ease. Enterprise software (ERP) currently lags. Tethered by legacy systems and regulatory caution, incumbent software players (e.g. Oracle and SAP) may sometimes use their heft to force the adoption of sub-par, expensive products. While that may have worked in the days of on-premise solutions when it was expensive and time-consuming to rip out established solutions, new-aged competitors such as Shopify’s cloud-based offering allow for quick implementation and scaling. We have seen this with Kylie Jenner’s Cosmetics creating a billion-dollar business on Shopify within three years.

Source: Company Data, Morgan Stanley Research & IDC

We believe vertical SaaS may erode legacy incumbents' market positions in select industries by offering superior services and customer experiences. This shift could ultimately narrow the gap between ERP and other cloud-based application penetration.

For enterprise customers, vertical software offers a more compelling proposition than horizontal software’s, one-size-fits-all approach. By addressing a particular sector's unique needs and challenges, vertical solutions can offer specialised features and workflows directly relevant to their customers. Compliance becomes less of a hurdle, as these solutions are built with industry-specific regulations in mind. Pre-configured for their industries, they enable faster implementation with less customisation required. Vendors of vertical SaaS may bring deep domain expertise, providing valuable insights and support that generic software can't match. The message is clear: vertical SaaS is empowering enterprises to adapt swiftly and efficiently, and those who embrace these specialised solutions may lead the next wave of innovation.

A prime local example is Gentrack Group, which provides pricing, billing, and CRM software to the global energy and utilities industry. Gentrack aims to displace Oracle and SAP with its cloud-based offering, allowing customers to quickly adapt to tariffs and smart meter capabilities. Meanwhile, Oracle and SAP must redesign their software to accommodate real-time smart meter monitoring, forcing customers to reconsider their platforms as they phase out their on-premise solutions. We believe Gentrack is well-positioned to lead the next phase of digitising the energy and utilities industry.

SaaS has fundamentally transformed security, reliability, and operational agility for users. Few internal IT teams can match the resources that cloud vendors dedicate to cybersecurity monitoring, patching, and R&D (Research and Development). Cloud solutions can offer layers of mitigation against sudden demand spikes, employing failover options to prevent slowdowns and outages. Companies can now treat IT as an operating expense, paying only for what they use, eliminating the need for large maintenance-focused IT teams managing data centres and hardware. With no hardware to buy or software to install, IT teams can deploy new cloud applications swiftly, giving users immediate access to the latest capabilities without the hassle of manual upgrades.

The software industry has undergone several major re-platforming cycles—from mainframes to client-server architectures in the 1990’s, and from on-premise solutions to the cloud over the past decade. Now, the integration of AI capabilities is set to drive significant changes in software functionality. As Jensen Huang, CEO of Nvidia, aptly noted, "Software is eating the world, but AI is going to eat software."

Source: DALL-E

Despite prevailing sentiments, we believe software businesses must proactively shift from being systems of record to systems of intelligence—building their software with an agentic AI focus first mindset. Front-end applications tied to databases like Oracle and supported by manual workflows will likely be overtaken by AI-native applications built on AI-native databases, where the database takes centre stage—fundamentally transforming how enterprise software operates.

Locally, both Serko and Vista Group are embracing AI to transform their industries. Serko is developing an agentic AI platform for corporate travel management, aiming to enhance efficiency and user experience. Meanwhile, Vista is creating predictive AI solutions to match moviegoers with films based on their viewing habits, enabling cinemas to target their marketing efforts more effectively and reduce customer acquisition costs.

Conclusion

The enterprise software landscape is undergoing a significant shift from generic, horizontal solutions to vertical SaaS applications tailored to specific industries. These specialised platforms offer industry-specific features and facilitate easier implementations. Simultaneously, the integration of AI is transforming software into systems of intelligence, enabling more efficient workflows and smarter decision-making.

Industry-level inflections like these have historically created attractive alpha opportunities for investors.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.