Article originally published 24th March 2025 by the NBR

Shares in retirement village operators including Oceania Healthcare, Ryman Healthcare and Summerset have delivered diverse return outcomes for investors over the last year. While Oceania and Summerset have outperformed the broad S&P/NZX50 share market benchmark index Ryman has underperformed as it has gone through a corporate and financial reset. After delivering great outcomes for residents and broader society through the challenges of COVID the retirement village sector has had to navigate a sharp increase in costs and slower residential property markets.

The cyclical slowdown in residential property activity has constrained industry cashflows and stretched balance sheets. However, following Ryman’s recapitalisation is the listed retirement village industry refreshed? With demographic driven resident demand for retirement living units set to potentially outpace unit supply as the retirement village industry moderates new development and build rates to improve returns, and with debt levels across the listed industry back to more reasonable levels, the answer maybe yes.

Silver tsunami of demographic demand

Demographic driven demand is set to potentially underpin a step up in demand for retirement village living in New Zealand. Many New Zealanders consider retirement village living as they get to a later point of their retirement, often from the age of 75, when they begin to value the social and care benefits of living in a village.

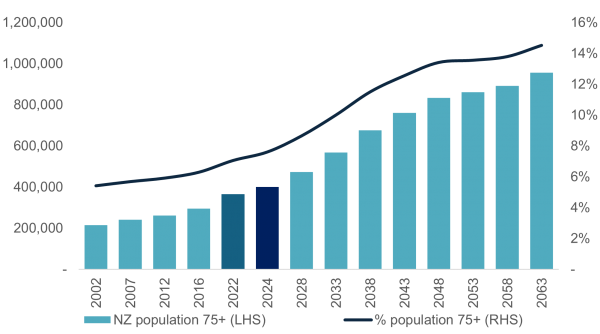

Over the medium term a ‘silver tsunami’ of over 75-year-olds is building in New Zealand. Statistics NZ national population projections indicates that the number of New Zealanders aged 75 years or older will increase from just over 400,000 in 2024 to just under 570,000 in 2033 – a 40% plus increase over a 9-year period. Given new retirement villages can take 7 to 10 years to complete, the retirement industry needs to be building in advance of this increase in demand.

Figure 1: Growth in 75-year-old plus population accelerating

Source: Stats NZ National Population projections, January 2021

Industry research groups suggest that approximately 15% of 75+ year old New Zealanders currently live in retirement villages, and that on average 1.25 New Zealanders live in each retirement village unit, with 1.25 reflecting that many 75+ year olds live on their own. If we assume that a similar 15% of 75+ New Zealanders choose to live in a retirement village then the retirement village industry needs to build more than 20,000 new units over the next 9 years to meet this potential demographic driven demand.

No FOMO to FOMO?

Many New Zealanders thinking about moving to a village may think they don’t have to rush – that there is currently plenty of retirement village unit supply and they can wait to sell their residential homes, with lower mortgage rates potentially supporting home prices – that there is no fear of missing out (FOMO). But that lack FOMO could turn to FOMO relatively quickly as the industry reduces new development supply and residential property markets stabilise.

In the near term, while demand for retirement living remains strong the ability of potential residents to move into villages is being constrained by a slow residential property market, with the sale of the family home often the key source of funding for a move. Concerns about the time it takes to sell the family home may be holding some potential residents back. A stabilisation in the New Zealand residential market including a reduction in the average days to sell a home may improve residents’ ability to move into a village and the cashflows of retirement village operators.

The slower pace of retirement village unit purchase settlement payments (e.g. payment of cash) when combined with higher costs (including construction costs, operating costs and funding costs) has contributed to an increase in debt levels within retirement villages. Slower existing unit sales and higher debt levels has seen retirement villages operators slow new build rates, change the mix of development, and in Ryman’s case raise new equity capital. Not-for-profit organisations continue to reduce the supply of existing retirement and aged care units.

In early 2025 international research firm CBRE estimated that the pipeline of development units proposed by the New Zealand retirement village sector was approximately 23,000 units. Since then, several listed and unlisted retirement village operators have cut their proposed development pipelines and reduced their annual build rates as they seek to improve returns and manage debt levels. As a result, the pipeline of potential development units maybe below the 20,000 plus units required to meet demographic demand out to 2033.

Ready to ride the wave

While the silver tsunami of demographic demand keeps building, the retirement village industry’s new unit build rate has slowed. Potential residents lack of FOMO could turn into FOMO in a relatively short period of time, supporting returns for those retirement village operators that are positioned to meet the strong underlying demand. As a result, shares in retirement village operators may be refreshed and ready to ride the ‘silver tsunami’ again.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.