- The RBNZ held the OCR at 5.50%, but in acknowledging a significant weakening in inflation pressures, they set themselves up with the option to cut the OCR pre-Christmas, possibly as early as their next meeting in August.

- “When the facts change, I change my mind. What do you do, sir?” John Maynard Keynes’ ghost could have been at the RBNZ’s OCR review meeting. The central bank, having been determined to bring inflation and inflation expectations down, has been consistent in signalling its preparedness to retain tight monetary conditions until the job is done. After some tentative signs of optimism recently, today was the first genuine signal that the RBNZ believes it might be making enough progress to look ahead and contemplate OCR cuts at upcoming meetings.

- Bond yields and the New Zealand dollar fell, as markets had only anticipated a more qualified sense of progress in getting inflation lower. We don’t yet see this as a sign that the economy might bottom any time soon. Rather, this may reduce the downside risk of a harder landing.

The RBNZ (Reserve Bank of New Zealand) held the OCR at 5.50% but, in acknowledging a significant weakening in inflation pressures, they set themselves up with the option to cut the OCR pre-Christmas, possibly as early as at their next meeting in August. OCR review meetings are less detailed events than the quarterly Monetary Policy Statement reviews, which include a full set of revised economic forecasts. Consequently, review dates such as today rarely signal much change in the assessment of the outlook for inflation. The exceptions occur when the news flow, or particular events, have made a big difference. In acknowledging a barrage of weak data lately, the RBNZ has aligned itself with messages from households, firms and financial markets. It is tough out there and inflation pressures are diminishing quite quickly. Today’s change in tone was a relatively big deal for the market and may prove to be the moment at which the RBNZ pivoted towards an easing bias.

Having acknowledged the progress, the next question is how quickly the RBNZ cuts the OCR. The RBNZ said that “the extent of (monetary) restraint will be tempered over time consistent with the expected decline in inflation pressures.” Taken at face value, today indicated a marked decline in the RBNZ’ expected inflation outlook. The threshold to cut may have been reached, making an August cut a possibility. However, this would be a very large movement away from their projections in May that the OCR would not be cut until H2 2025. While somewhere in the middle might seem a more realistic expectation, given the rapid deceleration in the economy and the lags at play as the economy responds to changes in monetary policy, it is not hard to make a case for rate cuts fairly soon.

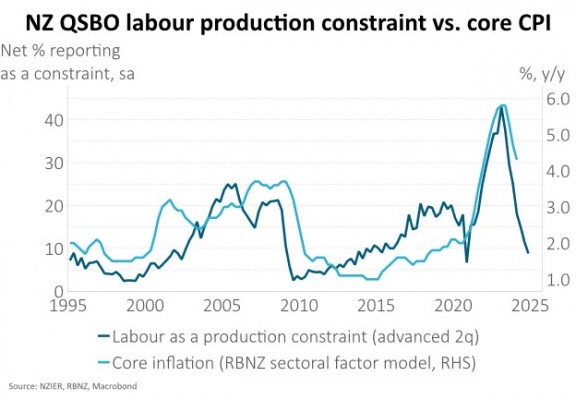

“When the facts change, I change my mind. What do you do, sir?” So, what is new? Recently, research at the RBNZ indicated that a measure of strength (or weakness) in the labour market has been proving to be a strong indicator of inflationary pressures. This is Labour as a Production Constraint, captured in the NZIER’s Quarterly Survey of Business Opinion. It fell sharply in the most recent survey, released on 3rd July. See our Navigator, Weak QSBO points to lower rates ahead. This is not the only sign of weakening inflation pressures, however, it captures the changes admirably.

Bond yields and the New Zealand dollar fell, as markets had only anticipated a more qualified sense of progress in getting inflation lower. We don’t yet see this as a sign that the economy will bottom any time soon. Rather, this may reduce the downside risk of a harder landing. If the RBNZ had not signalled any change in tone today, we would not only have been surprised, but also would have expected the economy and jobs market to continue to weaken into next year. Bond and swap yields fell sharply today, with the 2-year swap rate down 0.2% to 4.61%. The move in swap rates has taken expectations of the future OCR (Official Cash Rate) decisively below 4% for the first time since the OCR reached 5.5%. This is still a rate well above the RBNZ’s estimate of a neutral cash rate. It is unclear how far the OCR may ultimately be able to fall, but at present, swap rates still factor in tighter-than-neutral monetary policy over the next 5 years.

Changes in interest rates can have both near-term and longer influences on the equity market. History suggests that the first-round impact on the local equity market of a fall in interest rate expectations are largely felt through currency effects. Companies with significant offshore earnings - or translated earnings - may be early beneficiaries of an easing of monetary policy if there is a sustained fall in the currency. We think that the most likely impact is through the NZD-AUD exchange rate, where perceptions are rising of a cross current in monetary policy developing. Hence, we are unhedged on our Australian equity exposures, and prefer exposures in Australia. The second-round effects are less certain, with cyclical companies often seeing perceptions of improved economic conditions flowing through to share prices. In some instances, a recovery in house prices or the employment market might be secondary factors to provide support for retail or construction companies.

At this stage, equity portfolios are more heavily skewed to companies with offshore and Australian earnings while we wait to see more evidence that monetary policy might be eased sufficiently to take the pressure off the domestic economy. The opportunity to lift quality cyclical exposures may be beginning to present itself. However, it’s likely a question of whether we are at the start line or still traversing a tightrope.

IMPORTANT NOTICE AND DISCLAIMER

This article is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.