- NZ is now technically out of recession and most forecasters expect ongoing above-trend growth this year without stimulatory monetary policy, i.e. an OCR below 3%. We are sceptical and see risks skewed to NZ needing sub-3%, or at least a much longer period of neutral, interest rates given the historically large amount of spare capacity.

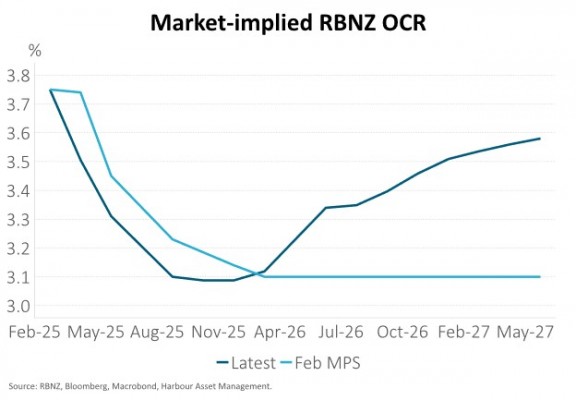

- There are of course several ways we could be wrong, including: the economy is stronger than we think, inflation is about to take off, the neutral OCR is higher than 3%, mortgage-related hedging is overstating the market implied path for the OCR and the RBNZ ends up being reluctant to take the OCR below 3% given the post-Covid inflation experience.

- If we are wrong, it will become apparent in a broadening of green shoots in the high-frequency hard data. If we are right, we are likely to see lower interest rates than markets price as the economy sends ongoing disinflationary signals.

NZ is now technically out of recession and most forecasters expect ongoing above-trend growth this year without stimulatory monetary policy, i.e. an OCR below 3%. The market is no different, implying the OCR troughs above 3% (i.e. above our view of neutral) and there are c.50bp of hikes next year. We are sceptical and see risks skewed to NZ needing sub-3%, or at least a much longer period of neutral, interest rates given the historically large amount of spare capacity. Yes, Q4 GDP growth of 0.7% was roughly double expectations, including the RBNZ that had 0.3%, but the composition was questionable. On the production side, 0.3 percentage points, i.e. almost half, of the 0.7% growth was due to the technical balancing item that should reverse in the coming quarters. Weakness in professional services suggested soft cyclical momentum. On the expenditure front, the 1.9% q/q increase in government consumption is unlikely to continue. Residential investment fell sharply, and consumption grew just 0.1%.

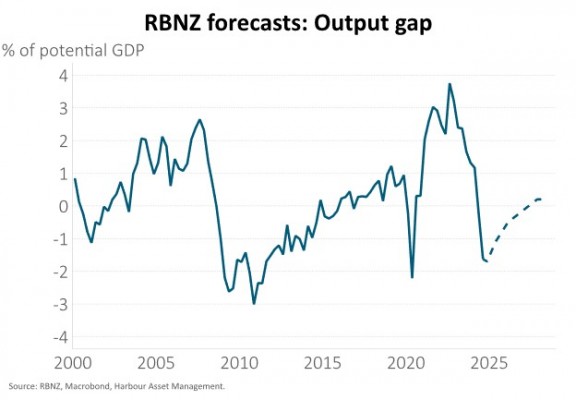

Don’t get us wrong; after contracting more than 1% last year, the economy is likely to feel better in 2025 as growth returns. But whether this growth will be strong enough to remove the large amount of spare capacity in the economy is another question. If not, this will prove a source of ongoing disinflation. The output gap is likely to be around -1.5% currently. Over the past 25 years, only the Global Financial Crisis and Covid have seen larger amounts of economic slack (see chart below). High frequency indicators for this quarter have been mixed and suggest this story is unlikely to change quickly. Consumer confidence, for example, has dropped markedly in Q1. With unemployment yet to peak and inflation close to target, we think the risk of an inflation undershoot over the coming year is high.

So, what on earth are we missing? As usual, there are several ways we could be wrong:

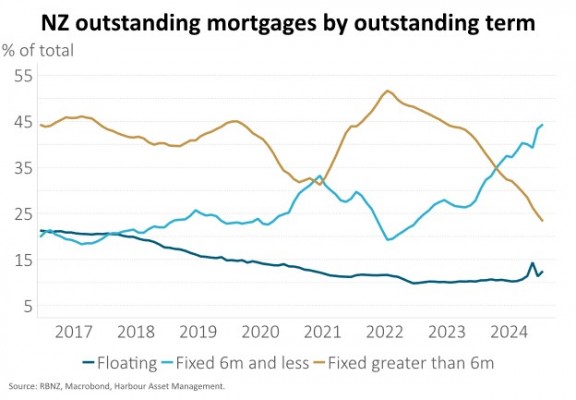

1) The economy is stronger than we think. The “green shoots” that we initially observed in survey data last year may be starting to translate into the real economy. It looks like the housing market is finally starting to show some signs of life. As of January, 44% of all mortgages were fixed for 6-months or less, despite the lowest rates being around the 2-year point. Borrowers should benefit as they roll on to lower fixed mortgage rates. There is uncertainty, however, as to how much of the cash flow gain from lower interest rates will be spent in an environment where the labour market is continuing to deteriorate.

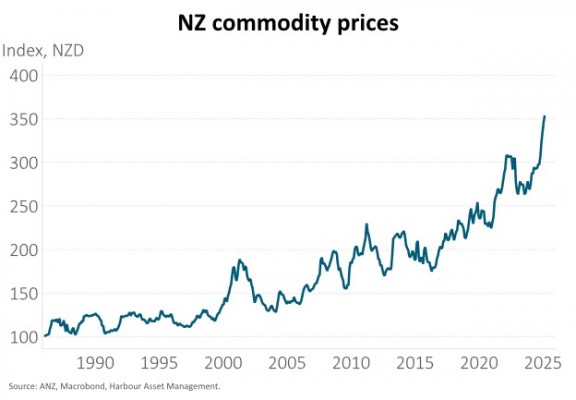

The external sector is performing well, enjoying higher commodity prices and ongoing global demand. The fly in the ointment, however, are trade tariffs which are likely to lower global growth. It doesn’t appear that this is factored into RBNZ or Treasury trading partner growth forecasts with the RBNZ expecting 2.6% growth this year, above the median analyst forecast according to Bloomberg. At this stage, it looks like all the RBNZ has done is to lower its forecasts of business investment given heightened global uncertainty to no growth this year, from 1.5% growth in the November MPS. It’s worth noting that domestic uncertainty has also grown with political polls suggesting a 50/50 chance of a change in government next year, not to mention the sudden departure of RBNZ Governor, Adrian Orr, for which a replacement is unlikely until much later this year.

Overall, while there is evidence of green shoots in some sectors, we find the overall story underwhelming. The external sector is expanding, and house prices may be showing some signs of stabilisation but other areas, such as consumption and construction remain anaemic. The economy may be finding a base, but we don’t think excess capacity is going to be removed sufficiently quickly to ensure inflation doesn’t fall below target in the next 1-2 years.

2) Inflation is currently close to the 2% target but will soon be much higher. No doubt, the weaker NZD is likely to add to tradable inflation this quarter but it’s not clear that this will persist with the exchange rate recently rebounding strongly in March. We also don’t believe the RBNZ will place great weight on higher tradable inflation with the economy so weak, providing an ongoing disinflationary force via non-tradable prices, and inflation expectations anchored at target.

3) The neutral OCR is higher. This is an ongoing uncertainty, and there is consensus that neutral interest rates are higher than they were pre-Covid (for further discussion see Harbour Navigator: What you need to know about neutral interest rates, 18 September 2023). If the neutral OCR is at the top end of recent RBNZ estimates, say 3.5-4.0%, an OCR low of 3% represents stimulatory policy.

In terms of our own view, we feel comfortable with our working neutral OCR assumption of 3.0% following RBNZ Chief Economist, Paul Conway’s recent speech “Beyond the Cycle: Growth and interest rates in the long run”[1] where he repeatedly referenced a neutral OCR being between 2.5 and 3.5%.

4) Mortgage-related hedging is overstating the market implied path for the OCR. As mentioned above, as of January, 44% of all outstanding mortgages, about $160bn, were fixed for 6-months or less (see chart below). Since then, we have seen increased competition for 2-year mortgages with the “big-4” banks lowering their special rates by c.30bp to 4.99% in February - almost 100bp below the current 6-month special rates. This has likely prompted increased mortgage fixing at this tenor which usually requires hedging by bank balance sheets, via paying the fixed leg of an interest rate swap and receiving the 3-month floating leg, to better match the maturity of their liabilities (deposits) with their assets (mortgages). As this happens, swap rates can be dragged higher and take overnight index swap rates (where the OCR is the floating leg) with them, overstating the market implied OCR path.

To the extent this persists, however, it represents an unwelcome tightening in monetary conditions that the RBNZ is likely to lean against via a lower OCR than previously projected.

5) There is also the possibility that while the economic rationale would be for the RBNZ to take monetary conditions into easy settings, they may be cautious about doing this. Central banks took too long to recognise the inflation risk in 2021 and memory of this may cause them to be more cautious about cutting rates, for fear of repeating the previous error. Given the imprecise knowledge of the true neutral cash rate, and the possibility of the RBNZ being cautious about taking the OCR too low, there is a scenario where policy stays too high over the next 12-24 months and the economy continues to generate disinflation.

Overall, we think the risks outlined above are largely priced, with economists and markets appearing to be positioned for somewhat of a goldilocks recovery where the economy quickly returns to full health, without the need for sub-3% rates. Given this setup, we think the skew of risks is to lower rates and have positioned portfolios accordingly.

[1] https://www.rbnz.govt.nz/news-and-events/events/2025/january/beyond-the-cycle

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.