- The GLP-1 drug class, which has predominantly been used to treat type 2 diabetes, has captured notable mindshare with healthcare specialists and macro investors due to initial findings from the Select study suggesting potential effectiveness of these drugs in addressing cardiovascular risk in obese patients.

- The broader implications for obesity, cardiovascular events and other associated conditions within this drug class may eventually extend its influence across other segments of the healthcare market and could impact on many other industries over time.

- GLP-1 drugs, as a front-line treatment for medical intervention to prevent cardiovascular disease in the obese population, are very early in their life cycle. Full data from the Select study is yet to be released, and there are a number of issues where the science and study results are still being interpreted.

The GLP-1 drug class has captured notable mindshare with healthcare specialists and macro investors.

The recent publication (8th August 2023) of a large-scale clinical study (the “Select” study) demonstrated GLP-1 drugs could result in a 20% relative reduction in cardiovascular risk[1] for non-diabetic obese patients with established cardiovascular disease. For context, this is seen as a very good result.

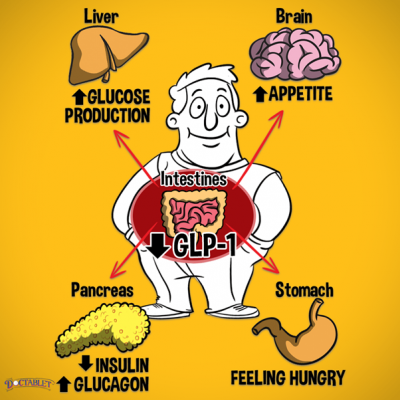

These drugs mimic the action of a hormone called glucagon-like peptide 1 (GLP-1). Your small intestine naturally releases this hormone when you eat food. The medicines work in several ways:

- By helping your pancreas to make more insulin (the hormone that controls the amount of sugar in your blood) when needed.

- By reducing the amount of sugar (glucose) that your liver makes.

- By slowing down the emptying of the stomach so that you feel fuller for longer and may consume smaller portions overall.

- They can also reduce your appetite in general, although the exact mechanisms for this are unclear.

Although these drugs can be used to combat obesity (at this stage we understand most obesity usage is off label[2]), over the last fifteen years they have been predominantly used to treat type 2 diabetes. While the range of GLP-1 drugs has several undesirable potential side effects (nausea and other gastrointestinal disturbances), these are largely well-recognised and documented, and can often be managed with dose modification. The treatment leads to an average weight loss of around 17-18%[3] when combined with changes to diet and exercise.

While there is an incontrovertible acceptance of a relationship between obesity and cardiovascular disease (along with other medical conditions), there had been limited clinical evidence to support obesity drugs having the ability to materially address this issue prior to the release of the Select study.

The Select study has only published high level data so far (more is expected to be released over the next 3 months) and has also yet to be peer-reviewed. However, the initial readings showed it to be achieving its primary end point, being a 20% decrease in major adverse cardiovascular events (MACEs) over a period of up to five years taking Semaglutide (a GLP-1 drug). The trial enrolled 17,604 overweight or obese adults aged 45 years or older with established cardiovascular disease (CVD), and no prior history of diabetes.

Promising, but a long road ahead

These drugs have the potential to have wide-ranging implications for many health treatments on a longer time frame. Clinicians we have listened to in recent weeks, while welcoming the study, have raised a number of questions which need to be addressed.

First, there is currently a shortage of GLP-1 drugs being manufactured. Secondly, upon stopping GLP-1 drug consumption (which is either daily or weekly) patients reportedly tend to put back on a proportion of the previous weight loss. Third, the most common application of the drug is currently via subcutaneous injection which may be a roadblock to wider usage, although there are oral options available and further under development. Some current oral options have been less effective to date so this development is being closely monitored as a potential further break-through. Furthermore, the side effects, while well-documented, do reportedly lead to a degree of non-compliance amongst current users.

Finally, and probably the biggest short-term roadblock, is that in most jurisdictions the drugs are only directly reimbursed by insurers for type 2 diabetes, not obesity. To highlight this impediment, the US public system (the largest healthcare market in the world) is explicitly legislated to exclude weight loss (and weight gain) drugs from reimbursement, despite extensive ongoing lobbying by the drug companies (the last failed attempt was in July 2023). One commentator recently made the following observation, “if just 10% of Medicare beneficiaries (~65m people) were treated with Wegovy (the Novo Nordisk Semaglutide drug used in the Select study), to treat all obese American adults with these drugs at current prices, it would cost US$1.3trn. The current US Defence budget is nearly $800b”. Indeed, most specialists we have listened to believe more studies and trials will need to be done to alter the reimbursement landscape even at the margin.

The potential impacts and flow on effects

Over 650 million adults worldwide are obese (more than three times as many as in 1975) and roughly another estimated 1.3 billion are overweight. According to the World Health Organisation, this is exacerbating conditions such as heart disease and type 2 diabetes. If GLP-1 drugs become widely used to combat these issues, it could impact on many industries, not just healthcare, over time.

While still in its early stages, the broader implications of lower obesity, cardiovascular events and other associated conditions within this drug class may eventually extend their influence across other segments of the healthcare market. GLP-1 drugs are also being studied in several focus conditions, with clinical trial readouts due in the next several quarters.

What is the equity market saying? There are several global listed companies involved in the production of GLP-1 drugs, and other healthcare companies that may be beneficiaries of this innovation. Equally, there are likely even more companies across a range of sectors potentially negatively impacted if the results of the Select study flow through to affordable effective uptake of GLP-1 drugs.

For instance, a Goldman Sachs GLP-1 Risk Basket (GSHLCGLP Index) recently constructed includes 25 healthcare companies that may be adversely impacted, including medtech tools and services, and managed care companies. It also includes a basket of restaurants, fast food companies and packaged foods and meats companies. While we consider this market index to be rather opportunistic, the recent significant underperformance of the index (-7% underperformance of the broad SP500 since 8 August) does highlight the potential for this study to fundamentally impact healthcare reforms.

However, we reiterate our earlier statements, GLP-1 drugs as a front-line treatment for medical intervention to prevent cardiovascular disease in the obese population are early in their life cycle. Further studies and medicine development cycles are worth monitoring for the impact on medical practices and applications.

Source: Docutatblet

[1] Novo Nordisk A/S: Semaglutide 2.4 mg reduces the risk of major adverse cardiovascular events by 20% in adults with overweight or obesity in the SELECT trial. 8 August 2023.

[2] For Weight Loss, Off-Label GLP-1s Are Increasingly the Chosen Ones | AMCP March 2023

[3] Studies found people using Semaglutide and making lifestyle changes lost about 33.7 pounds (15.3 kilograms) versus 5.7 pounds (2.6 kilograms) in those who didn't use the drug. Source: GLP-1 agonists: Diabetes drugs and weight loss. Mayo Clinic June 2022

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013