- The recent failure of Silicon Valley Bank (SVB) and rescue of Credit Suisse have tightened global financial conditions and reduced the need for monetary policy to be as restrictive.

- As a small open economy with a heavy reliance on global investors to fund our current account deficit, New Zealand has a high sensitivity to the health of the global economy and international financial markets.

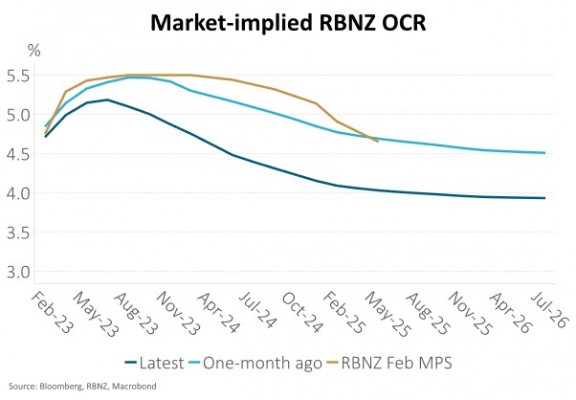

- At this stage, we expect the stress in financial markets will not be judged concerning enough to prompt the RBNZ to break with projected interest rate hikes and pause its tightening cycle next week. A 25bp hike to 5.00%, however, may prove to be the last in this cycle, leading to an extended period with rates on hold before an eventual shift to gradually lowering rates.

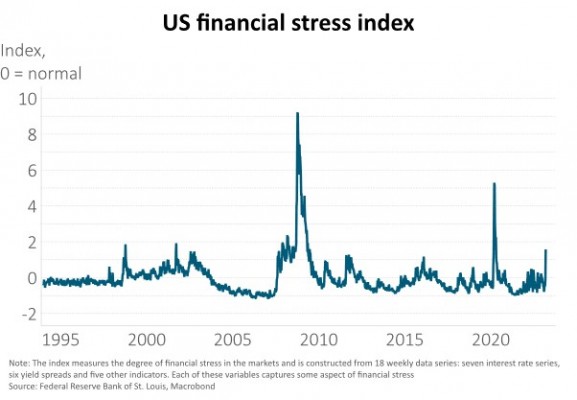

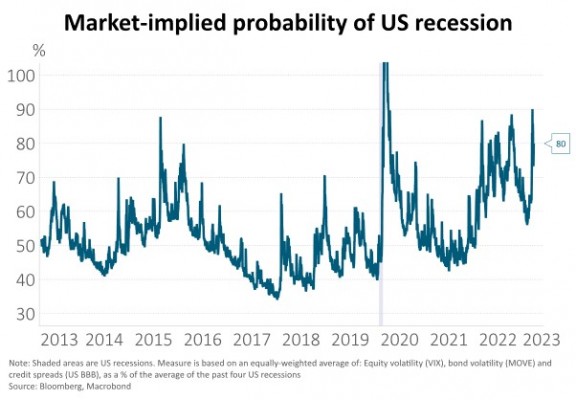

The recent failure of Silicon Valley Bank (SVB) and rescue of Credit Suisse have tightened global financial conditions and reduced the need for monetary policy to be as restrictive. A liquidity crisis, driven by a broad-based withdrawal of bank deposits, has likely been stopped in the US by an expansion of deposit guarantees and the creation of more favourable central bank borrowing facilities. In Europe, the European Central Bank has eased concerns by signalling it’s ready to provide liquidity to banks if needed. But global bank borrowing costs, relative to risk free rates, are now higher and banks are likely to be much more careful in their lending – particularly regional banks that are important lenders to small and medium-sized businesses. This represents a tightening in financial conditions that markets believe raises the probability of recession and reduces the need for monetary policy to be as restrictive. This has been most pronounced in the US, where the Fed Funds rate is implied to be more than 100bp lower than the market pricing that prevailed prior to SVB failure.

Instead of discussing here whether the market’s interpretation of these recent events is correct, we thought it would be more useful to examine the implications for Reserve Bank of New Zealand (RBNZ) policy settings.

As a small open economy with a heavy reliance on global investors to fund a large current account deficit, New Zealand has a high sensitivity to the health of the global economy and international financial markets. The RBNZ published an article in 2019 that described how international shocks impact New Zealand via three key channels – trade, financial markets and uncertainty. This provides a useful framework to assess the impact of the recent banking stress:

- Trade channel. New Zealand exports of goods and services account are worth $60-70bn per year, or about 25% of GDP. It is still too early to assess the likely impact on global growth from the tightening in financial conditions, but to the extent this weighs on global activity it is likely to reduce the demand for, and price of, our exports.

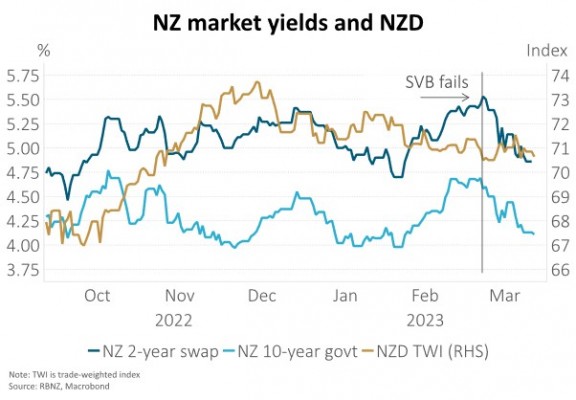

- Financial market channel. Since SVB’s failure in early March, our interest rates have declined 50-60bp in sympathy with those in the US and Europe. The NZD is marginally weaker on a trade-weighted basis over this time. All else equal, this is positive for New Zealand economic growth and provides an offset to the possible reduction in export demand. While NZ bank bond yields have declined by a smaller amount relative to interest rate swaps, with 5-year senior bond spreads widening about 20bp to 95bp over the past month, the large drop in risk-free rates has meant that wholesale NZ bank funding costs have reduced.

- Uncertainty channel. Again, it’s too early to judge the extent to which the recent global events have impacted the appetite of New Zealand businesses and households to spend. Greater uncertainty is likely to reduce business investment and household consumption.

At this stage, we expect the stress in financial markets will not be judged concerning enough to prompt the RBNZ to break with its projected hikes and pause its tightening cycle next week. A 25bp hike to 5.00%, however, may prove to be the last in this cycle, leading to an extended period with interest rates onhold before an eventual shift to gradually lower rates once inflation comes back to their target range. However, inflation remains too high and the labour market too tight for the RBNZ to relent at this stage. The likely rebuild from the North Island floods adds further impetus for tight monetary policy. A Monetary Policy Review, with no forecasts or press conference, is also not an ideal platform to announce a change in policy direction. But as we wrote in late February, there are clear signs from leading indicators that monetary policy is working and we think the RBNZ is very close to the end of its tightening cycle (see Harbour Navigator: RBNZ not done yet but getting close, 28 February 2023). We think this will be considered carefully at the 24 May Monetary Policy Statement meeting when more information will be available and the RBNZ will have its full suite of communication tools available.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.