- Investors may be paying too much for short term dividend income illusions.

- Paying dividends from capital rather than recurring earnings is not sustainable over time

- One-off asset sales might better be paid out as special dividends or returned to shareholders as share buy backs

Investors must exercise caution when evaluating companies offering seemingly attractive dividends. A high current yield may mask underlying issues that could jeopardise future payouts. Investors may be paying too much for short term dividend income illusions. Investing in companies that can sustainably and progressively increase dividend income payments to shareholders has historically been a value-adding investment strategy.

Unsustainable Payout Ratios – A Dividend Chimera

Companies paying out a disproportionate share of earnings as dividends may struggle to maintain these levels during economic downturns or periods of reduced profitability. Some investors have an unfortunate track record of paying up for regular dividends that may be based on a very full payout of unsustainable underlying company earnings or dividends from capital rather than earnings. Some income-focused investors bid up share prices of companies paying what might appear to be relatively high regular dividends without considering whether the dividend payments can be sustainably funded from underlying, recurring earnings. These dividend distributions eventually get exposed as a dividend chimera - an unrealistic, unreliable mythical investment monster – and the share price tends to fall back to levels that the market thinks truly reflect sustainable dividend income.

Boards of directors might hesitate to reduce dividends when company earnings decline. This is due to concerns that shareholders who rely on dividend income may sell their shares. Consequently, they may distribute more than 100% of underlying earnings in the near term on the basis that company earnings will eventually recover.

Capital-Funded Dividends

But what if the company’s earnings don’t recover, or not to the level required to support expectations? Distributions funded from capital rather than recurring earnings are inherently unsustainable and may erode long-term shareholder value. Cyclical New Zealand companies that are more exposed to economic volatility, including, for example, Air New Zealand and Fletcher Building, have been forced to make dramatic cuts to dividends recently leading to swings in their share prices. It may be better for shareholders if companies cut dividends rather than face a higher cost of debt capital when their debt credit rating drops as a result of stretching the balance sheet to pay dividends. Worse still, companies may be forced to raise new equity to shore up their balance sheets through reducing debt after overpaying dividends.

One-Time Events

Dividends boosted by non-recurring events such as asset sales can create a false impression of sustainable income growth. One-off asset sales might better be paid out as special dividends or returned to shareholders as share buy backs to avoid the ‘hangover’ risk arising from including them in regular dividend payments.

One-off asset sales by businesses may make company balance sheets look over-capitalised in the short term. Being over-capitalised means businesses may not be funded with an optimal balance of equity and debt capital. As companies might look to return excess capital to shareholders, directors may be tempted to include that capital return as regular dividends, effectively boosting dividend income above the level underlying company earnings can support. Unless asset sales are recurring, with the company effectively winding itself up, such dividends may create an unsustainable illusion.

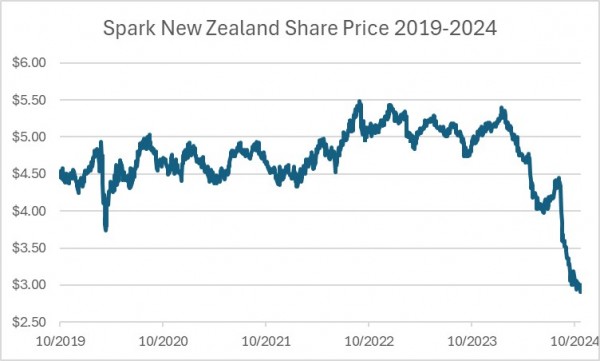

Spark New Zealand has recently cut its earnings and dividend guidance as the company may face cyclical and structural earnings risk. The new dividend guidance may still be dependent on deferring capital investment or the sale of assets, meaning that dividends are dependent on one-off capital events rather than sustainable, recurring earnings generated by Spark’s core business. As a result, investors in Spark may remain wary about paying up for headline dividend payments until they get greater comfort around the sustainability of those dividends.

Figure 1: Falling dividend expectations may have impacted negatively on the Spark New Zealand share price

Source: Bloomberg November 2024

While rock band Guns ‘N’ Roses may have made good returns from their 1991 album ‘Use Your Illusion’, investing in shares where dividends might be an illusion may not lead to the same good times.

IMPORTANT NOTICE AND DISCLAIMER

This article is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.