- Less than six months ago the Chinese economy was partly locked down with COVID restrictions and commentary remained bearish across a range of industries.

- Fast forward to now and Chinese non-manufacturing purchasing managers’ index (PMI) readings are pointing to a very solid recovery in Chinese economic activity from 2022’s COVID lockdowns.

- A core indicator, the China non-manufacturing PMI for March of +58.2 was well up from 56.3 in February, and much higher than consensus expectations of 55. A reading above 50 is consistent with expansion. This strength in the Chinese economy is directly leading to an improved sentiment for global growth.

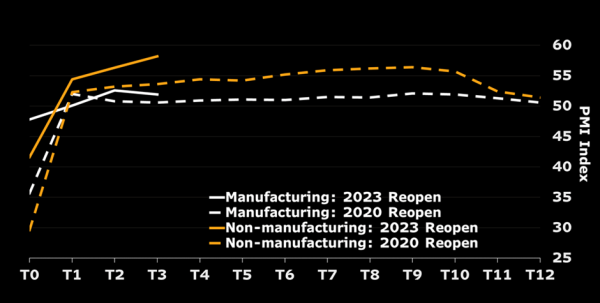

Importantly, 2023’s recovery is running ahead of that seen after 2020’s China partial reopening after the initial COVID lockdowns, suggesting there may be a greater degree of confidence in this recovery.

Figure 1: China PMI’s 2020 Vs 2023 Reopening – more conviction?

Source: NBS, Bloomberg Economics

The economic expansion in March 2023 reflects spending on services and government investment in infrastructure is driving the economy’s recovery. Looking at the detail, the China services PMI continued its increase to 56.9 from 55.6. The China construction gauge rebounded to 65.6 from 60.2 - the highest reading in the gauge since May 2012 — highlighting the strength of the public investment drive associated with the Government’s pro-growth policy stance that has seen a combination of easier financial conditions and specific targeted growth initiatives.

The lift in Chinese economic demand is a useful tonic for other economies, particularly those with a larger relative trading relationship. The regions of Europe and Asia may benefit directly. And, most obviously, the Australian economy may continue to see both volume and elevated price trends for mineral exports, particularly iron ore and copper. Indeed, in recent weeks there has also been a tangible improvement in potential trading relationships for several other Australian sectors with an easing of tensions. Official Australian delegations, and business conferences, point to a potential reconnection of trading opportunities.

Within Harbour equity growth portfolios, the lift in Chinese infrastructure and stabilisation in construction activity may provide support for iron ore and copper producer, BHP. The recovery and lift in consumer confidence may also be supportive for returns from shares in student placement business IDP Education, travel and tourism shares such as Auckland Airport, and wine producer Treasury Wine Estate as consumption patterns normalise.

As a final note, many global forecasters have lifted projections for both Chinese and global growth in 2023. Although there may be pockets of soft and perhaps very soft economic data, these areas of weakness are likely to be focussed on the consumer and housing sectors. After a few weeks of markets focussing on financial risks, it is good to remind ourselves that the world’s second largest economy is accelerating, and this trend may have significant consequences for investors.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.