Key market movements

- The MSCI All Country World Index (ACWI) edged 0.6% higher last month, in New Zealand dollar-unhedged terms. Returns in NZD-hedged terms were much better for a second month due to continued NZD strength, coming in at 1.9% for September.

- Locally, New Zealand equity market returns for the month were again muted after strong returns in July, with the S&P/NZX 50 Gross Index (including imputation credits) flat. The S&P/ASX 200 Index, however, responded positively to surprise Chinese stimulus and returned 3.0% (3.6% in NZD terms) for the month.

- Bond indices continued to post gains. The Bloomberg NZ Bond Composite 0+ Yr Index rose 0.6%, whilst the Bloomberg Global Aggregate Bond Index (hedged to NZD) rose 1.1% over the month. US 10-year government bond yields were 12bps lower on the month, ending at 3.78%, whilst the New Zealand 10-year yield fell 3bps to end at 4.24%.

Key developments

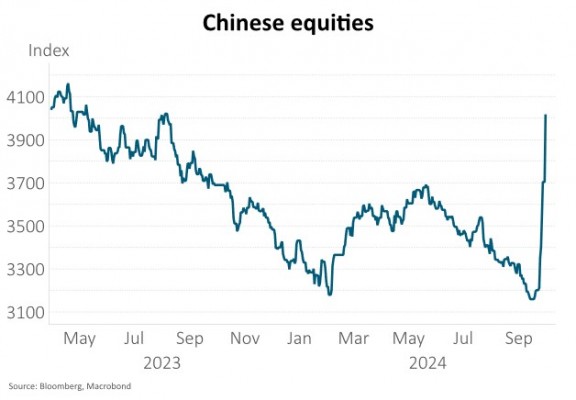

China unexpectedly introduced several stimulus measures in September to support its housing market and consumption, though the scale is smaller than past efforts. If more stimulus follows, this could add significantly to GDP growth in 2025.

The US economy appears far from recession, despite market expectations of significant Fed rate cuts. The Federal Reserve began its easing cycle with a 50bp rate cut, surprising economists who predicted 25bp. However, the market response was muted, as much of the cut had already been priced in. The “dot plot" forecast for the Fed Funds rate remains higher than market expectations, consistent with ongoing economic resilience. Q3 GDP, for example, is currently tracking around 3% on an annualised basis.

Trump’s potential impact on inflation remains a concern for bond markets, even though Kamala Harris is seen as the stronger presidential candidate. Bond yields could rise under Trump due to his inflationary policies, such as tax cuts and tariffs. In swing states, polling is still close, so the outcome remains uncertain, keeping markets on edge.

Following the RBNZ’s August MPS rate cut, financial markets have moved to price an accelerated easing cycle, inconsistent with the central bank’s OCR forecast and data releases since the August MPS. Don’t get us wrong, things are still tough out there, and there is a chance that the RBNZ recalibrates policy settings in line with market pricing, but we think risks are skewed to the central bank not delivering on pricing that takes the OCR below 3%.

What to watch

Chinese equity markets staged a spectacular rally after the government and central bank signalled strong commitment to rebooting the economy, with a range of monetary and fiscal measures. Though the size of the stimulus is unlikely to match the scale of 15 years ago, market reaction to the announcements indicates an expectation that stimulus measures will meaningfully impact economic growth in the short-term. While some analysts are optimistic about short-term growth, others remain sceptical of the long-term effects on consumption and structural issues, given China’s demographic trends (for further discussion, see Harbour Navigator: Beijing gets serious: fiscal and monetary stimuli to boost Chinese growth, 30 September 2024).

Market outlook and positioning

Ongoing cooling inflation may prompt further central bank rate cuts which, given ongoing economic growth, should support global equity returns. In New Zealand, the potential stabilisation of the economy could improve earnings forecasts and boost share market performance. However, market volatility may rise due to overly optimistic expectations for central bank cuts and geopolitical risks, such as Middle East conflict or US election uncertainty. Following a strong rally, some investment positions have been reduced to increase cash reserves, with plans to reinvest during market pullbacks for better returns over the next year.

Lower interest rates encourage capital formation as investors seek higher-risk assets, which broadens positive performance across equity markets. Additionally, mergers and acquisitions (M&A) may accelerate in a more stable interest rate environment, with M&A activity expected to rise in the coming years. However, caution is advised as inflation risks remain, and geopolitical factors could lead to short-term volatility.

New Zealand's earnings growth potential is promising, with positive signals emerging from recent business sentiment surveys. The ANZ Business Outlook survey and NZIER's Quarterly Survey of Business Opinion show a rebound in confidence, suggesting possible earnings surprises in the share market. While the NZ economy still faces challenges, further interest rate cuts by the RBNZ may support continued growth. In Australia, mining and industrial sectors faced negative earnings revisions in September, but recent Chinese stimulus could improve earnings forecasts in the coming months, boosting market performance.

Within equity growth portfolios, Harbour’s strategy focuses on patience, scenario planning, and selective investments in quality growth. We are prioritising companies with strong earnings per share (EPS) growth, particularly those benefiting from long-term trends like digitisation, disruption, de-carbonisation, and demographic shifts. While lower interest rates may boost M&A activity, sustainable value comes from long-term earnings growth, not M&A alone. Within the portfolio we are selectively overweight growth at a reasonable price (GARP) shares in the healthcare, information technology, financial services and materials sectors given they offer the potential for compound growth. The information technology (IT) sector’s secular growth potential is underscored by the runway remaining in GenAI, improving IT budgets, and expectations for improving margins but we are mindful of share price valuations. The portfolio remains underweight in the lower growth utilities, telecommunications, infrastructure and real estate sectors.

In fixed interest portfolios, we highlighted last month a shift in our investment strategy from duration positioning to focusing on security and sector selection. Over the past three years, duration positioning and inflation-indexed bonds have been key in adding value, but we now expect lower volatility and more stable inflation, making active management more challenging. Credit presents an attractive opportunity, not due to valuation but the potential to diversify away from the Fund's benchmark, which is heavily weighted in NZ Government Stock and AAA-rated securities. By reducing exposure to these and diversifying into other investment-grade issuers, higher yields can be achieved with acceptable risk. Additionally, specific bond issues in the NZ Government Stock yield curve may be mispriced, offering further opportunities. While duration management remains relevant, we’ll focus on more technical market aspects for the time being.

Within the Active Growth Fund, we continue to hold a small underweight position to global equities. One of our reservations about taking a more constructive view on global equities is valuations. While not a short-term indicator, the level of risk premium that is priced into current valuations, measured by the forward-looking equity risk premium, is hovering near two-decade lows. While valuations are not a catalyst in themselves, with US elections, trade tensions rising and war, one could imagine a scenario where risk premia are revisited. It isn’t all doom and gloom, however, as the ability of companies, particularly in the US, to deliver resilient earnings continues to impress.

In the Income Fund, we are focused on maintaining a benchmark or below weighting in equities while shifting our fixed income strategy away from duration positioning toward security and sector selection. The shift towards a more cautious equity exposure is driven by the proximity of the US election and a shift in global bond markets as rate cut expectations are being pared back. We have also been reducing the duration of fixed interest investments.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.