Key market movements

- The MSCI All Country World Index (ACWI) retreated almost 3% last month, in New Zealand dollar-unhedged terms, after gaining 4.2% in July. August returns in NZD-hedged terms were much better due to a bounce in the NZ dollar, coming in at 1.6%.

- Locally, equity market returns for the month were muted after a spectacular August, with the S&P/NZX 50 Gross Index (with imputation credits) returning 0.4%, and the S&P/ASX 200 Index returning 0.5% (-1.1% in New Zealand dollar terms).

- Bond indices had another solid month. The Bloomberg NZ Bond Composite 0+ Yr Index rose 0.9%, whilst the Bloomberg Global Aggregate Bond Index (hedged to NZD) rose 1.1% over the month. US 10-year government bond yields were 13bps lower on the month, ending at 3.90%, whilst the New Zealand 10-year yield fell 8bps to end at 4.27%.

Key developments

Global economic growth is slowing, driven by China, the euro area, and the US, but it's not stalling. Central banks are beginning to ease monetary policy due to ongoing disinflation, which should help avoid recessions in most regions. The US Federal Reserve has hinted at upcoming rate cuts, despite the economy growing near its trend, to prevent further cooling in the labour market.

The upcoming US election may add to market volatility, with Kamala Harris emerging as a strong challenger to Trump. A Trump victory could increase inflation pressures through an extension of tax cuts, trade tariffs, and immigration restrictions. Meanwhile, Japan's central bank is cautiously normalizing its policy, signalling confidence in its economic recovery by raising short-term rates and reducing bond purchases, which has strengthened the yen and contributed to volatility in global markets.

In New Zealand, the RBNZ has appropriately started its easing cycle in the face of a rapid economic slowdown. While confidence has bounced in response to lower interest rates, activity and labour market outcomes are likely to get worse before they get better, given the long and variable lags with which monetary policy works and that interest rates remain restrictive. This may encourage a faster easing cycle than the RBNZ currently forecasts.

What to watch

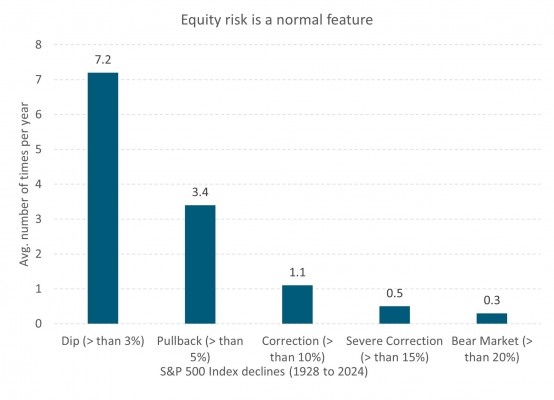

Given the spike in cross-asset volatility in early August, caused partly by an unwinding of Japanese yen carry trades, we thought it worth noting that equity pull-backs of the size we saw are not unusual. The largest daily drop in the S&P 500 during this time was 3%. Data reported by Bloomberg from LPL Financial outlined that there has been 354 days since 1928 when the S&P 500 index has fallen by more than 3% in one trading session. Moreover, 94% of the years since 1928 have experienced a pull-back of more than 5%, and, on average, the S&P 500 experiences more than three pullbacks of over 5% each year

Source: LPL Financial, Bloomberg.

Market outlook and positioning

Spring brings warmer temperatures and longer days, but the season's unpredictability—with occasional cold and wet storms—mirrors current share markets. In August, markets reacted sharply to weaker economic data, highlighting investor sensitivity and their expectation that central bank rate cuts will remedy economic concerns. While moderating global pricing pressures and economic activity support expectations of rate cuts, market volatility is likely to remain as investors navigate these uncertain times.

Globally, optimism is returning among investors, but markets remain sensitive to interest rate cuts, earnings momentum, and geopolitical risks. Inflation will determine the trajectory of rate cuts, while economic growth data will dictate the pace and magnitude. In the US, defensive growth sectors, like healthcare and consumer staples, tend to perform better following Federal Reserve rate cuts. However, the broader market's optimism may be tempered by concerns about lower growth and rising unemployment.

In New Zealand, despite cautious outlooks during the June profit reporting season, company management has shown confidence in their strategies. Business and consumer confidence indices have improved, though they remain below long-term averages, suggesting a less severe economic contraction. However, widespread earnings growth in the NZ market is still uncertain, with potential for further downgrades. Australian markets may see moderate growth with lower global interest rates, but challenges persist, including high valuations, profit margin pressures, and sticky inflation that limits the Reserve Bank of Australia's ability to cut rates.

Within equity growth portfolios, Harbour’s strategy focuses on patience, scenario planning, and selective investments in quality growth. We are prioritising companies with strong earnings per share (EPS) growth, particularly those benefiting from long-term trends like digitisation, disruption, de-carbonisation, and demographic shifts. While lower interest rates may boost merger and acquisition (M&A) activity, sustainable value comes from long-term earnings growth, not M&A alone. Within the portfolio we are selectively overweight growth at a reasonable price (GARP) shares in the healthcare, information technology, financial services and materials sectors given they offer the potential for compound growth. The information technology (IT) sector’s secular growth potential is underscored by the runway remaining in GenAI, improving IT budgets, and expectations for improving margins but we are mindful of share price valuations.. The portfolio remains underweight in the lower growth utilities, telecommunications, infrastructure and real estate sectors.

Over the past year, the fixed interest market has performed well as expectations shifted from the Reserve Bank of New Zealand (RBNZ) potentially raising the Official Cash Rate (OCR) above 5.50% to an actual rate cut in August. With the OCR now expected to fall to around 3%, monetary conditions are moving from "tight" to nearly "neutral." As a result, the strategy of holding long-duration positions, which benefited from falling market rates, is being reassessed. Although further OCR cuts below 3% might be necessary, the conditions for this, such as core inflation nearing 2%, are not yet met. Factors like improved business and consumer confidence, mortgage rate hedging, and government bond issuance may temper market enthusiasm for lower yields. Consequently, the investment focus is shifting from a core long duration position to security and sector selection, particularly in areas with attractive pricing and manageable default risks.

Within the Active Growth Fund, we have recently become more constructive on New Zealand equities and the cut from recent cut from the RBNZ helped reinforce that view. We see scope for the New Zealand market to further close the performance gap versus global equities. This is based off three key factors, firstly the valuation picture is more favourable, whilst not being cheap. Secondly, the earnings cycle seems to be closer to the bottom. Lastly, there could be more of a bid tone to some of the more defensive sectors which are more prevalent in the New Zealand market, with many companies’ dividend yields starting to look more attractive relative to falling bond yields.

Income Fund performance has benefitted from strong performance across both equity and fixed interest markets over recent months. As noted above, neither now have cheap valuations, with equity P/E ratios higher and the bond markets pricing in fairly aggressive rate cuts in the US. The fund is holding benchmark weights across fixed interest and equities at present, but we have a bias towards reducing exposure, without seeing reasons to do so aggressively. Central bank rate cuts can help underpin economic activity, which is ultimately supportive for asset markets. Accordingly, at this stage we envisage scope mainly for moderate market corrections rather than a significant pullback in market levels.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.