Key market movements

- Global equities were again lower in unhedged New Zealand dollar terms in April, with the MSCI All Country World Index (ACWI) declining 3.7%. With the NZD strengthening against the USD, returns in hedged terms were -0.4% for the month.

- Locally, the New Zealand equity market continued its poor start to the year with the S&P/NZX 50 Gross Index (including imputation credits) down a further 3.0% in April. In contrast, Australian equities performed well with the S&P/ASX 200 Index up 3.6% (1.6% in NZD terms).

- NZ bond returns were positive in April (+1.1%), measured by the Bloomberg NZ Bond Composite 0+ Yr Index. Global bonds also provided positive performance with the Bloomberg Global Aggregate Bond Index (NZD-hedged) returning 0.9%. At the end of the month US 10-year Treasury yields had only declined 4 bps to 4.16%, despite a rollercoaster month where the mark saw highs of 4.49% and lows of 3.99%.

Key developments

April was dominated by President Trump's unexpected "Liberation Day" tariffs, which initially imposed 10% duties on most trading partners including Australia and New Zealand, with substantially higher tariffs of 125-145% on China. This triggered immediate market volatility and prompted widespread reassessment of global growth prospects. While mid-month adjustments reduced some tariffs for 90 days and exempted certain tech products retroactively, China-US tensions escalated with reciprocal measures. Late-month signals from Treasury Secretary Bessent noted the tariff war is "unsustainable" and Trump's hints at reducing Chinese tariffs "substantially" helped improve risk sentiment, reversing some strength in safe-haven assets.

The economic impact has been swift and significant, with the IMF warning of a "major negative shock" to the world economy. The US economy contracted 0.3% (annualised) in Q1, with forecasts for 2025 now around 0.5%, down from previous expectations of 1.6%. China's Q1 growth surprisingly reached 5.4%, but economists remain sceptical about its ability to offset tariff impacts through stimulus, with average growth forecasts now around 4% for the year. Global economic growth is expected to reach only 2% this year, down from 3% prior to the tariffs, with significant implications for trade-dependent economies like New Zealand.

New Zealand's central bank responded with a 25bp OCR cut to 3.50%, signalling "scope to lower the OCR further as appropriate". Q1 inflation edged up slightly to 2.5%, though core measures remain within the 1-3% target band and continue to decline toward 2%. ANZ now forecasts the OCR to reach 2.50% by October (previously 3.0%), aligning with market expectations around 2.7%. This monetary stimulus appears increasingly necessary as Finance Minister Willis has signalled no fiscal support in the upcoming Budget, due to lower GDP forecasts and reduced tax revenue, positioning the RBNZ as the primary economic stabilizer.

The US Q1 earnings season showed a high proportion of companies beating consensus expectations that had been widely downgraded previously. Despite this, these companies weren't uniformly rewarded in share prices while companies missing consensus were punished, with investors keen to take more stock in the forward guidance provided by management teams. Mega-cap tech companies delivered strong results, particularly in cloud services, with Microsoft's Azure revenues up 35% year-on-year and major tech firms maintaining or increasing capital expenditure plans despite tariff concerns, potentially restoring confidence in the tech sector's AI investment cycle.

Several New Zealand companies issued profit downgrades during April, including Mercury Energy (citing hydrology conditions), Air New Zealand (maintenance and aircraft availability issues), and Tourism Holdings (directly referencing weak vehicle sales and poor US bookings). In contrast, Mainfreight provided a positive update guiding above consensus while noting limited US exposure (7% of total earnings). Looking forward, three major trading banks are set to report in early May, which should provide further insight into the domestic economy's resilience. With weakening business confidence and investment intentions, market watchers are increasingly convinced the OCR will need to fall to 2.50% to provide necessary stimulus in the face of global trade disruptions and their impact on New Zealand's key trading partners.

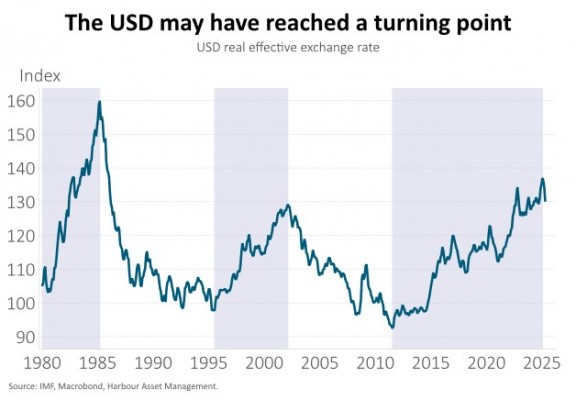

Deutsche Bank pointed out last week that after an unusually long period of USD appreciation (almost 14 years!), it may finally have reached a turning point and be heading lower. It usually takes a significant event for this to happen and Trump 2.0 seems to fit the bill as global investors question the merits of investing in the US. The USD appreciation in the first half of the 1980’s was down to Fed Chair Volcker’s attack on inflation and then ended with the Plaza accord in 1985. The USD strength in the second half of the 1990’s reflected strong US economic growth and the Asian crisis. The bursting of the dotcom bubble and lower rates took the USD lower from 2000 to 2010 before the euro area crisis in the early 2010’s sparked the most recent period of USD strength.

Market outlook and positioning

The impact of tariffs on global growth is unambiguously negative, particularly when the most aggressive parties are the world's two largest economies. Despite recent pauses and targeted rollbacks, the effective US tariff increase is historic. The average effective tariff rate is likely to jump from around 2.5% in 2024 to somewhere between 14% and 18% in 2025, with consumers facing even higher rates in some cases. There are still a large range of potential economic outcomes, and one can argue that tariff policy could be reversed, ultimately settling at a less punitive level. While the markets could react positively to such an outcome, part of the problem is that the damage has been done, by virtue of the super-aggressive approach taken by Trump and his colleagues. Firms and investors might well assume that uncertainty is here to stay, reducing risk appetite and limiting scope for a genuine resumption of strong activity. The various elasticities of demand to price shocks, and of propensities to save and invest given uncertainty, provide the potential for large forecast errors.

The Fed's ability to help support the US economy via lower rates is likely to be hampered by higher inflation. Fed Chair Powell recently noted that the inflationary effects of tariffs could be "more persistent" and that the Fed's "obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem". Slightly weaker-than-expected March US core inflation was largely dismissed as "old news" by markets. Surveyed inflation expectations have lifted meaningfully, and economists estimate that tariffs will push US core inflation to 4% this year, from a previous forecast of around 3%. Markets price 100bp of Fed rate cuts this year to 3.3% but don't imply a sub-3% Fed Funds rate at any point.

NZ is highly exposed to a slowing global economy and monetary stimulus is likely to be required. No doubt, our exporters are in a strong position to weather this storm with our terms of trade close to all-time highs, but our top two trading partners are now involved in an unprecedented trade war, with Australia (our third) highly exposed to China. A strengthening NZD is rubbing salt in the wound. Our ready reckoner model suggests the combination of weaker trading partner growth and a soft economic starting point requires the OCR to be cut to 2.5%, vs. the market-implied low of 2.7% and the RBNZ trough of 3.1%. At the April Monetary Policy Review (MPR), the RBNZ cut the OCR by 25bp to 3.5% and noted it had "scope to lower the OCR further as appropriate." We expect a further OCR reduction at the 28 May MPS, alongside a lowering of its forecast path.

Within equity growth portfolios, Harbour’s strategy remains to be patient, position for a range of scenarios and to be selective, focusing on quality growth. We continue to focus on companies delivering earnings per share growth, particularly where that earnings growth has the potential to be higher and last for longer than consensus expectations allow for. After sifting through the early April market fall our Funds have added to high quality growth companies with resilient earnings per share growth at better prices. Investing in growth shares with low US exposure such as Xero, Challenger, HUB24, and oversold healthcare companies such as Fisher & Paykel Healthcare, Ryman and Summerset may support long term Fund returns. We have made a small tilt to companies with domestically sourced earnings with leverage to lower central bank official rates. But we see better opportunities to invest in quality growth companies, with resilient earnings growth at better valuation levels. De-escalation of trade tariff concerns may allow investors to focus back on companies that generate compound growth through the cycle that are trading at better prices.

In fixed interest portfolios, amongst the drama of topsy-turvy tariff announcements, elevated market volatility and the sense of a changing world order, it was quite some paradox that we found ourselves developing more conviction, rather than less, in our investment views in April. Indeed, it has been the reaction to the sheer magnitude and uncertainty of tariff policy that has prompted us to envisage a weaker economic environment. This increases the prospect of easier monetary policy in New Zealand and suggests ongoing pressure on risk assets. At present, we suspect that the RBNZ will find it sufficient to continue with their pre-existing bias of steadily taking the OCR towards 3%. However, with the passage of time and continuing domestic and global challenges, we see a skew for the OCR to head into the 2.75% to 2.25% range and we have continued to position the portfolio for this. Long-dated government stock yields have also been under pressure globally. This has arisen from increasing concern about fiscal deficits, particularly in the United States. The yield curve has already steepened, with long-term bond yields sitting well above cash rates. From our perspective this additional premia does provide some appeal for now. In April we bought 30-year bonds, which have performed well subsequently. However, our intent is to buy into weakness and be willing to take profit if ongoing strong performance reduces our measures of value. In this regard, we have retained a preference to keep active positions relatively light and maintain scope to make adjustments as required.

Within the Active Growth Fund, the key positions we have is an underweight position to global equities and an overweight currency hedging position for global shares. Global share markets remain fully valued given the risks which are prevalent, in particular, the risks that tariffs pose to earnings and capital expenditure. With regard to currency hedging, the USD remains expensive compared to long term fair value, however we did reduce the size of the position over the month as the USD substantially weakened.

In the Income Fund, strategy is centred around the broad themes that have been evolving. Fixed Interest positioning reflects the view that cash rates may be cut further, but that long-maturity bonds face some ongoing pressure due to concerns about the United States resolve to address their very large fiscal deficit. Equity exposure to global markets has been hedged but we have increased our investment in Australasian listed property, which are priced attractively when compared to fixed interest. We have exited a position where we had bought the New Zealand Dollar against the US Dollar and are looking for fresh levels to reinvest. More generally, with risk assets having cheapened, entry levels are better, but are not so attractive that we are comfortable taking the leap of faith that markets will settle down just yet. In fact, our view is that we will live with the ebb and flow of elevated risk and volatility for some time.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.