ESG (Environmental, Social and Governance) considerations play a central role in Harbour’s investment philosophy.

Harbour is a market leader for integrating ESG research into our investment process.

ESG considerations are important for two reasons:

As a responsible corporate citizen, with a fiduciary duty to our clients, we have an obligation to consider all types of risk. This includes the environmental, social and governance risks associated with the companies we invest in.

As active investors, we believe that ESG risks and opportunities are often not fully reflected in the market price for securities. We are able to use this knowledge to invest to achieve better outcomes for our clients.

Key responsible investing documents:

At Harbour, we employ a strategy of integration and company engagement. This means our team researches companies we invest in and actively checks for any environmental, social or governance (ESG) risks that may apply to them. It helps our Portfolio Managers develop an understanding of each company, and influences not only whether we invest in companies, but also how much. It helps us to unearth companies which may be great opportunities for long term growth, as well as companies with potentially hidden risks.

We are able to use our role as a shareholder to engage with company leadership, highlight any concerns we may have and use our influence to encourage better behaviour.

We also apply a baseline of exclusions to the funds which employ our ESG strategy, to remove companies whose business activities may lead to significant harm in society. Exclusions cover areas such as tobacco, nuclear explosives, cluster munitions, anti-personnel mines, pornography and controversial firearms. We explain how these exclusions are applied in our Environmental, Social and Governance Policy, available above.

Our annual Corporate Behaviour Survey researches how companies rate on issues like:

Environmental

-

Carbon emissions

-

Energy use

-

Waste

-

Environmental policies and risk management

Social

-

Health and safety

-

Modern slavery

-

Stakeholder relations

-

Diversity

Governance

-

Board composition

-

Executive remuneration and incentives

-

Ethics

-

Anti-competitive practices

Harbour has been a UNPRI signatory since 2010.

Harbour is also a member of the RIAA.

You can read about Harbour's approach to corporate responsibility here.

Policy Submissions

Harbour’s engagement program not only focuses on constructively working with companies in our investment universe, but also contributing to public policy/regulatory consultations to positively influence policy settings relating to ESG considerations.

| Date | Link to submission | Submitted to |

| May 2022 | External Reporting Board (XRB) Submission | External Reporting Board |

| Mar 2021 | Submission on the Climate Change Commission’s Draft Advice | Climate Change Commission |

| Dec 2019 | Climate change-related financial disclosure submission | Ministry for the Environment & Ministry for Business, Innovation and Employment |

| Oct 2019 | Submission on green bonds and other responsible investment products | Financial Markets Authority |

| Aug 2019 | Clean Car Standard & Clean Car Discount submission | Ministry of Transport |

| Jul 2018 | Zero Carbon Bill Submission | Ministry for the Environment |

| Jun 2018 | Response to NZX Listing Rules Review, second round | NZX |

| Nov 2017 | Response to NZX Listing Rules Review | NZX |

| Oct 2016 | Submission to NZX Corporate Governance Code Review | NZX |

Stewardship

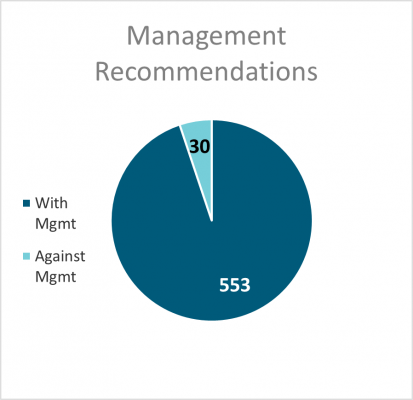

We demonstrate our responsible investing philosophy and fiduciary duty by keeping active in our investments through our extensive engagement programme and proxy voting process.

Click here to see Harbour's voting statistics for 2023

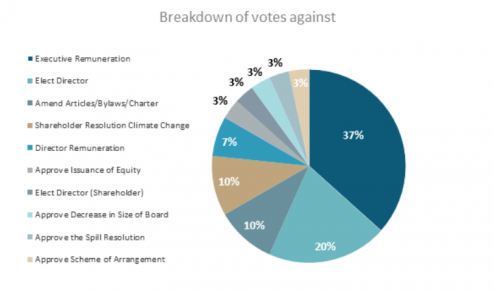

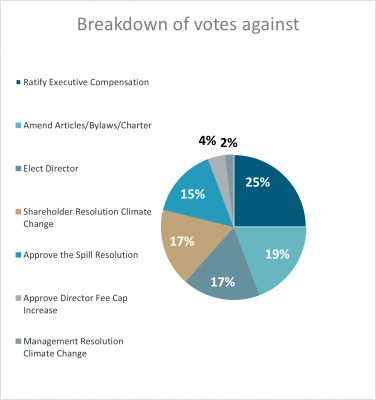

The most prevalent voting resolutions that were contentious over the year related to executive remuneration followed by the election of directors. There were less shareholder resolutions filed compared to the previous year for companies in Harbour funds with these primarily focused on climate change.

On executive remuneration, an example where we voted against management recommendations was for an Australian consumer services company regarding two resolutions to approve the bonuses paid to executives. This was due to both the amount of these bonuses being excessive relative to other similar companies as well as the lack of transparency over the performance measures. The results from the AGM showed that the resolutions still carried with 95% shareholder support.

There were less director elections opposed by Harbour compared to 2022 with most of these due to factors such as the lack of independence, too many directorships (over-boarding) and as a signal for poor remuneration practices. There was also a shareholder-endorsed director candidate in one case that we did not deem as justified to be appointed and therefore voted accordingly.

Climate change resolutions were proposed by shareholders but were often not put to the meeting given they were conditional on resolutions to amend constitutions which did not carry. Regardless, our voting intentions tended to be against these proposals given requests for climate action or information where, in many cases, companies were already making solid progress. Examples included the major Australian banks who have joined the Net Zero Banking Alliance, set near-term targets in their lending portfolios (sector-specific) and committed to the phasing out of financing fossil fuel production.

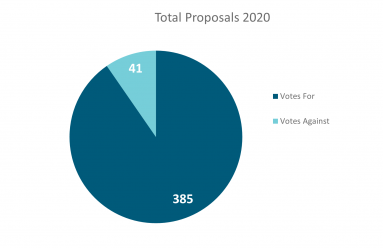

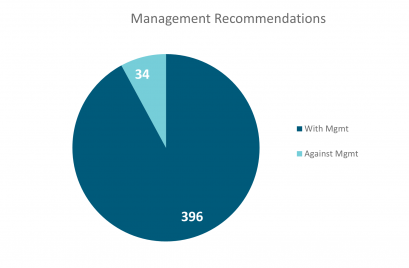

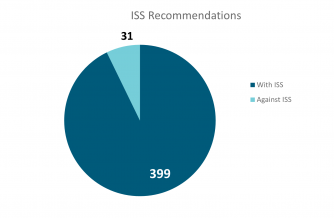

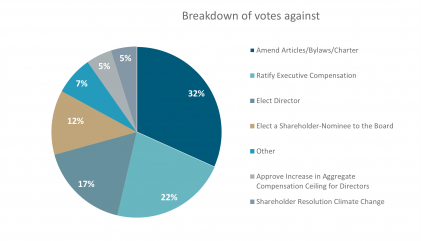

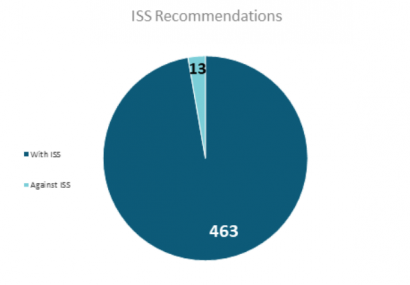

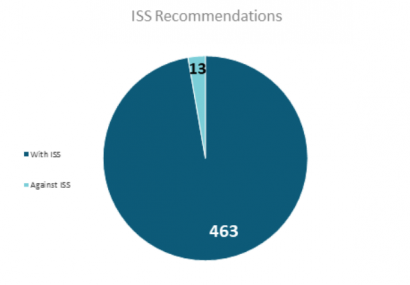

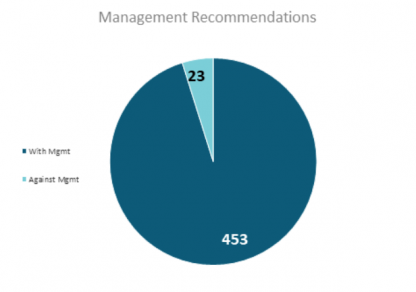

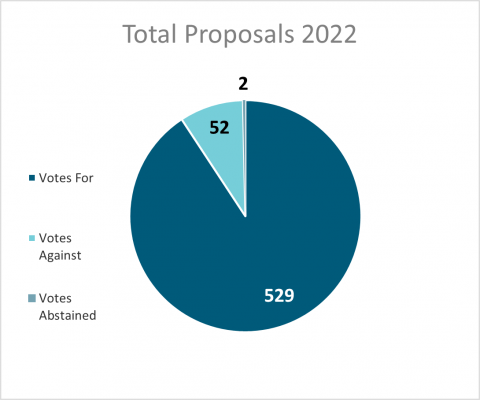

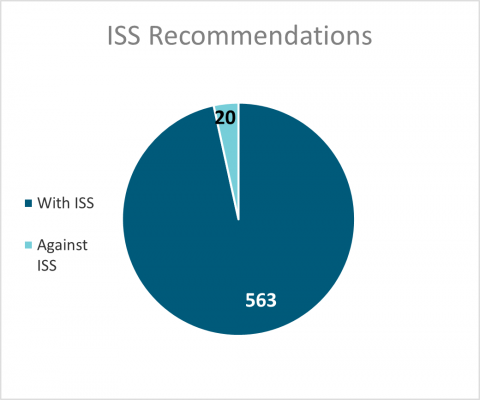

A summary of proxy voting activity for the 12 months to 31st December 2022 is provided through the charts below.

Click here to see Harbour's voting outcomes for 2022

The most prevalent voting resolutions that were contentious over the year related to executive remuneration followed by amending governance documents like constitutions or board committee charters. The election of directors continued to be controversial in some circumstances and there were a growing number of shareholder resolutions related to climate change, particularly in Australia.

On executive remuneration, an example where we voted against management recommendations was for an Australian healthcare company regarding a resolution on issuing options to a non-executive director. It is our view that performance-based remuneration for non-executive directors is inconsistent with best governance practice and therefore voted accordingly. We expressed our concerns to the company and it was acknowledged that this practice would be stopped for all new appointees going forward. The results from the AGM showed that the resolution still carried with 60% shareholder support.

Regarding resolutions to amend governance documents, these were mostly shareholder resolutions in Australia to enable the filing of additional resolutions such as those relating to climate change. These were largely opposed due to the fact there is already a legal system in place to oversee shareholder proposals (the Corporations Act) and other mechanisms that shareholders can engage companies such as submitting questions at the AGMs.

Climate change resolutions were primarily proposed by shareholders but were often not put to the meeting given they were conditional on the resolutions to amend constitutions which did not carry. Regardless, our voting intentions tended to be against these proposals given requests for climate action or information where in many cases companies were already making solid progress. Examples included the major Australian banks who have joined the Net Zero Banking Alliance, set near term targets in their lending portfolios (sector specific) and committed to the phasing out of financing fossil fuel production.

Engagement Strategy

Our engagement over 2023 continued to focus on climate change and key social issues such as modern slavery and community impact. Domestically, the extreme weather events at the start of the year were a poignant reminder of the acute effects of climate change and caused us to reach out to affected companies to assess the impact on their people and operations. The other main driver of our climate engagement agenda was the upcoming disclosure regulation given it was the penultimate year before many companies were due to report. Social issues, particularly modern slavery, were adversely affected by uncertainty surrounding the general election towards the end of the year and the subsequent direction of policy settings.

Climate engagements related to the Auckland flooding and Cyclone Gabrielle revealed that company employees were generally safe and well but many of them faced disruption such as not being able to get to work. Operational impact tended to be more significant with some companies noting temporary closure and/or asset damage. On the discussions regarding climate disclosure regulation, these focused on gauging preparedness and, in general, companies seemed comfortable given many already had a solid foundation of voluntary disclosure in place. However, they also noted the significant resource and workload that was required.

We have also engaged on climate change at an industry level by participating with peers in a group discussion with our regulator (the FMA) on the new reporting regulation to express our concerns with implementation from a fund manager perspective and learn what type of approach they would be taking for monitoring and enforcement.

Regarding social issues, modern slavery practices from companies were largely in limbo during the year, awaiting developments in policy settings. Our engagement subsequently focused on collaborating with others in the industry to promote more ambition and clarity over this issue. This included tangible action at the end of the year, once the new government was formed, to submit a joint letter to the minister in charge of this work to advocate the implementation of modern slavery legislation in New Zealand and for this to include due diligence requirements rather being solely a reporting exercise. Other social engagements involved seeking insight into specific initiatives that companies were undertaking to provide positive impacts (in the form of health and education outcomes) to the targeted communities.

Our engagement strategy also continued to capture companies with contentious ESG issues such as Board composition and executive/director remuneration particularly around company AGMs. There were a higher number of companies this year with contentious director elections and several conversations were had with company Chairs justifying these appointments given concerns over independence and too many directorships (over-boarding). There were also a few cases where we promoted more transparency in the performance criteria for the long-term remuneration outcomes of executives.

These targeted engagements were supplemented by the general ESG engagement we conduct across our whole New Zealand investment universe each year as part of our Corporate Behaviour Survey.

The Corporate Behaviour Survey is our primary way of comprehensively assessing how well each company in our New Zealand investment universe is addressing ESG considerations with engagement playing a key part. More information can be found in our ESG policy at https://www.harbourasset.co.nz/about-us/responsible-investing/

Engagement Breakdown

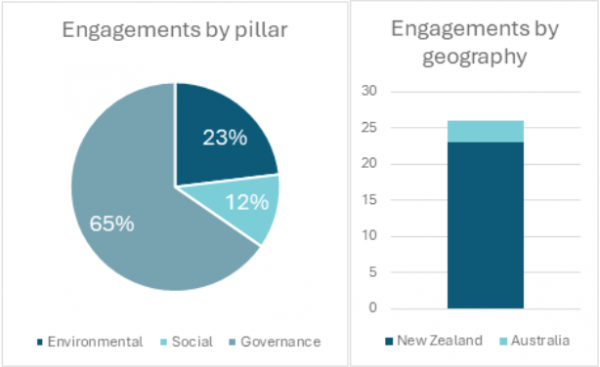

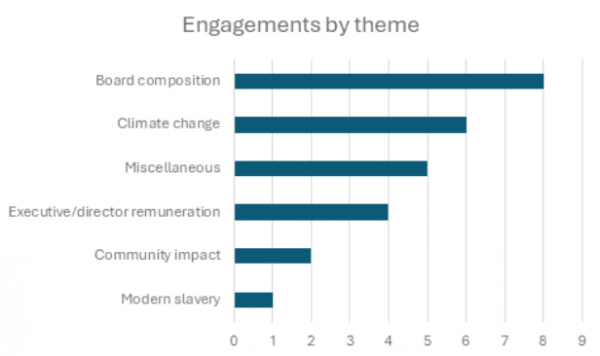

During the year we conducted 26 ESG-related engagements on ad hoc issues in addition to the engagements we conduct annually as part of our Corporate Behaviour Survey.

For the ad hoc engagements, these were mostly for New Zealand companies rather than Australian companies (23 vs. 3). This reflects the fact that Harbour portfolios have a larger weighting to New Zealand companies compared to Australian, and reverses the trend from 2022 given a lower number of contentious governance issues for Australian companies.

There were a variety of different ESG issues covered in these engagements and, in some cases, they involved multiple interactions with the company. As part of our process, we engaged with six companies on climate change and three on social aspects including modern slavery and community impact. We continued to engage on AGM resolutions relating to board composition through eight director election engagements, and four on executive/director remuneration. There were also five engagements on miscellaneous ESG issues such as sustainable financing and stakeholder materiality assessments.

Outcomes from these engagements were generally constructive with many of the companies receptive to our concerns and, in some cases, taking action to improve on the issues identified, as demonstrated through the case studies below. We acknowledge that some of these issues are long term in nature and take time to enact change. We are both patient and confident that companies will eventually make the appropriate adjustments, but we will continue to monitor and liaise with them until these are made.

Case Study 1:

We engaged with a New Zealand agricultural company on the impact of Cyclone Gabrielle given it was significantly exposed to the event. The company explained how the priority was looking after its people with a helicopter rescuing affected workers, for example. There was a material impact on the company's operations given direct asset damage and remediation costs that were yet to be fully quantified at the time.

Outcome: We gained clarity over the company's response to the cyclone and impact on its people and operations. We were encouraged that the company provided a range of support services to its staff following the event such as emergency accommodation, counselling, and financial contributions. Going forward, we will monitor the company's remediation work and investment into climate adaptation to ensure its resilience to similar events in future.

Case Study 2:

Over the past few years, we have engaged with senior management and the directors of a New Zealand industrial company on long-standing independence and diversity issues on its board. This involved multiple interactions and escalation through voting dissent at the company's annual shareholder meetings. During the latest engagement with the company on the issue last year, the board committed to appointing two independent directors within the next two years.

Outcome: We were pleased to see them follow through on this commitment with an announcement in January this year that the board had appointed two female, non-executive directors that should bring valuable skills and experience to the roles and address the independence and diversity issues.

Case Study 3:

We met with a New Zealand utility company’s new dedicated sustainability manager to provide feedback on its latest sustainability report. We applauded the company for making a significant improvement in their ESG measurement and disclosure this year, particularly for metrics and targets that spanned portfolio companies at the group level. We outlined some areas for improvement going forward from our perspective, such as focusing on progress in tangible sustainability initiatives rather than just policy coverage and providing more detail on climate risks and opportunities.

Outcome:

We’ve seen encouraging progress from the company leading up to this engagement with significant improvement in sustainability disclosure facilitated through a dedicated resource. We will continue to monitor how this evolves over the coming year, particularly whether our feedback is taken into account.

Summary

Overall, the year has seen climate issues take centre stage in our engagement with companies and industry, particularly given the severe weather events that happened over the first quarter. This highlighted the need for companies to have robust emergency response plans in place for these types of events and to focus on investments in climate resilience. Another important climate-related engagement theme has been on reporting, given the new regulatory standards due to kick in from next year, having many conversations with companies on their progress and readiness.

Looking forward, we expect this issue to continue to be a dominant engagement topic in 2024 but see other sustainability issues like modern slavery and biodiversity gain traction as well.

In addition, we will continue to engage companies as any material ESG issues arise, particularly on contentious areas proposed during company AGMs. This includes maintaining our dialogue with companies that we have identified as lagging on an issue such as Board independence, remuneration or ESG disclosure, by constructively working with them in the long term to achieve the best outcomes for shareholders.