Key market movements

- The MSCI All Country World Index (ACWI) rounded off the first quarter with a third positive monthly return at 5.1% in New Zealand dollar-unhedged (3.5% in NZD-hedged) terms for the month. From a sector perspective performance was broadly positive, with energy the outstanding performer at 7.6%, followed by materials (5.5%) and utilities (4.8%).

- Locally, market returns for the month were also strong with the S&P/NZX 50 Gross Index (with imputation credits) returning 3.3%, and the S&P/ASX 200 Index also returning 3.3% (5.4% in New Zealand dollar terms).

- Bond indices were also positive over the month. The Bloomberg NZ Bond Composite 0+ Yr Index rose 1.1%, whilst the Bloomberg Global Aggregate Bond Index (hedged to NZD) added 0.9% over the month. 10-year government bond yields in the US were roughly flat on the month, ending at 4.2%, whilst in New Zealand the 10-year yield fell 16bps to end at 4.5%.

Key developments

The New Zealand economy went backwards last year, which is likely to help reduce non-tradable inflation pressure. That’s what the Q4 GDP data confirmed when it was released at the end of March. On a per capita basis, the economy retreated 0.7% in the quarter and 3% in 2023. After business surveys, such as the NZIER’s QSBO, had suggested a possible bounce in Q4, activity was weighed down by weakness in the goods-producing parts of the economy – manufacturing, wholesale trade, retail, and construction – sectors that are usually sensitive to interest rates. The Reserve Bank of New Zealand (RBNZ) is likely to be pleased, as lower domestic demand is necessary to lower still-high non-tradable inflation. The Government's Budget Policy Statement indicated it is also likely to play its part with a declining contribution to activity over the coming years, despite confirming tax cuts.

Ongoing US economic momentum and a pick-up in inflation haven’t altered the Fed’s dovish bias. GDP growth is tracking around 2% on an annualised basis and the labour market continues to create a healthy number of jobs. Inflation has picked up this year with the Fed’s preferred measure of core inflation, core PCE, running at 2.6% on a 3-month annualised basis. It is not all one-way traffic; however, retail sales have been weak and there has been a decent drop in job ads which, along the lower rate of quits, suggest the labour market is loosening. The US Federal Reserve sounded the dovish horn at its March meeting with Committee member forecasts showing it was still likely to cut interest rates by 75bp this year, as was the case in December, and despite the recent pick-up in inflation. Chair Powell discounted the signal from the recent inflation data by saying “they haven’t really changed the overall story which is that of inflation moving down gradually on a sometimes-bumpy road toward two percent”. The market now prices 80bp of rate cuts this year, from 75bp prior to the meeting.

Japan is experiencing rare momentum of economic strength that has allowed the Bank of Japan (BoJ) to exit its negative interest rate policy for the first time since 2015. At its March meeting, the BoJ lifted its target policy rate range from -0.1% to 0% to 0% to 0.1% and abandoned its Yield Curve Control (YCC) that focused on keeping 10-year Japanese Government Bond yields below 1%. After almost two years of inflation above the BoJ’s 2% inflation target and a year of solid economic growth, the final straw to motivate the policy tightening was a stronger-than-expected round of annual wage negotiations (“shunto”). Initial surveys suggest wages will rise 5.3%, much higher than last year’s 3.6%. This has provided the BoJ with more confidence that it will sustainably achieve its 2% inflation target and that ultra-loose monetary policy is becoming less necessary. The market reaction suggested the BoJ fell short of more hawkish expectations with bond yields falling and the JPY weakening following the decision. Some of the dovish elements were that the decision was not unanimous, with two of the 9 voting members favouring no change, and that Governor Ueda emphasised a desire to maintain accommodative financial conditions.

What to watch

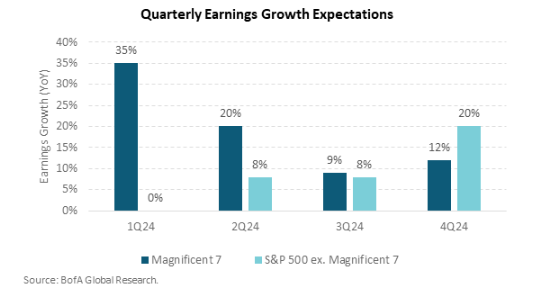

A key driver of US markets over the past 12 months has been the outstanding earnings growth of the Magnificent Seven (Apple, Amazon, Alphabet, Meta, Microsoft, NVIDIA and Tesla) but, as pointed out by T. Rowe Price, the remainder of the S&P 500 is about to start picking up the slack. This could lead to a broadening in the performance of the US equity market which has seen nine out of eleven sectors have positive earnings revisions over the last three months.

Market outlook and positioning

Earnings growth drives share market returns over the medium term. In the near term, markets are likely to oscillate around central bank interest rate cut expectations and economic activity risk. Economic activity remains supportive for equity markets – or at least activity remains better than many investors had previously expected. Positive global purchasing manager indices (including that inventory destocking is slowing) continue to provide a positive lead for corporate profits and earnings expectations. Economic growth may continue to ease in New Zealand and Australia as net migration population growth slows, but if the global economy can avoid a hard landing, then share market earnings expectations may remain supported.

The recent improvement in investor sentiment and the flow of capital into global share markets, which has pushed valuation multiples back to above average long run levels, may have reduced the risk-adjusted return attractiveness of equity markets. Expectations of official interest rate cuts by central bankers continued to be pushed out over the period in terms of timing and amount. Central bankers continue to note progress in slowing price growth but, with some components of inflation remaining sticky and economic activity holding up, they may prefer to see more evidence that inflation is headed lower before cutting interest rates. Investors may be underestimating the risk that interest rates are held higher for longer, which may stifle the capital flow from fixed interest to share markets observed over the March quarter and increases the earnings risk for interest rate sensitive shares. Capital markets may also not be allowing for elevated geopolitical risks.

Share markets typically start pricing in official interest rate cuts six months before they happen. While there is some risk that the New Zealand share market may be starting to get ahead of itself on timing, there is an increasing probability the RBNZ may be in a position to move back to more neutral monetary policy settings from current tight conditions and cut official interest rates late in 2024 or early 2025. New Zealand’s inflation is falling and may get back to below 3%. Strong net migration is likely to move from being a year one inflationary force (as migrants set up their homes) to being a year two deflationary force (increased labour pool). Market monetary policy expectations have RBNZ official rate cuts starting from August 2024. Given the interest-rate-sensitive mix of the New Zealand share market, rate cuts may support New Zealand share market returns more than the earnings risk implied by the need for RBNZ rate cuts to offset economic weakness.

Within equity growth portfolios our strategy remains to position for a range of scenarios and to be selective. The potential to return to a pre-COVID lower growth, lower inflation environment supports our continued favouring of investments with secular tailwinds that are less dependent on strong economic activity. Within the portfolios we are selectively overweight shares in the healthcare, information technology and financial services sectors that offer potential for compound growth. While the healthcare sector may remain dynamic and face further disruption from innovative technology, the reset in investor expectations and valuation multiples provides us with the confidence to sustain a relatively large but share-specific investment in this proven compound growth sector. The information technology (IT) sector’s secular growth potential is underscored by the runway remaining in GenAI, improving IT budgets and expectations for improving margins. We remain wary of cyclicals that are dependent on a recovery in consumer and corporate confidence. We continue to have a bias to quality, well-capitalised businesses that are well positioned to fund value-adding growth opportunities.

Our fixed interest strategy remains positive about the scope for rate cuts over the next 2 to 3 years. With the New Zealand economy dipping into what, at this stage, is a mild recession, the fixed interest market is of the view that the RBNZ is unlikely to hike rates again in this cycle. The fixed interest market is attractively priced in our opinion, as although rates cuts are priced, it still underappreciates the total amount of cuts that could occur over a 2- to 3-year period. We expect economic activity to remain very soft over the next 6 months and this backdrop is what may prompt the RBNZ to move more quickly towards rate cuts than they currently project. Offshore, the dominant US Treasury market is reacting to ongoing robust data, causing the pace and extent of rate cuts there to be dialled back, despite the Federal Reserve’s willingness to signal cuts. This is creating a headwind for performance of longer-dated bonds and we are underweight exposure in 7-years and longer securities in the New Zealand fixed interest portfolios.

The Active Growth Fund is defensively positioned, being overweight bonds and underweight equities. After the recent rally in global share markets, the current risk return proposition may not be as compelling as it was, and we may see a period of consolidation in global equity markets. At a headline level, global equity markets (measured by the MSCI ACWI Index) are trading at their 92nd percentile valuation when compared to the past 20 years, which is expensive in absolute terms. However, when we look at the forward-looking risk premium relative to bonds, we see an even more extreme outcome, trading at 100th percentile (i.e. expensive relative to history). These valuation levels have historically preceded below-average returns in the following 12 months, which makes us wary of holding a higher weight to equities.

The Income Fund strategy reflects the weak economic outlook we have for the domestic economy this year. We are overweight in short-dated New Zealand fixed income securities and are short the New Zealand dollar against both the Australian dollar and on a trade-weighted basis. We have continued with an underweight allocation to equities, with a bias towards adding in any notable weakness in the market. Risks coming from rising global bond yields and geopolitical risks argue against increasing exposure at present.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.