- As market interest rates in New Zealand decline further, additional consequences are revealing themselves. The theme of accelerating progression of longer-term trends continues.

- Wholesale interest rates continue to decline, with the Government’s PREFU announcement being the catalyst this week, due to a $10bln reduction in the size of the Government Stock issuance program for the 2020/21 fiscal year. The five-year New Zealand Government bond now trades at a negative yield, joining the one and two year maturities. 35% of outstanding nominal New Zealand Government Stock is now in the “negative rate” club.

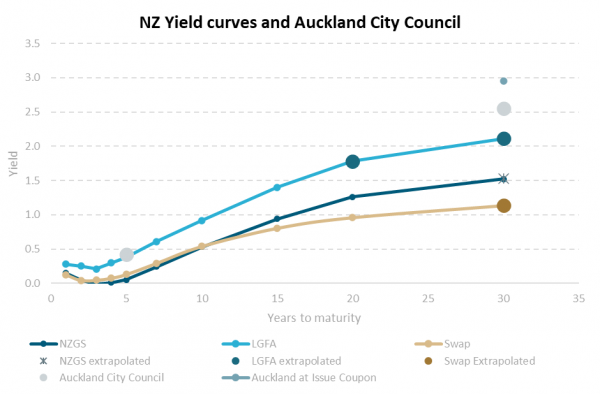

- This week the Auckland Council issued the longest maturity bond in New Zealand for more than fifty years. The ability of a council to issue 30-year bonds in the domestic market is a notable milestone in the ongoing development of the New Zealand capital market.

- This shift lower in bond yields is likely to continue to have implications for all asset prices[1], but more specifically, the five-year rate is widely used in valuations for equity markets. Moreover, the New Zealand Commerce Commission utilises the five-year government bond in determining returns and hence pricing outcomes for regulated assets, such as Chorus’s Ultra Fast Broadband investment.

In the last week, forward interest rates have continued to decline in New Zealand. This shift lower in yields, in part reflects a lower than expected government borrowing requirement as fiscal projections reduced proposed borrowing in the current year from $60bn to $50bn. At the same time, market participants still expect the Reserve Bank of New Zealand (RBNZ) to continue with their Large Scale Asset Purchase (LSAP) programme, which at present remains at $100bn. We expect the RBNZ’s LSAP programme to ease back in line with Treasury’s reduced issuance, but this isn’t a certainty and timing may prove influential.

Bond yields are lowest for shorter-maturity bonds, with 10-year Government Stock trading about 0.5% higher than 2 year stock. That is very much a normal situation, but with central banks providing guidance for a long period of low rates and with short term yields in negative territory, investors are motivated to buy longer-dated bonds. This buying pressure has pushed market yields lower.

This backdrop provided an ideal environment for Auckland Council to issue a new 30-year bond deal. At a coupon of 2.95% significant demand also opens the pathway for other issuers to take advantage of these conditions.

There are other interesting aspects to the Auckland deal. It came as a genuine surprise, as the New Zealand Treasury had not even issued to this maturity. Pricing the deal was a challenge, as the usual reference points were not available. Finding a ‘fair value’ price involved extrapolating Government Stock, swap and corporate bond credit spreads out to 30 years, with plenty of margin for error. In that regard, it was notable that the deal found support and was able to be fully placed very quickly. This was partly achieved by the involvement of a large cornerstone investor, who most probably took $300mn of the $500mn issued. This involvement was announced only a few hours after the deal was launched and created a scurry of activity as other investors rushed to firm up their applications. The deal closed quickly, and not everyone was able to meet the shortened timeframe. Although settlement is not until 28th September, preliminary trading has seen the bond perform well.

Many might balk at the idea of making a 30-year investment at 2.95%. From our perspective, we can hedge the interest rate risk if we wish to do so, while we can enjoy the attractive credit spread that is offered from one of the better quality issuers in New Zealand. This is one of the ways to adapt to the new low rate environment and provide positive returns. Of course, this does not come without risk. Sound credit assessment and risk management are key. With the global outlook still so uncertain, we certainly have a preference for high grade bond issuers in our fixed interest funds.

Source: Bloomberg and Harbour

Lower bond yields also have implications for regulated rates of return.

In October, the New Zealand Commerce Commission is expected to outline further valuation information on regulated return principles for the telecommunications sector (this mostly impacts the listed company, Chorus)[2]. The Commission expects to adopt a risk-free rate with a five-year term to determine the weighted average cost of capital (WACC). In a recent regulatory review for Vector, the five-year bond yield was 1.12%. That same government bond yield today trades at a fraction under 0%.

We asked investment bank UBS what influence that might have on their WACC calculations for Chorus. At a 1.12% five-year bond yield, UBS calculated a 4.93% WACC for Chorus; if the five-year bond yield was 0% the WACC falls to 4.12%. This is a 16% decline in the cost of capital that would be applied to the regulatory asset base to calculate an appropriate rate of return for Chorus in the subsequent five years. While most of the recent submissions to the Commerce Commission on the broadband fibre review focus on arguments on what might constitute a regulatory asset base, the potential change in WACC could also have a meaningful impact on pricing outcomes for fibre.

Our view is that sharp downward shift in longer term government bond yields may have wide implications for the debt and equity capital markets, placing a higher emphasis on being active in managing both debt and equity positions.

[1] See Negative cash rates – The afterburner for asset prices

[2] https://comcom.govt.nz/regulated-industries/telecommunications/projects/fibre-input-methodologies

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.