- Following last month’s RBNZ rate cut, financial markets have moved to price an accelerated easing cycle, inconsistent with the central bank’s latest OCR forecast and largely driven by lower US rates.

- Recent New Zealand economic data don’t support current market pricing with Q2 GDP contracting less than the RBNZ had forecast and soft data showing improvement in response to lower interest rates.

- Don’t get us wrong, things are still tough out there, and there is a chance that the RBNZ recalibrates policy settings in line with market pricing, but we think risks are skewed to the central bank not delivering this degree of easing.

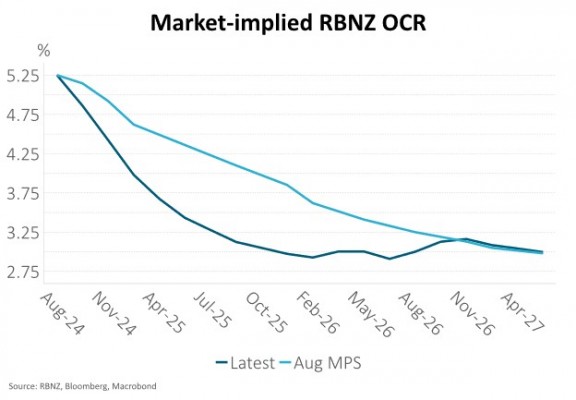

Following last month’s Reserve Bank of New Zealand (RBNZ) rate cut, financial markets have moved to price an accelerated easing cycle, inconsistent with the central bank’s latest OCR forecast and largely driven by lower US rates. New Zealand interest rates have shown a high sensitivity to US interest rates since COVID, with 2-year New Zealand rates moving by about 7bp (0.07%) for every 10bp change in the US equivalent. Since the August Monetary Policy Statement (MPS), short-term US interest rates have dropped by about 40bp on mixed US data and growing speculation of the 50bp Fed rate cut that was recently delivered. Our market has followed, now pricing about 125bp of RBNZ rate cuts over the next three meetings, 50bp more than the RBNZ forecasts, and an eventual OCR low of 2.8%, 20bp below the RBNZ forecasts (see chart above).

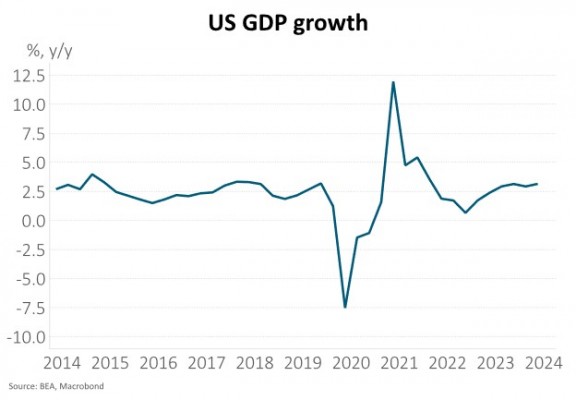

Looking ahead, the US market prices a further 200bp of cuts, taking the Fed Funds rate to 2.8% by the end of next year – 60bp below the updated Fed projections. This seems overdone and we expect US interest rates to rise as markets pare back these expectations. We think the US economy remains miles away from recession, with Q2 GDP growing around trend and real-time estimates of Q3 well above trend (see chart below). While excess savings are close to spent, consumption is being supported by continuing household income growth and spectacularly strong balance sheets – helped by gains in financial and property assets. The unemployment rate is historically low at 4.2% and core inflation remains above 2.5%. This is to say nothing about the ongoing risk of Trump’s inflationary policies, if he is to become President again. Markets have been removing the Trump risk as his betting odds have dropped to below 50% in the past two months.

Recent New Zealand economic data don’t support current market pricing with Q2 GDP contracting less than the RBNZ had forecast and soft data showing improvement in response to lower interest rates. Q2 GDP dropped 0.2% on the quarter, vs. RBNZ expectations of a 0.5% decline, with unexpected strength in goods-producing industries. Consumption was also surprisingly strong, growing 0.4% in Q2 and contributing to no change in expenditure GDP, vs. RBNZ expectations of a 0.6% decline.

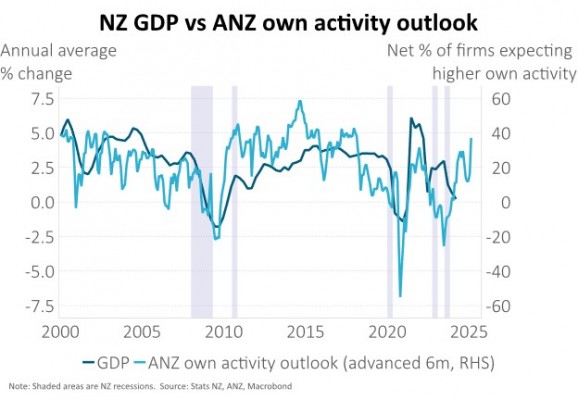

Looking ahead, the economy is likely to continue going backwards on a per capita basis, growth will probably remain below trend and the labour market is likely to continue loosening through to early next year. But the activity outlook is improving in real-time and forward activity indicators have responded positively to the more than 100bp drop in short-term interest rates since the RBNZ performed its dovish pivot on 10 July. Firms’ expectations of their own activity are at the highest level since early 2018 with almost a net 40% of firms expecting higher activity, admittedly from a very low base (see chart below). Business confidence tells a similar story. Purchasing Manager Indices (PMIs) have moved to less contractionary territory and consumers are feeling less glum. The RBNZ is likely to be encouraged by this response at such an early stage of the easing cycle.

The housing market should provide the next signal of less monetary constraint having an impact. It remained soggy in August, perhaps reflecting the ongoing challenges from moderating population growth, rising unemployment and poor affordability – not helped by recent increases in council rates and insurance. As borrowers refix on to lower rates, having increasingly chosen short-dated mortgages, it is reasonable to expect some improvement as we approach summer.

Don’t get us wrong: things are still tough out there, and there is a chance that the RBNZ recalibrates policy settings in line with market pricing, but we think risks are skewed to the central bank not delivering this degree of easing. With a blank sheet of paper, headline inflation likely to print close to the 2% target in Q3, a negative output gap and rising unemployment, you could easily argue that monetary policy should be at stimulatory levels, i.e. below 3%. In that scenario, a succession of 50bp cuts to much lower levels is not unreasonable. But that is not how the RBNZ has told us it sees things, noting in the August MPS record of meeting that “monetary policy will need to remain restrictive for some time to ensure that domestic inflationary pressures continue to dissipate” and forecasting on OCR path consistent with that. Non-tradable inflation, for example, remains historically high. An additional consideration is that the market is already doing a lot of work for the central bank by implying easy policy towards the end of next year, almost two years sooner than the RBNZ OCR forecasts, and prompting meaningful declines in retail interest rates.

IMPORTANT NOTICE AND DISCLAIMER

This article is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.