Investors have their noses to the wind for the source of the next crisis. The terrifyingly titled pile of debt, known as “leveraged loans”, could be starting to pong. At Harbour we remain vigilant, monitoring the US market, but taking comfort in the structure of markets down under.

Leveraged loans are simply private market borrowing by sub-investment grade companies[1]. The US leveraged loan marketplace provides well over $US1 trillion in funding for companies involved in private equity buy-outs, gearing their balance sheets or funding expansion. Banks provide around half of this funding with the remaining share going to institutional investors, hedge funds, insurance companies and non-bank finance companies[2]. Banks underpin support for a sizeable European market also; the New Zealand market is tiny in comparison. But we do have leveraged loans. For example, the debt funding used by a private equity firm to buy TradeMe is considered a leveraged loan.

Potential warning signs

- Rapid growth: The US leveraged loan market has more than doubled in size since 2010, leading to greater corporate vulnerability via higher indebtedness.

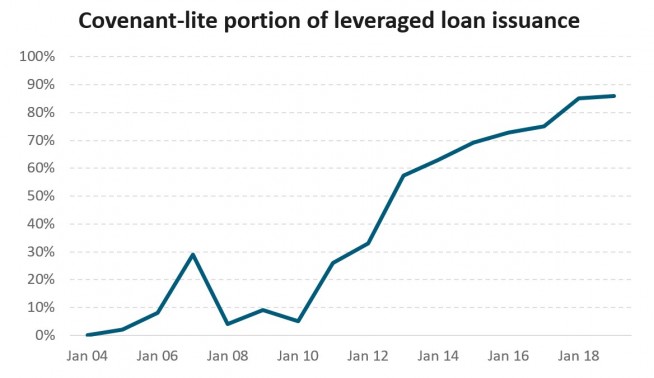

- Lax underwriting standards: In addition to accepting higher gearing levels from borrowers, lenders have increasingly permitted more aggressive accounting to weaken their covenants. For example, intangibles now make up a far greater percentage of assets in debt/asset ratios and management earnings adjustments, baking in yet-to-be realised earnings, make up a significant portion of earnings in debt/EBITDA ratios. Worse still, the portion of loans with lax covenant packages, known as “cov-lite” loans, has soared as shown below.

Source: LCD (A Standard & Poor’s company)

- Loans for dividends: A large volume of leveraged loans have been used to fund dividends while business investment has remained subdued.

- More securitisation: A greater portion of leveraged loans are finding homes in collateralised loan obligations (CLOs – the loan equivalent of Mortgage-Backed Securities).

The makings of a credit cycle

Poor quality loans are more likely to experience losses when corporate profitability dips. If losses are material enough, this can reduce banks’ broader appetite to lend as they recapitalise, thus impacting the real economy.

There are reasons for optimism that the leveraged loan sector would not cause a banking crisis. We examine these along with our more balanced view:

Source: FSB taken from banks’ supervisory filings.

The leveraged loan sector can be de-risked if US corporate profitability growth remains strong while the standards of new loans improves. We saw encouraging, but tentative, signs of this in Q4 2019. Loan losses remain below long-term averages. For now, we watch corporate profitability as a lead indicator for loan quality as well as continuing to monitor loan growth and underwriting standards.

The Harbour Income Fund has funded sub-investment grade borrowers via the Australasian high yield market. The lack of issuance of bank capital securities has provided borrowers a favourable environment in New Zealand. Harbour has had limited participation in the few deals that have been issued in this market owing to issuer-friendly pricing (low yields) and generally weak investor protections. Meanwhile, not only have we found spreads more rewarding in Australia, but covenants have also offered investors more protection. For example, Australian payment technology firm Afterpay is not allowed to make any distributions to shareholders while our bonds remain outstanding. In another example, the bond documentation of Australian data centre owner-operator, NextDC, permits it to pay dividends only when net debt / EBITDA remains below 1.5x. Many of the recent New Zealand high-yield deals included no protection.

[1] There is no universal definition, with some disagreement about whether spread, leverage, rating or even purpose is the defining feature.

[2] Given the market’s private nature, precise figures aren’t known; for a sound analysis see this paper from early warning watchdog, Financial Stability Board.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.