As we sit down to write our Top 10 Risks and Opportunities each year, we write it not so much as a forecast for the next 12 months, but rather as a reflection of where we are and what that can potentially tell us about where we are going. Because one unmistakable part of investment research and asset management is that the starting point matters. Be it equity market valuations where we have 100 years of data telling us if you buy equities when the Shiller Price to Earnings Ratio is high then returns for the next decade will be lower than average, or in bonds, where the best predictor of forward returns over the next five years is your starting yield.

In dynamic markets, where price movements can be swift (just look at Japan over the past week or so), the starting point can change rapidly and it’s that change which has prompted us to reflect on where the balance of risks are skewed to for the rest of 2024. So, after the appropriate disclaimer below, here are the six risks and opportunities we are most focussed on for the second half of 2024.

"There are two kinds of forecasters: those who don't know, and those who don't know they don't know”

-John Kenneth Galbraith.

Concentration and the outlook for global equities?

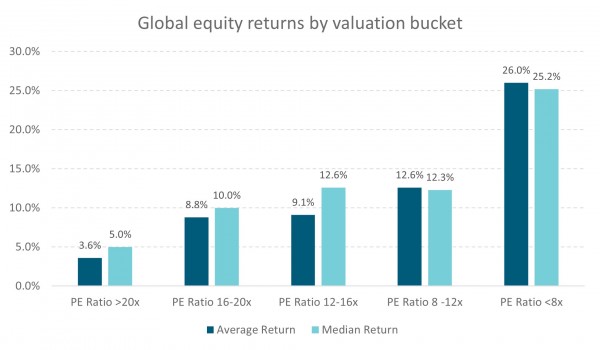

Around two-thirds of the 15% return (in NZD hedged terms) which the MSCI All Country World Index delivered since the start of the year to has been driven by nine stocks. The key return driver has been the US market and, in particular, the tech-laden information technology and consumer discretionary sectors. The collective investment community has undoubtedly seen AI and the associated demand for computing power as a major force in years to come. This has seen the US market reach a valuation measured by the price to earnings ratio of 25 times trailing earnings and around 23 times the next 12-months’ earnings. This level of valuation has typically led to below average returns in the following 12-month period.

Source: Harbour. Data for the S&P 500 from 01/01/1952 to 31/07/2024. Uses trailing Price to Earnings Ratio and measures forward 12 month returns.

The recent earnings season has led to some question marks about the level of capital expenditure, and research and development spend going towards AI-related projects. Further, use cases and commercialisation, while promising, remain unclear. This could potentially lead to some broadening of market performance and one of the positive flip sides to market concentration is that there are corners of the market that have not rallied and are not expensive. The S&P500 equal-weighted index trades where it did three years ago. In our opinion, mid-cap company valuations are attractive (noting that even the smallest companies in the S&P500 are larger than New Zealand’s largest listed company). Additionally global infrastructure stocks are trading at near-low relative valuation levels vs. broader equity markets, making these sectors potential candidates for investor attention.

Are we at a positive turning point for New Zealand equities?

In July the New Zealand equity market rallied by 5.9%. A broader measure of the New Zealand equity market, the S&P/NZX Portfolio Index lifted by almost 7.5%. Market observers know to respect price moves as collectively signalling turning points. The New Zealand equity market was a world leader in the decade to 2020, as low starting valuations combined with steady economic growth and a generally falling-to-low-interest rate environment. There were some specific leaders, a2 Milk, Mainfreight and Fisher & Paykel Healthcare that all provided evidence that New Zealand companies can win on the global stage.

Three years ago, the starting valuation of the New Zealand equity market was close to 30 times earnings. Expensive on most measures, the New Zealand market was susceptible to the impact of higher interest rates. The market de-rated to a valuation of closer to 20 times, and the median stock valuation fell further to almost 16 times earnings. The recent economic recession and higher interest rates have bitten into sales and margins, and net profits for many cyclical companies have been downgraded sharply.

However, the dovish pivot by the Reserve Bank of New Zealand signals intent. Wholesale and retail interest rates are falling and, while unemployment may rise for several quarters, the equity market can become very forward-looking. Supported by renewed M&A, we think that domestic institutions are very underweight the local market, and Australian institutional positioning is also subdued. Better valuations, lower interest rates and underweight positioning suggests we may get a follow through in demand for local shares. The sufficient condition to call a real turning point could be a better second-half earnings outcome for our largest stocks although, in the short term, we may still see further earnings downgrades across the market. It is fair to say that, on a relative basis, the set-up for the local market is a lot more attractive than three years ago.

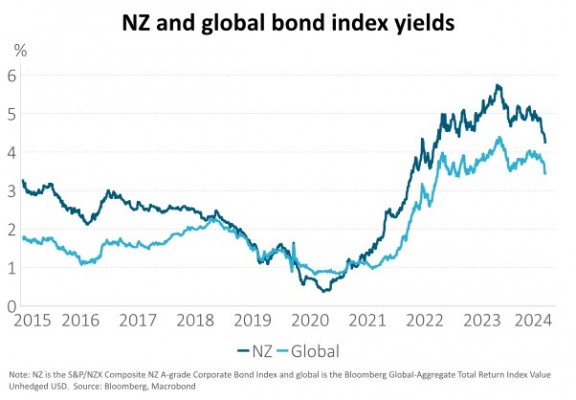

Bonds have rallied sharply, where might yields get to this cycle?

Global and New Zealand bonds have delivered significant returns over the past year, as yields have fallen by more than markets anticipated. Many are now asking where these yields might get to this cycle, essentially a question of whether bonds may offer further capital gain, in addition to current yields of around 4%. This depends on two factors: i) a view on the level of neutral interest rates; and ii) the degree of economic weakness, that may require stimulatory monetary policy. On the former, we took a deep dive look at neutral interest rates about a year ago which you can read here. For the purposes of this discussion, we can be led by most developed economy central banks that see the average neutral policy rate to be between 2.5 and 3%.

The next question is whether monetary policy needs to be stimulatory. We see less need for that in the US, where the economy continues to grow at an above-trend pace and recession is unlikely. With markets already pricing the Fed Funds rate to fall slightly below 3%, further capital gains from US bonds appear unlikely. In New Zealand, our economy is in a much worse state, with economic output likely contracting sharply and the labour market loosening rapidly. With inflation soon to re-enter the RBNZ’s 1-3% target band, stimulatory monetary policy may soon be necessary here. Our market, however, only prices the OCR to fall to around 3% which makes capital gains for New Zealand fixed income more likely over the coming quarters.

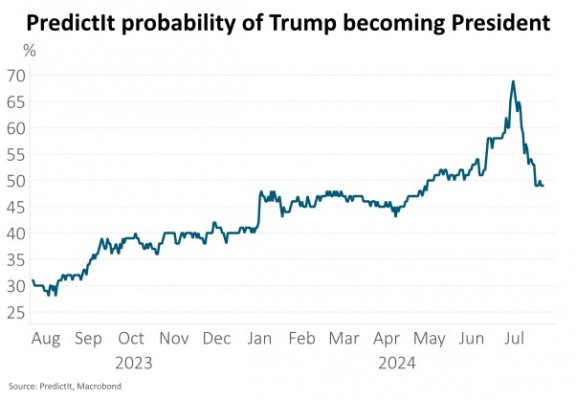

How will the US election impact markets?

Trump’s lead in the polls has dropped considerably after sitting President, Joe Biden, withdrew from the race in late July. Betting markets suggest the 5 November US election has become a coin flip between Trump and new Democratic candidate, Kamala Harris. Markets are likely to focus on the monetary and fiscal policy implications associated with the election result. A Republican sweep is likely to support growth and increase inflation pressure as Trump tax cuts may be extended, trade tariffs increased, and immigration policy tightened. This would likely push yields higher across the curve. In the event of Trump winning the Presidency but with a divided Congress, trade and immigration policies can still be changed via executive action, which is likely to be inflationary. However, yields are unlikely to rise as much in this scenario as Trump’s 2018 tax cuts would not be extended.

A Democratic presidency with a divided Congress likely carries the smallest amount of policy change. Yields may decline across the curve as markets price out the risk of expansionary and inflationary fiscal policy. A Democratic sweep likely holds few implications for the fiscal balance as the proposed 2025 fiscal year budget showed higher taxes but also higher spending. The market may still look to price out inflation and spending risk, taking yields lower.

Geopolitical developments present both risk and opportunity, are markets prepared?

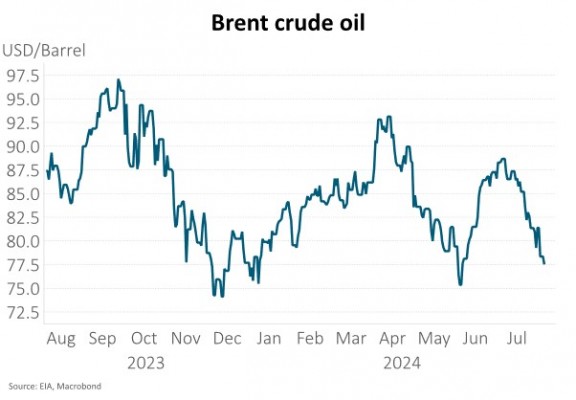

Tensions in the Middle East have been high since the October 7 Hamas attack on Israel and Israel’s subsequent response in Gaza. However, these tensions have intensified in recent months after Israel launched retaliatory attacks in Beirut and Tehran. This occurred after a rocket attack, blamed on Hezbollah, killed 12 young Israelis. While Israel has not commented on the attack in Tehran that killed Ismail Haniyeh, the political leader of Hamas, it has claimed responsibility for the air strike in Beirut that killed a senior Hezbollah commander. Some are now concerned about all-out war in the Middle East with Iran vowing to respond to the Tehran attack and the US redeploying military support to the region. The heightened risk of disruption to oil supply chains has placed some upward pressure on oil prices but, given recent concerns about slowing global demand, brent oil is trading close to one-year lows, vulnerable to a move higher if the region takes another step toward war.

Elsewhere, geopolitical risks may be easing. Ukraine continues to require support from the US and other allies to make progress against the Russian invasion but there also remains the possibility of a territorial concession by Ukraine in return for peace – something that markets may be under-pricing. Closer to home, China appears to be reducing its focus on Taiwan in recent months as it deals with economic weakness at home and the possibility of US trade tariffs under a Trump Presidency.

Persistent inflation prompts Bank of Japan to hike cash rates further, reducing investor appetite for carry trades and the capital applied across financial markets.

For many years, the Japanese bond market has been a sleeper, with structurally low inflation driving the Bank of Japan (BoJ) to persist with negative, then zero and now ultra-low interest rates. This situation has motivated many investors in the leveraged hedge fund community to load up on higher-yielding assets, while funding them cheaply in Japanese yen. This is a classic ‘carry’ trade, but one that comes with currency risk. Recently, the combination of weaker data in the US that might bring more rapid rate cuts from the Federal Reserve, combined with a rate hike from the BoJ, have caused the US dollar to depreciate against the yen causing an unwelcome currency loss to the carry trades.

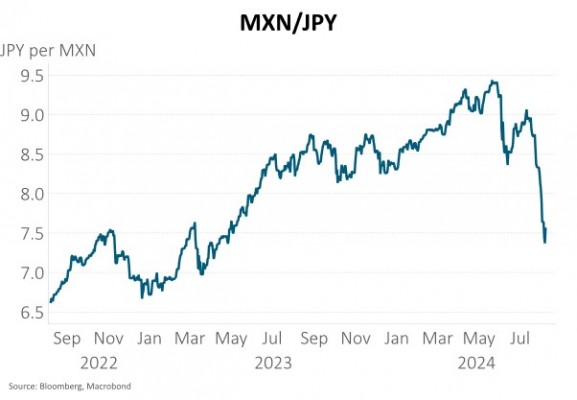

For instance, one popular carry trade has been to buy the higher-yielding Mexican peso, partly favoured due to ex-President Trump’s desire to reduce reliance on supply of goods from Asia, making Mexico an attractive alternative. With the US presidential race now less certain, the Mexican peso/Japanese yen cross rate has two fresh sources of volatility that has prompted significant unwinding of investment positions.

With markets being heavily interconnected, other carry trades are being liquidated. The by-product of possible further BoJ rate hikes over time could be that volatility increases across parts of the financial markets, prompting investors to dial back the capital they apply to higher-yielding risky assets.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.