Key Points

- Listed property assets have not yet fully recovered.

- Diverse impact of COVID-19 may create investment opportunities.

- A wide range of outcomes are possible, and we review current evidence on rental abatements and deferrals.

- It is reasonable to assume rentals falling by between -5% for industrial assets, through to -20% plus for secondary retail malls.

- Banks have been supportive refinancing and extending debt facilities.

More than ever, the environment highlights the need to be selective and active when investing in listed property securities. Far from being the same, the underlying basis for earnings and corporate structure in property securities is very diverse.

After being one of the best performing asset classes in 2019 (up 32.4%), New Zealand listed property securities have been one of the worst performing growth assets in 2020, down -17.5%, compared to New Zealand equities in general which are down -6.2 % (for the year to 17 April 2020). While the pricing of other listed growth assets has partially recovered from March’s liquidity-driven drop, when dysfunctional bond markets saw listed assets (including listed property) sold to meet liquidity requirements, the recovery in listed property pricing has remained relatively muted thus far. With the yield spread offered by New Zealand listed property above 10-year New Zealand Government bond yields back to Global Financial Crisis (GFC) level highs, we take a look at the current investment proposition for New Zealand listed property.

COVID-19 creates risks for listed property earnings, dividends and valuations

Listed property security Net Property Income (NPI)[1], which encapsulates rentals, vacancy and leasing incentives, is exposed to COVID-19 containment policy and the associated economic slowdown. Uncertainty about what COVID-19 containment means for the obligation, ability and willingness of tenants to pay rent has contributed to weakness in listed property stock prices. While all tenants are obliged to pay their rents, a very small number of relatively new leases in the office sector include clauses where the tenant does not have to pay rent if they are unable to access the property due to pandemic restrictions. So, the risk for property security NPI is predominantly economic.

Different sectors within real estate are impacted to different degrees as containment restrictions range from Level 4 to Level 2. At Level 4, essential service providers, including supermarkets, healthcare, logistics users and Government agencies, that are occupiers of office buildings can occupy their tenancies. At Level 3, many industrial users can occupy their tenancies; office users that can show safe separation can occupy their tenancy, and some retailers and food & beverage operators that can provide contactless home delivery may be able to, at least partially, occupy their tenancies. At Level 2, all tenants, including shopping mall specialty retailers, can occupy their tenancies.

A number of tenants are seeking rent relief in the form of rental abatements (suspending or paying a portion of rental) and rental deferrals (agreeing to pay but deferring payment dates). A very small number of tenants are simply not paying their rent. Tenants impacted significantly by COVID-19 seeking deferment seems like a reasonable outcome given the uncertain times. Harbour is actively encouraging listed property landlords to work with tenants to provide rental relief, to allow tenants to pay a fair and reasonable rental amount, to defer rental payment in lieu of extending leases or avoiding the costs of vacancy (no rental, incurring property costs, incurring leasing costs in a weak economy). It is also fair for landlords to share some of the benefit of the New Zealand Government’s recent announcement that allows New Zealand property owners to depreciate buildings in a period where tenants face profit pressure. Some tenants, mainly structurally impaired retailers, and some industrial users are attempting to use COVID-19 as a way to reset their rental cost structures. Listed property landlords are doing the right thing and asking for full financials and business plans and providing support to tenants where there is real hardship due to the current events. Larger tenants that have access to capital and are ‘trying it on’ are being reminded of their legal obligation to pay rent.

So far, the rental evidence is constructive. In New Zealand, rentals are generally invoiced monthly and paid on the 1st day of the following month. For the month of April, Harbour’s unofficial survey of property security landlords indicated a wide range - for one, 25% of retail rentals were received, while for another, over 70% of industrial rents were received. This is actually higher than many people expect, and it will be important that landlords reward this support from tenants as containment constraints continue.

Into 2021, some tenants may shrink their property needs while others may grow. Some tenants may fail. All up, it is likely to be an environment where vacancy increases, and releasing becomes more difficult. Office and retail users may shrink their property requirements, reflecting a smaller economy. Partially working from home may become common for office users, meaning white collar employers may not need as much space. However, they will still need office space to maintain their corporate culture, engage with clients and provide core services. For retail tenants, COVID-19 may force some operators to accelerate the shrinkage of their store footprints that was already occurring with many retailers forced to grow their e-commerce platforms. Office and retail may take a ‘less space, but better quality’ approach. Some industrial users may increase their space requirements, reflecting growth in e-commerce and increased onshore manufacturing. Others exposed to a cyclical slowdown may be forced to close. In our view, it is reasonable to assume rentals falling by between -5% for industrial assets, through to -20% plus for secondary retail malls.

A number of listed property securities have withdrawn earnings and dividend guidance. If the drop in net property income were to be sustained on a 12-month rolling basis, some New Zealand listed property securities may breach their Interest Cover Ratio (ICR) debt covenants. Importantly, ICRs are based on accounting-based earnings not cashflow so, where rental payment is deferred but not physically received, ICRs are not at risk as the measurement is based on accrued income not received income. The non-capitalisation weighted average ICR for New Zealand property securities was 3.3x before COVID-19, with unweighted average ICR covenants of 1.9x, meaning interest cover would have to fall by a ‘scorched earth’ 50% or more to trigger a debt default event. To date, banks have been supportive refinancing and extending debt facilities.

So far, two New Zealand property securities, retail-exposed Kiwi Property and secondary asset-exposed Asset Plus, have suspended their next dividends. For some investors that have invested in property securities purely for income, this has been a shock and may have contributed to them reducing investment in listed property. In Harbour’s view, flexing dividends is prudent – dividends are an outcome of sustainable earnings – property securities that are more exposed to the impact of COVID-19 should be retaining capital to support tenants for longer term gains. If the COVID-19 containment period proves to be shorter than expected, these property securities can increase subsequent dividends.

Independent valuation of physical properties may prove challenging in the near term. Increased income uncertainty and a lack of transactional evidence, with counterparties unable to complete due diligence due to containment measures, means that property valuers may take on a more conservative tone. Capitalisation rates (the rate that expected income is discounted at) which have been falling, are likely to stop falling and, in some cases, increase, reflecting increased rental income uncertainty. Given some better-quality New Zealand property securities were under-rented pre-COVID-19, versus spot market rental levels, reversion in market rentals back to previous contract levels may result in limited impact on near-term valuations. Capitalisation rate increases will be limited by the fall in interest costs, as bond yields have fallen with the global economic slowdown and easing in rates by central banks. Valuation risk may be highest for retail assets (which were under pressure pre-COVID-19) and for secondary assets where tenant covenants may be more at risk.

Many New Zealand listed property securities will be releasing their independent valuations for the March period. While it may be too early for valuers to fully reflect COVID-19, they are likely to reduce rental forecasts and assume greater vacancy periods. Secondary asset-owner, Asset Plus, was the first to report its independent valuations with individual asset values falling by between -5% for an Auckland grocery-anchored neighbourhood shopping asset, where the weighted asset lease term has fallen to below three years, through to a 14% reduction in value for a secondary Auckland office redevelopment asset where the tenant is vacating and a 14% fall in value for a secondary Christchurch shopping mall, where competition is high and recent leasing incentives have been aggressive. In Harbour’s opinion, Asset Plus’s negative valuation moves may be at the larger end for this valuation round. Post-GFC, it took 2 to 3 years for capitalisation rates to peak and rentals to bottom. Valuers are likely to be more proactive this cycle but, given the range of COVID-19 containment and post lockdown scenarios, including the degree of economic slowdown and recovery timing, valuers may be cautious about how they approach valuations.

In Harbour’s view, going forward, at best, it is reasonable to assume property security physical property valuations could fall by 3-20% across securities over the next year. Such a fall in values is unlikely to trigger widespread loan-to-valuation (LVR) debt covenant breaches. With an average non-capitalisation weighted debt-to-valuation (including committed capital works) for the New Zealand property security benchmark sitting at 35% (with a range of 21-41%), forced equity-raising risk looks low relative to an average bank covenant trigger level of 49.3%. If COVID-19 containment levels 4 & 3 last longer than three months, some retail-owning property securities may require additional equity capital, which is why several have retained earnings rather than paying out near-term dividends. Some may turn on dividend reinvestment plans. And some may also raise modest levels of equity capital to give them flexibility to take advantage of what may be a dysfunctional physical property market over the next 12 months.

Why this is not 2007

Post the GFC, a small number of New Zealand property securities chose to recapitalise by raising new equity at a low point in their stock prices. Only AMP Property (now known as Precinct) had a relatively large raising of $70m (an 8.9% increase in issued stock) in April 2007. Kiwi Property also raised a small amount of additional equity. In hindsight, AMP Property’s model was aggressive pre- GFC, and it over-raised post-GFC to give it a chance to reset the business.

Key differences between property securities now and the GFC are:

- Better portfolios, with a lower exposure to historically more volatile office sector than in 2007, and more exposure to industrial sector, which has structural tailwinds. The office sector also enters the current slowdown with its lowest vacancy ever in prime office (6% in the Auckland CBD relative to 14% in the GFC), with limited uncommitted supply (and modest urban fringe new supply coming on can be turned off quickly). The asset class also has a non-capitalisation weighted average lease term at 6 years, which was almost twice that in 2007, meaning a lower risk from near-term lease expiries.

- Lower debt levels. Current debt-to-valuation levels are at 30%, on a market capitalisation-weighted basis, providing more flexibility when compared with the average in 2007, gearing in the high 40% level.

- Basis for dividend distribution is more conservative at approximately 80% of accounting distributable earnings on a non-capitalisation average basis. In 2007, property securities paid out more than 100% of accounting earnings as dividends.

Is the yield spread enough?

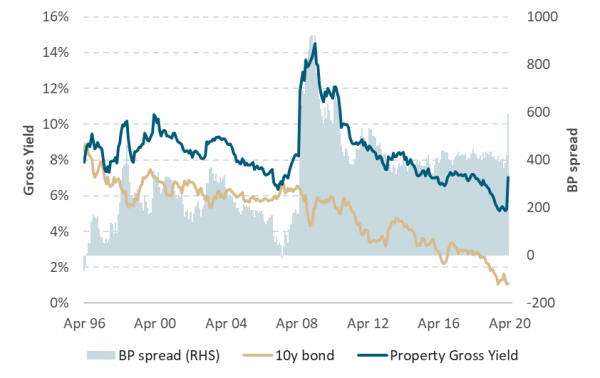

Since 2014, the New Zealand listed property yield has closely tracked movements in the 10-year New Zealand Government bond yields, at an average spread of circa 4%, or 400 basis points (bp). As shown in Figure 1, using consensus market earnings and dividend expectations, at almost 6% above New Zealand 10-Year Government bond yields, the gross yield offered by New Zealand property securities is back to GFC high levels.

Figure 1: Gross yield offered by New Zealand property above New Zealand Government bonds is back to GFC high levels

Source: Forsyth Barr April 2020

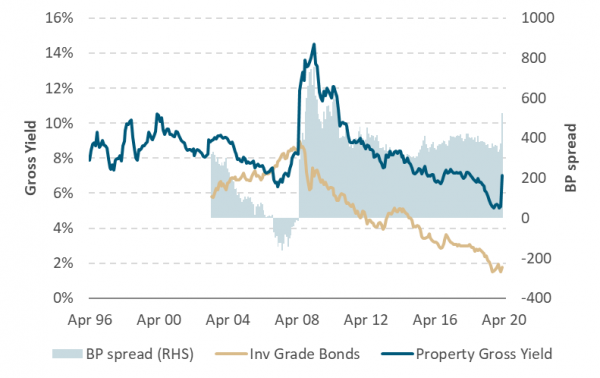

And, as shown in Figure 2, again using consensus market earnings and dividend expectations, at more than 5% above higher-risk New Zealand investment-grade bond yields, the gross yield offered by New Zealand property securities is back to GFC high levels.

Figure 2: Gross yield offered by New Zealand property above New Zealand investment grade bonds is back to GFC highs

Source: Forsyth Barr April 2020

To be priced in line with the post-GFC average spread of 4% above 10-year government bond yields, implies New Zealand property dividends would need to fall 30% or more. Dividends did fall by this magnitude post-GFC, but it took 4 years of gradual cuts so the market may have priced in a reasonable amount of risk. Consensus dividend expectations are likely to be trimmed over the next few months, but perhaps not as much indicated purely on the potential fall in net property income. While net property income forecasts may fall by more than 10% on average, this may be partially offset by lower interest costs (a 1-2% reduction depending on interest rate hedging) and lower tax rates (a 5-7% reduction depending on the type of property asset) from 2021 as a result of the recent re-introduction of the ability for property owners to depreciate commercial and industrial physical property structures.

On a capitalisation-weighted basis, New Zealand listed property securities are now trading in line with their historic independent property valuations based net tangible asset (NTA) backing per share, as illustrated in Figure 3.

Figure 3: New Zealand listed property trading in line with historical NTAs

Source: Forsyth Barr April 2020

Property security pricing has pulled back sharply after trading at a premium in anticipation of expected rental growth and strong transactional evidence supporting lower capitalisation rates. The fall has been dominated by a decline in retail-exposed property securities dropping, from trading at premium to NTA, to trading at a discount. While industrial property stocks are still trading at a premium to NTA, the premium is smaller than pre-COVID-19.

On a non-market capitalisation basis, New Zealand property securities are trading at 0.85x NTA, which is a better reference point to consider how dramatic the move in the pricing of New Zealand property stocks has been in the COVID-19 environment. The 15% discount to historical valuations is equivalent to a 1.1% increase in capitalisation rates from the last valuation round. Property research group CBRE, points out that capitalisation rates increased from 1.1% to 2.5% in the 2 years post the GFC, depending on the sector. So, the current 15% discount against historical NTA may capture potential for falling property valuations. Nonetheless, until there is more clarity on independent valuation risk, near-term capital gains may be constrained.

Conclusion – Return metrics known; COVID-19 duration unknown

Currently there is uncertainty about how long COVID-19 containment actions will impact on New Zealand property stock earnings. However, in our view, that risk is reflected in the pricing of New Zealand property securities relative to New Zealand Government bonds and investment-grade bonds. At a stock and sector level, the relative risks are at least partially reflected in the relative pricing movements of higher-risk retail property owners relative to lower-risk Industrial property owners.

In the near term, the risk of property securities needing equity recapitalisation may be overstated, but if COVID-19 containment constraints last more than three months then there is a potential need for a modest amount of new equity to be raised. Non-natural owners that were investing in property securities as high-yield bonds, without a focus on the source of earnings, have exited the asset class.

But with capital gains from asset values likely to remain volatile (limited upside, modest downside risk) over the next 12-months, investors may need to depend on the relative income yield offered by property securities to support returns in the near-term.

What do we need to see for New Zealand listed property performance to pick up? A mix of:

- COVID-19 containment dropping back to level 2 for a sustained period of time.

- Dividend confidence re-established.

- Property valuation risk clarified.

The key risk to returns, is that a recovery in economic activity takes longer than 2 years.

As clarity emerges over the next six months, listed property may prove to be a consistent, low volatility way to benefit from the recovery in the New Zealand economy over the next 2-3 years. Long term, large institutional investors remain under-exposed to real estate, which provides an attractive yield-driven investment in a low interest rate environment.

At Harbour, we are patient investors focused on investing in listed property stocks that benefit from structural change, including changing office space use, the rise of e-commerce, increased use of automation and robotics, increasing healthcare demand, changing population demographics and urbanisation.

More than ever, the environment highlights the need be selective and active when investing in listed property securities. Far from being the same, the underlying basis for earnings and corporate structure in property securities is very diverse.

[1] Net Property Income is a metric which looks at the rental income generated by a property securities portfolio of properties is performing, allowing for operating costs including leasing incentives.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.