Key points

- It was another strong month for equities, with the MSCI All Country World Index (ACWI) returning 2.0% in New Zealand dollar terms, and 3.2% in New Zealand dollar-hedged terms. Closer to home the S&P/NZX 50 Gross index (with imputation credits) advanced 1.2%, whilst the S&P/ASX 200 Index added 2.9% in AUD terms (and 2.4% in NZD terms).

- Globally, returns were strong across all sectors, with energy leading the way at 6.5%, closely followed by communication services at 6.2%. As has been the trend in recent months, defensive sectors lagged, with health care, utilities and consumer staples the bottom 3 performers (albeit still positive).

- Equity markets rallied as investors embraced the ‘soft landing’ economic scenario on easing inflation concerns and lower terminal central bank rate expectations. The reduction in peak rate concerns, reasonable economic activity and better-than-expected earnings updates contributed to an increased appetite across share markets, pulling in investors who had been sitting on the sidelines.

- Bond indices were flat to slightly positive despite some intra-month volatility. The Bloomberg NZ Bond Composite 0+ Yr Index returned 0.0%, whilst the Bloomberg Global Aggregate Bond Index (hedged to NZD) increased 0.1% over the month. Overall, central banks are seeing the desired response to tighter monetary policy but progress is slow and persistently high interest rates are expected for some time.

Key developments

Global growth has become increasingly uneven over the past month. The US economy has been surprisingly strong. Q2 GDP data showed the economy expanded at an annualised pace of 2.4%, following a 2.0% annualised increase in Q1. The services sector remains healthy, and a tight labour market continues to generate high rates of wage growth. This is keeping core inflation rates high, while headline inflation has been able to drop meaningfully on lower food and energy prices. Economic data out of Europe and China, in contrast, has disappointed. Europe is suffering from the combined forces of policy tightening, a stalled Chinese economy and ongoing geopolitical uncertainty from the Ukraine-Russia war. In China, expectations of stimulus increased slightly following the July Politburo meeting where some support for the property and capital markets was indicated. This likely comes too late for 2023, however, with economic forecasts for GDP growth this year downgraded from 5.5% to 5.2% over the past few weeks.

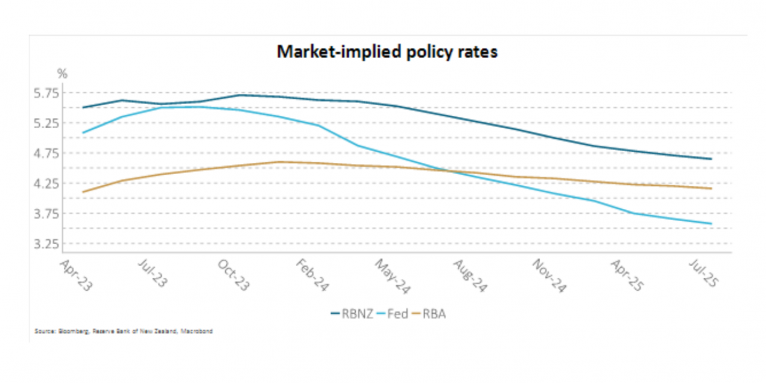

Most global central banks are close to the end of their tightening cycles but that doesn’t mean cuts are coming soon. Recent policy decisions and communication by the US Federal Reserve, the European Central Bank and Reserve Bank of Australia suggest further tightening from these central banks will be data dependent. Given high rates of core inflation and low unemployment rates, we think rate cuts are some way off. The US market looks particularly vulnerable to a repricing higher of rate expectations with the market currently anticipating almost 130bp of cuts next year to a Fed Funds rate of 4.2%, 40bp below the Fed’s own forecasts. In Japan, the recent expansion of the Bank of Japan’s yield curve control to allow the 10-year JGB to trade as high as 1%, from 0.5% previously, will likely allow a better calibration of policy to incoming data.

Increased US Treasury issuance, in the context of high levels of US government debt, is pushing longer-term bond yields higher. This dynamic was punctuated by Fitch cutting the US credit rating from AAA to AA+, citing governance concerns after the recent debt ceiling impasse and last-minute resolution. With term premia historically low, these concerns may place further upward pressure on long-term Treasury yields.

The Reserve Bank of New Zealand’s (RBNZ’s) view that it has delivered sufficient policy tightening has largely been supported over the past month. Business surveys of experienced activity continue to suggest very little economic growth this year. This is also supported by responses which suggest a lack of demand, rather than a lack of labour, is constraining output. On the price side, selling price and wage growth expectations continue to drop, albeit from high levels. The export sector is experiencing a combination of falling export demand and lower prices, that looks likely to continue. Data for Q2 revealed high core inflation and a still-tight labour market, but due to the lagged nature of these economic variables, this won’t come as a surprise to the RBNZ. Migration appears to be adding helpfully to labour supply but is also moderating from the astronomical levels seen earlier this year.

What to watch – have we reached peak OCR?

Looking ahead, we don’t anticipate RBNZ rate hikes. Tight monetary policy is working and is still in the process of delivering its peak impact. Despite no change in the Official Cash Rate (OCR), 1- and 2-year mortgage rates have pushed c.30bp higher over the past month to levels around 7%. 50% of borrowers are scheduled to refix to these high rates over the next year and may lock in this restrictive policy for longer tenors due to the negative slope of the mortgage curve. We continue to expect a long period of below-trend economic growth that creates higher levels of unemployment and lowers core inflation. We anticipate there will be enough evidence of this that the RBNZ will begin cutting the OCR at the beginning of next year, but it will likely be careful in indicating an easing cycle before then.

Market outlook and positioning

Capital markets may be near a key inflection point for interest rate settings and for company earnings. A point of inflection is the location where a curve changes from sloping up or down to sloping down or up. With inflation near its peak, interest rates may also be near their peak, reducing equity market valuation risk. If the rate of economic slowdown is near the end, we may be at a point where company earnings risk becomes more balanced, if not positive. In this environment equity market returns may be attractive. But we are not there yet. After a solid recovery in equity markets, we are in the 'twilight zone' between economic frameworks. Investor sentiment and positioning has moved to being positive towards equity investments – this does not mean equity markets can't keep delivering positive returns near-term, but it needs a not too hot, not too cold 'Goldilocks' environment to keep emerging. We continue to expect equity markets to grind higher, but with some pullbacks and volatility as capital markets move through the inflection point. In this environment, we continue to favour quality investments and those investments that benefit from structural tailwinds.

Inflation indicators continue to fall, taking pressure away from central banks to aggressively lift official interest rates. Capacity pressures are easing, and wage growth may have peaked, but parts of the labour market remain sticky with wage increases continuing to come through. While central banks may be close to finishing their current rate increase cycle, they remain data-dependent with employment and wage inflation remaining a key point of focus. Capital markets have begun to price in central bank official interest rate cuts from mid calendar year 2024. It may be too early to consider an official interest rate cutting cycle – inflation is still above central targets, and it may take time for interest rates increases to deflate economies. The ongoing normalisation of supply chains may support a faster reduction in inflation rates. While we may be near the end of central bank official interest rate increases, central banks are quantitatively tightening, reducing their investment in assets including government bonds, right at the time when government bond issuance is increasing in some economies. As a result, overall financial conditions could remain tight providing a headwind for equity market returns.

Within equity growth portfolios our strategy continues to position for a range of scenarios and to be selective. We continue to favour investments with structural tailwinds that are less dependent on strong economic activity. We continue to see technology dispersion, decarbonisation, and demographic changes as supporting company earnings. Businesses exposed to energy transition and the onshoring/nearshoring of manufacturing and storage of goods may face opportunities and threats. We are also favouring businesses with productivity and efficiency programmes, particularly where business re-engineering introduces technology that improves both revenue and cost structures. We continue to have a bias to quality, well-capitalised businesses that are less vulnerable to a tightening in financial conditions.

Within fixed interest portfolios, we increased the average maturity (duration) of investments when market yields rose in early July. This is predominantly in the 2-year to 7-year maturity range, which is where anticipated changes in domestic monetary policy are more keenly reflected. Currently, market pricing assumes that the OCR will not go lower than 4.5% before the end of 2026. We think that, given the weakness we are seeing in the economy, we can expect inflation to decline and for the market to anticipate lower cash rates over time. We are more cautious about longer-dated bond maturities, due to risks from global markets and due to the weakness we have seen in the New Zealand Current Account. Here, pressure is coming from a relative absence of tourists and the weaker earnings coming from dairy exports. We are seeing opportunities from some sectors of the credit market, although this is mainly where the more challenging macroeconomic pressures are being felt, so some caution is also warranted.

The Active Growth Fund is defensively positioned. The rally in share markets has seen equities trade at a narrow forward-looking risk premium relative to history, even considering recent falls in bond yields. While this is not a short-term indicator, it does temper our medium-term outlook for equities. That said, we are excited about the prospects for growth equities going forward which were challenged in 2022 battling with yields which were up significantly. With central banks well into their tightening cycle, the headwinds for growth equities may shift from bond yields to more idiosyncratic drivers making the operational performance of companies the key driver of returns. We are overweight fixed interest duration relative to our benchmark reflecting our view that, particularly in New Zealand, there is scope for interest rates to fall more than is priced in to forward curves currently.

Within the Income Fund strategy continues to reflect some caution towards equity markets and an ongoing positive attitude towards fixed interest. We have continued to hold an underweight position in equities. In July, the better performance came from sectors of the equity market that we do not normally emphasise within the portfolio, being the more volatile growth-styled firms. However listed property has also performed well and, while upside from here may be limited by the performance already seen, we are inclined to start increasing exposure. We have continued to hold a short position in the New Zealand dollar, effectively holding some global assets on an unhedged basis. Our expectation is that the New Zealand dollar can continue to weaken against major currencies, as softer growth and current account risks seem likely to continue. The fixed interest strategy within the Fund replicates the themes described above for fixed interest portfolios.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.