An outline of Scott Berg’s recent address at Harbour’s investment seminar series.

- Still opportunities in global markets

- Attracted to global technology beyond the FAANGs and emerging market consumer stocks

- Controversially, Scott talks about his recent observations on Tesla and Trump

Scott Berg has developed an incredible investment performance history at T. Rowe Price since taking the helm of the Global Equity Growth Fund nine years and eleven months ago. Today, T. Rowe Price manages more than $1.5trn New Zealand dollars.

There is a trend towards more concentrated global equity portfolios. With 130 to 150 stocks from across more than 30 countries, Scott’s portfolio bucks this trend. Diversification is a key tenant of Scott’s philosophy and is underpinned by his admission that he expects to get a handful of projections wrong each year. Scott made a number of projections for 2017 that didn’t transpire, yet the NZ PIE Fund outperformed its benchmark by over 10%; fairly strong support for Scott’s approach.

Portfolio performance has been very strong with global equity markets up 20% globally in the year to August last year, and his portfolio has provided returns of nearly 28% in New Zealand dollars. A year ago, he thought markets might do 5-7% and he’s trying to do 3-4% better.

Scott makes the key point that missing out on the 28% return, would erode a ten- or twenty-year portfolio track-record. Unless you are remarkable with your market timing, staying generally in the market is better than believing you can time your complete entry and exit.

You have to be invested to get equity market returns.

Amazon was misunderstood

In his presentation, Scott reviewed some of his projections from a year ago. For example, he thought that both Amazon and Alibaba were incredibly well placed as leaders in artificial intelligence and dominant across a number of integrated technology platforms with huge option value around big data and the consumer.

These stocks were his biggest positions a year ago. In fact, Amazon is the only stock in the portfolio that Scott has owned for every day in the last 10 years. He recalls his first owning Amazon at $59.50 a share. He then lost 35% in Amazon in the first five months as a portfolio manager.

It is staggering to think that in the subsequent nine years, Amazon’s share price rose from $40 to $1,000, making 25 times your money through to September 2017 when Amazon’s market capitalisation reached half a trillion dollars.

Roll on another year and Amazon’s share price is now up another 95%. In the last nine and half years, investors made 40 times their money in one stock. This wasn’t a speculative mining stock or biotech innovation, it was one of the largest stocks in the world, widely covered by many analysts and consistently trading on a very high PE, but consistently beating analyst expectations on revenue, EBIT and profit growth and building a huge option value with big data and a global (ex-China) consumer business.

Contrast that with Alibaba whose stock price has barely moved in the last year, and yet its revenues have grown faster than Amazon’s. He’s a bit surprised that Alibaba’s stock price hasn’t moved. Scott says he’s being patient; the market will also come to recognise the significant intrinsic value of Alibaba.

While one of the two largest positions in the portfolio has barely budged, the average return across these two stocks exceeds 45%. Not bad.

Tesla is now the largest portfolio position (still only a 3% active position)

Scott cites Tesla as the most controversial investment he has held in his portfolio in his tenure. This is a stock he has conviction in.

Tesla’s stock price, like Alibaba’s, is flat on a year ago. Still, T. Rowe Price has made a lot of money in Tesla by changing the position as the share price has been very volatile; today it is the single largest active bet in the portfolio. He admits to buying a significant stake in the last 10 days, more than buying back the stock he sold when the stock price was much stronger. In fact, Scott sold down the position to less than 1.5% of the portfolio and has now bought the position back to around a 3% active position in the portfolio highlighting his active management.

Amidst controversy surrounding Elon Musk, Scott believes Tesla investors are sceptical. And this is the opportunity. Scott has recently walked the entire Nevada Tesla giga-factory production line start to finish; he and his team did the same for the car production line in California, viewing the haphazard ‘tent’ as it’s touted in the media; he’s had calls with Elon Musk; and, he has had a phone call with the Board regarding Mr Musk. These steps are designed to develop an opinion. The fact that the market is fearful creates an opportunity. Not all opportunities are times to buy, however, you have to be ready to buy when the rest of the world is concerned.

Source: T. Rowe Price

Controversy aside, Tesla did produce 6,000 Model 3 cars last week (well above the 5,000 target that the financial media did not think could happen), and the car now is outselling the BMW 3 series by a 3 to 1 ratio in the US. Scott believes that the BMW 3 series was the aspirational car in the US. The Tesla Model 3 is not named as such coincidentally. The external dimensions of the Tesla are almost exactly the same as the BMW 3 series, whilst the interior is closer in size to the BMW 5 series. Scott thinks Tesla is right on target to be the disruptor, it is all set for self-driving; and will be able to produce cars on a much larger scale. At T. Rowe Price’s headquarters in Baltimore there were only 2 Teslas a year ago, now there is at least one new Tesla appearing every week and they are installing a whole half floor of the car park with electric chargers. Not that he will need one for his Tesla as his round-trip drive is only 40 km a day, out of a 400 km range.

Returning to the Amazon story, Scott notes Amazon is now better understood, so the portfolio has reduced the position. Being an active portfolio manager, Scott thinks that volatility is a very positive thing and Tesla is providing plenty of it.

Technology: the FAANGs and beyond

Apple provides an example where Scott was wrong but was able to minimise the impact. Apple’s share price is up 40% and a year ago he didn’t own the stock. But the portfolio isn’t static, and he actually bought the stock through the year and made 25%. He continues to like Apple, so his thinking has changed. In general, the prices of technology products fall over time; except the more aspirational products like the new iPhone. For instance, the iPhone 4 originally cost US$400 but the iPhone 10 with all the bells and whistles is selling at US$1,450. The price of a new iPhone is now more than a laptop. No analyst expected that, and therefore market revenue estimates have lifted. T. Rowe Price changed their view. Scott said he is looking forward to the release of the new iWatch with a curved OLED screen and more accurate personal health data capture.

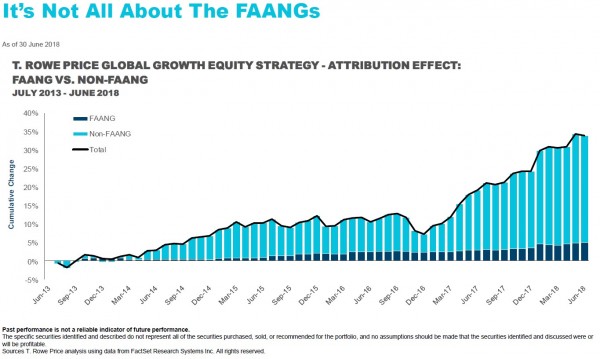

Scott concedes that the prominent FAANGs (Facebook, Alibaba, Apple, Netflix, Google) had added value in his portfolio, but notes non-FAANGs have added a lot more (5-6 times the alpha in fact). Also, the FAANGs aren’t so much technology as they are consumer stocks. Scott touched on a number of pure technology companies in the portfolio including German company WireCard with a share price up 163% in the last year. Only one or two people in his audiences across Australia and New Zealand this week had heard of this payments system stock; he also has a large position in accounting software company Intuit. Another stock is Shopify, the Canadian-based online management company; he also highlights Dassault Systems software, a French-based company, used for instance by Boeing and Tesla to optimise production plants, and finally, he talks about AMS, the Swiss-based tech company that creates facial recognition software for mobile phones.

Source: T. Rowe Price

He challenges the audience: How could you invest in this range of tech stocks across the world from NZ and really know what they were doing? Good point.

He still thinks that the FAANGs will do okay; but even if they roll over, his portfolio has many drivers for earnings growth in the technology sector.

Emerging markets are still a long-term driver

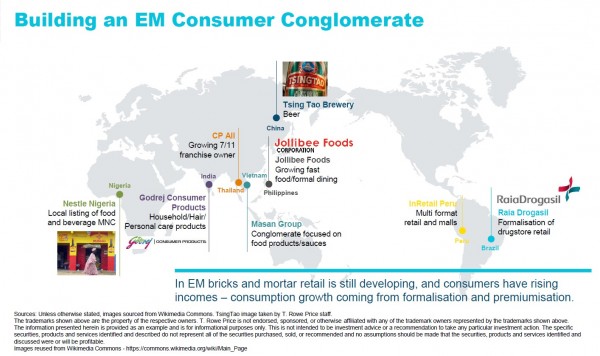

Another key topic for Scott is emerging markets exposures. He is still constructive despite emerging markets being down 25% in the last year. T. Rowe Price owns 150 names across every sector and active management and stock picking has added value. That means he does not own stocks in all emerging markets, especially some of the notable problem markets recently, which is one of the benefits of the extensive research resources available to him. Scott talked about why owning many stocks across emerging markets is better than, say, a policy of just owning Nestle to get your emerging market exposure.

Consumer staples has been a challenged sector over the past year. T. Rowe Price has still managed to make some very profitable investments given the depth of their research. For example, one of Scott’s largest exposures is InRetail a Peruvian owner of multi-format retail and malls. He jests that he never hears the question why don’t you own InRetail Peru? It’s because no one knows this company. The average investment manager doesn’t travel to Peru. Yet it is the largest consumer stock in Peru, a country growing by over 4% pa, urbanisation occurring faster than in China and in which InRetail has a strong franchise.

This is full non-benchmark idiosyncratic risk.

Source: T. Rowe Price

Another example Scott discussed is the Indian consumer products company, Godrej. Godrej is the leading personal care product and soap maker in India and all these products are increasingly seeing strong growth as the middle class increases.

And this theme continues in Vietnam, where Massan Group is a conglomerate focussed on food products and sauces. Scott used this example to talk about the liquidity challenges, and how T. Rowe Price uses market opportunities, for instance when people want to get out because of general emerging market weakness, say, because of sentiment associated with Trump’s anti-trade policies.

The extraordinary perspective is that these are domestic businesses unlikely to be as significantly influenced by global economic activity.

Scott again reinforces this point, yes, you could own Nestle as a global consumer conglomerate exposed to these themes, but actually, it would be better to “create your own Nestle” picking out the best bets. And Scott says perhaps Nestle Nigeria is the best consumer business in Nigeria, in contrast, Nestle may not be the best business in other emerging markets such as China, India and parts of Latin America.

Major market themes and the key market risks

Although the Global Equity Growth portfolio is a bottom-up process, Scott also covered the big four macro concerns he gets asked to discuss.

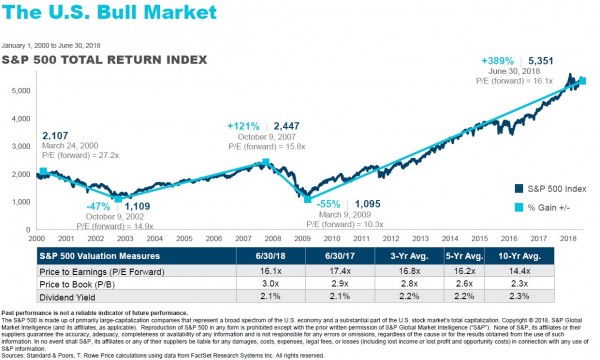

First, the bull market has been running 9 years. Yes, Scott is less optimistic than a year ago and he has moved the portfolio beta down from 1.05 to 1.00. But he is still constructive. Valuation is not stretched enough yet to stop the rally; the next correction needs a macro or political event. He doesn’t predict a recession in the next two years. Instead, he says:

- The world is growing “some” but not remarkably

- Japan has the slowest growth, but it’s picking up

- US growth is probably as good as it can get at 3% - but a softening in that growth to, say, 2.5% is still okay

- Earnings growth is good as well in the US

- But in Europe earnings growth for the major indices is held back by the concentration on financial stocks

- Valuations are average or a bit above average, but not excessive

Source: T. Rowe Price

In addressing the big issue on the bull market Scott notes:

- In 2000 the equity market PE was 27 times earnings (27x)

- Then the market fell 47% in 2.5 years

- The equity multiple halved to 14.9x

- Over the next five years, the equity market return was 121% and profits grew 100% and the PE rose to 15.8x

- And then the GFC saw the market lose 55% to produce a market low of PE of only 10.3x at the trough

- And now the market valuation has risen today to 16.1x providing a market return of 389%

- Most remarkably, over the timeframe since 2002 the market has returned 500% and corporate earnings have risen 490%, basically, in line with earnings – i.e. the market valuation now is similar to the valuation trough following the dot-com bubble.

The conclusion is that we are some way off a major correction based on valuation alone. And Scott outlines the positive perspective for the medium term that with low inflation, interest rates are likely to be more anchored than the market thinks, supporting valuations. He points to a recent article published by the US Federal Reserve that combines technological progress, globalisation, demographics and deleveraging as disinflationary forces.

Trump and China

Scott posits that it’s almost impossible to add value predicting the outcome of tariffs and trade policy. It’s a dangerous game trying to guess what Trump is going to do, the only way to add value is to consider the scenarios. Scott demonstrates that Trump and President Xi have different horizons. China can wait for a long time and probably won’t negotiate through bullying; therefore, any outcome is hard to predict. The Mexican and European deals on tariffs do signal a willingness of the US administration to negotiate, but disappointment on progress on Canadian-US negotiations signals some pessimism on a read-through for Chinese-US negotiations.

When pressed to come up with a view, Scott says that if we do get an escalation of the China-US trade war, markets could fall about 15-20% on lower GDP growth and a fall in valuation reflecting earnings risks. However, if China and the US do sit down and work through the broad lowering of trade barriers, we could be in for a very prosperous period and markets in a year’s time could easily be up 15%.

How does the portfolio consider these risks? Diversification, many positions across markets and sectors. It is obvious that Scott views the pessimistic and optimistic scenarios as equal probabilities. For this reason, today the portfolio beta is neutral and, as always, fully invested.

This column does not constitute advice to any person. www.harbourasset.co.nz/disclaimer/

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.