Key points

- The spread of COVID-19 outside of China dented sentiment during February, causing global interest rates and equity prices to fall sharply.

- US political risk was elevated during the month, as polling and early primary results saw Bernie Sanders emerge as the frontrunner in the race to become the Democratic candidate for the US Presidency. He since has dropped to a clear second favourite, behind Joe Biden. Sanders is not considered a “market friendly” candidate due to his views on (anti) trade, plans to break up big tech and unconventional views on monetary policy.

- The US earnings season saw 491 companies report. 359 companies (73%) delivered earnings in excess of consensus estimates, with the best performing sectors being technology where 94% of companies beat expectations. The sectors which performed poorest were telecommunications (50% beat rate), and oil and gas (44% beat rate).

- In New Zealand, the December company reporting season was weaker than expected with more misses against expectations in results, versus beats. Company outlook statements were cautious. Consensus earnings forecast downgrades exceeded upgrades.

Key developments

February was a volatile month for investment markets. Optimism generated from a positive US earnings season in early February, soon gave way to fear as the spread of COVID-19 left markets pondering just how large the impact of this virus could be on economic activity and company earnings. This saw the MSCI World Index down 8.2% over the month (in local currency) after being up 4.0% on the 12th of February. In fixed income markets, the tone was entirely driven by the spread of COVID-19. Late in the month, when almost simultaneous outbreaks occurred in South Korea, Iran and Italy, bond markets anticipated a tougher economic outlook and the need for rate cuts. Bonds rallied, with US Treasury yields reaching record low levels, and credit spreads widened.

At the time of writing, COVID-19 is in 76 countries, has infected over 95,000 patients and claimed over 3,200 lives, while over 51,000 people have recovered. The virus is having a very real human impact. The economic impact is more linked to the solution, the efforts to contain the virus, than the virus itself. As governments prioritise health implications, disruption to both supply and demand has the potential to create a “sudden stop” in global activity.

The sell-off, which came with the realisation that COVID-19 may be more serious than initially anticipated, followed one of the stronger US earnings seasons in recent history. Not only did 73% of companies in the S&P 500 index beat on earnings, guidance was strong, quashing fears of an earnings recession and providing optimism to investors about future employment growth and capital spending. Since then, many companies have come out talking down guidance due to the impact of COVID-19.

NZ earnings season was weaker than expected. Wage increases drove profits below expectations, particularly in the aged care and retail sectors. Travel and tourism results were below expectations, with revenues below expectations pre COVID-19 and companies downgrading profit guidance based on estimates of the potential impact of COVID-19. Similarly, transport infrastructure companies reported softer operating statistics pre COVID-19, with China-US trade negotiations and slowing NZ agricultural spend hitting activity levels. The impact of gas outages and lower-than-expected hydro generation, due to drought conditions and uncertainty around the outlook for the New Zealand's Aluminium Smelter (NZAS) Tiwai Point negotiations, contributed to a sharp sell-off in electricity generator retailers (“gentailers”). While the local profit reporting season ended on a soft note, underlying corporate profitability remains robust and balance sheets are in good order.

What to watch

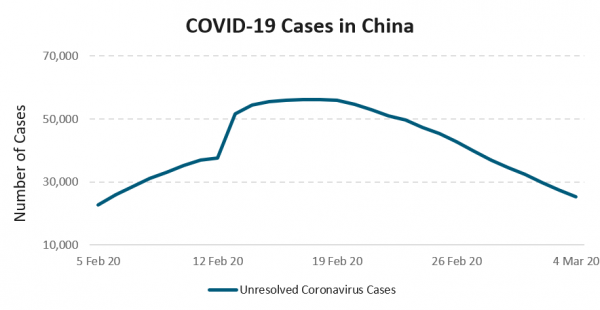

Coronavirus: The scientific communitys’ understanding of COVID-19 is developing fast, we monitor this closely by participating in numerous calls with epidemiologists. Economic scenarios vary widely and are very dependent on consumer behaviour and confidence. Valuation declines in risk assets, as investors become unwilling to accept risk, can be self-fulfilling and we look to see if the circuit breakers of fiscal stimulus and interest rate cuts are effective. We are also assessing if valuations capture a scenario of widespread infection rates, typical of those of the seasonal flu, as this outcome is appearing increasingly likely. A peak and steady decline in COVID-19 new patient numbers (as being seen in China in the below chart) could see an improvement in investor confidence.

Source: Bloomberg. Unresolved cases are confirmed cases which have not resulted in someone recovering or dying from the virus.

Policy Responses: Global central bank and government stimulus is increasingly seen as a possible circuit breaker. The Reserve Bank of Australia cut the cash rate 25bp at its March meeting and was followed by an unexpected 50bp cut by the US Federal Reserve in an out-of-cycle meeting. The market is now pricing the US central bank to cut a further 70bp over the next 12 months, from 30bp at the end of January. The European Central Bank (ECB) said “we stand ready to take appropriate and targeted measures”, and ECB easing expectations have increased by more than 20bp over the past month. The Bank of Japan is providing additional liquidity to banks via its open market operations. Italy, where the number of cases sits around 2,000, has announced a EUR3.6bn (0.2% of GDP) spending package. China has continued to use a combination of fiscal stimulus and central bank rate cuts to provide support.

US Elections: Joe Biden is now at short odds to become the Democratic Presidential candidate. This has reversed some of the risk that was priced into markets around Sanders gaining the Democratic nomination. While Biden’s policies are far more market-friendly than Sanders’, his plans to raise the corporate tax rate and introduce a financial transactions and wealth tax are less friendly to markets than Trump’s policies. However, there are some elements, like his proposed infrastructure spend and more progressive view on climate change, that will be welcomed by markets. Bearing in mind that all policies are subject to not only Biden becoming President, but also the success of the Democrats in Congress and the Senate.

Market outlook and positioning

The combination of events has highlighted the need to be selective when investing in stocks. Fear of missing out (FOMO) has driven parts of the equity market, masking how some companies were lagging due to slowing growth, accelerating technology disruption and the loss of pricing power.

Within Harbour’s equity growth portfolios, we continue to bias portfolios to stocks that benefit from structural change that can sustain and grow earnings and dividends through what may remain an imbalanced global economic growth environment. While the local profit reporting season ended on a soft note, underlying corporate profitability remains robust and balance sheets are in good order. A sustained period of economic weakness may test some more cyclical businesses but may provide opportunities for stronger businesses to grow organically or by acquisition. The pronounced weakness in late February may have been bordering on irrational, with markets driven by fear rather than fact. Potential policy easing (monetary and fiscal policy already occurring) may provide some stabilisation to economic activity and to markets. With the market ‘on sale’, we will look to add to quality stocks at what may prove to be medium term discounted prices.

Within fixed interest portfolios, our investment strategy has been to include the more negative scenario in our positioning, especially as this could have the biggest impact in markets if it eventuates. Specifically, we have added duration in the short end of the yield curve (maturities between 1 – 3 years), as this is where the scope for yields to fall is the greatest. We now think the market is fully pricing in a cut in the Official Cash Rate (OCR) to 0.50% by the Reserve Bank. Anything beyond that would be quite aggressive and require a poor environment. Accordingly, we have taken some profits on positions entered into earlier in February. In credit markets, spreads have started to widen, and more is possible, especially for more vulnerable companies. We have made some divestments in a couple of bonds and for now, will remain cautious.

In multi-asset portfolios, we remain cautiously positioned. This reflects our assessment that the balance of risks around Coronavirus being tilted to the downside over the short term. Taking a more medium-term view, we remain optimistic that equity markets should edge higher so will be looking for buying opportunities, especially in areas of the market which will benefit from easier financial conditions.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.