Key points

- The MSCI All Country World Index returned 4.9% over the month and 6.4% in New Zealand dollar-hedged terms. Sub-sector performance was almost a mirror image of last year, with more defensive sectors, such as utilities and consumer staples, lagging as investors rotated to the more interest rate-sensitive sectors such as consumer discretionary, communication services and information technology.

- The New Zealand equity market (S&P/NZX 50 Gross with imputation) returned 5.7% over the month. Secular growth stocks Fisher and Paykel Healthcare, Auckland Airport, Ryman, Mainfreight and Summerset drove the New Zealand market higher.

- Both New Zealand and Global Bonds delivered positive returns over the month with the Bloomberg NZ Bond Composite 0+ Yr Index up 2% and the Bloomberg Global Aggregate Index up 2.2%.

- Economic data continues to show slowing inflation and inflation lead indicators which suggest a disinflation process is well underway globally. We may be near a point where central banks go on hold from official interest rate increases.

Key developments

Equity markets rallied strongly in January reflecting lower bond yields and better-than-expected company updates (including quarterly production/sales and Christmas trading updates) and an absence of earnings downgrades into reporting season. Data suggesting that inflation is peaking has reduced the risk of further sharp increases in central bank interest rates, motivating some investors to reduce the degree of underweight exposure to equity markets relative to long-term targets.

Global inflation pressures have reduced in recent months as the normalisation of global supply chains, lower commodity prices and slowing demand work their way through economies. Shipping costs have returned to pre-COVID levels and energy prices have fully retraced the increases associated with Russia's invasion of Ukraine. In the US, some economic data, such as new orders, are consistent with a slowing economy and falling house prices, as well as more real time measures of rent, point to a lower contribution to CPI from shelter (that makes up 1/3 of headline CPI, 40% of core CPI). Critically, labour markets are beginning to loosen with slowing job growth beginning to translate into a drop in wage inflation.

While inflation is moderating, it remains well above central bank targets. Even more recent US core inflation prints, while lower, are running at an annualised pace of around 3%. China’s reopening is adding to global activity and labour markets remain too tight. In the US, for example, there remains almost two job openings for each unemployed person. With the inflation target of 2% for most central banks, they can’t yet declare victory. The US Federal Reserve and European Central Bank decisions both emphasised the need for further tightening, and that policy will likely need to remain restrictive for some time to ensure inflation has been tamed. Markets, however, just don’t believe it and price policy rate cuts in the second half of this year in most economies – contributing to the recent easing in financial conditions.

In New Zealand, the tension between strong historical data and weak forward indicators continues. Incoming quarterly data continues to tell a story that economic activity was stronger than most anticipated last year, helped by the reopening of borders that allowed tourists to return. This kept the labour market tight and allowed for high inflation (above 7% y/y) to persist. However, more forward-looking measures, such as business and consumer confidence, are historically low, along with firms’ expectations of their own activity which are consistent with recession this year. The impact of falling house prices (negative wealth effect) and higher mortgage rates point to households continuing to reduce consumption, providing headwinds to growth.

What to watch

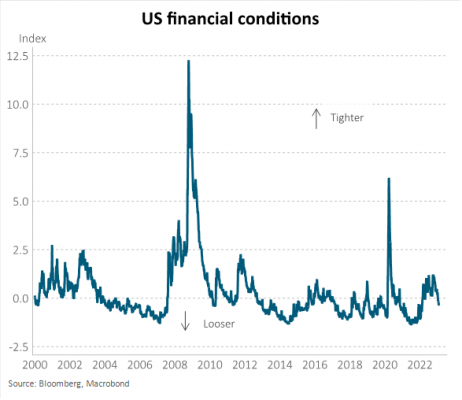

Financial conditions have loosened notably in recent months as investors have priced in better inflation data and the prospects of a softer landing. With central banks still to get inflation down near their acceptable targets, financial conditions that become too loose, could elicit more hawkish central banks.

Market outlook and positioning

Investor positioning remains defensive and under-exposed to equities. In the near term, we may face a skittish low conviction equity market. Easing inflation and China’s recovery provide tailwinds to global equities even as earnings downgrades may continue. But we may continue to face a volatile equity market. Harbour's strategy is to remain diversified for a range of macroeconomic settings. Growth stocks have underperformed for two years. Harbour continues to favour investments driven by secular trends, including demographics, digitisation, disruption, decarbonisation and deglobalisation. We expect such secular growth trends to re-emerge as drivers of returns as the pace of interest rate increases slow. At Harbour we remain focused on security analysis and on through-the-cycle returns to identify attractive stocks. In our view, stock selection and identifying investments supported by self-propelling strategic execution and improving cashflow may continue to enhance portfolio returns through time.

Within equity growth portfolios, we remain active taking profits in investments when markets get ahead of fundamentals and adding on weakness where supported by stock specifics. Within the portfolio we continue to maintain a mix of investments in enduring growth stocks (including quality defensive growth stocks in the healthcare sector that can sustain and grow returns through a period of slower cyclical economic activity), selected cyclical growth stocks (including financial stocks that have pricing power to deliver higher earnings in a period of higher inflation and increasing interest rates) and stocks that benefit from secular trends including demographic change, digitisation, industry disruption, decarbonisation (greenablers) and deglobalisation.

Within fixed interest portfolios, the New Zealand yield curve has become steeply inverted in recent weeks, with interest rates out to one year pricing in further OCR (Official Cash Rate) hikes from the RBNZ. However, from two years out to five years yields get lower each year. This reflects an expectation that the RBNZ will cut rates in the second half of this year and progressively lower the OCR to below 4% at some stage during 2025. Recently, the market had been expecting the OCR to be hiked to around 5.4%, but this expectation has been cut back to about 5.2%. Our view is that the RBNZ is likely to peak in rate hikes at 5.0% and we have invested through this timeframe accordingly. We don't think it is so likely that they will reverse direction during 2023, but we do expect rate cuts in the years to come and think that it is likely that the OCR will get closer to 3%, not 4% as is priced. Accordingly, we see value in yields further out the curve. We think that to be sure the OCR can get down to 3%, we need evidence that medium-term inflation pressures are heading back towards the 1% to 3% target range. This will probably take some time, so it may be difficult for longer term bond yields to rally far right now. All of this suggests a relatively cautious approach to interest rate positioning and the Fund's duration is close to the index at present for longer-dated exposures.

Despite the expectation that inflation will ease back from 7%, we see value in inflation-indexed bonds, which price in a decline towards 2.5%. We think risks are skewed higher than that, so are continuing to hold bonds maturing from 2030 to 2035. We also like the 2025 bond, which assumes CPI will be 3% through to its maturity in around 2 1/2 years. With inflation running at a very high pace at present, the inflation accrual that occurs is very attractive.

Within the Active Growth Fund, we trimmed our equities position following the strong rally into February. Equities overall, on a price-to-earnings ratio basis look broadly fairly valued, but relative to bonds do look slightly expensive. This is a market aggregate measure though and, within the market, there remain extremes. For example, larger capitalisation companies appear expensive relative to smaller companies, US companies expensive relative to Asian companies and defensives expensive relative to growth stocks, which creates opportunity for active management. The Active Growth Fund has a diversified exposure to equity markets including a specific allocation to a clean energy, smaller companies and Asian equities to complement our more "core" and larger capitalisation equity strategies.

Within the Income Fund, we have continued to be tilted defensively over recent months based on a judgement that risk assets would continue to experience some challenges as central banks continued hiking interest rates. For equities, the prospect of ongoing cost pressures and slower demand affecting revenues adversely has motivated a cautious approach. However, in January, with inflation now looking to be peaking and without the economy suffering too badly at this stage, investors have been keen to reinvest in growth-styled equities. We had made a modest reallocation along these lines in November, increasing exposure to global equities at the expense of Australasian equities, but still retained an underweight exposure to equities overall. This has led to some underperformance of the Fund relative to benchmark. If inflation continues to decline as we expect throughout the year, there can continue to be a positive environment for risk assets. We are expecting better returns in the months ahead and are likely to increase exposure to risk assets, aiming to use periods of market pullbacks to invest.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.