Key points

- The MSCI All Country World Index fell -2.0% over the month in New Zealand dollar-unhedged terms, and -9.0% in New Zealand dollar-hedged terms.

- The New Zealand equity market (S&P/NZX 50 Gross with imputation) finished the month down -4.6%, whilst the Australian equity market (S&P ASX 200) fell -6.2% in Australian dollar terms in the month, and -4.0% in New Zealand dollar terms.

- Bond yields rose over the month with New Zealand 10-year government bond yields ending the month at 4.30%, representing a 0.32% increase for September. The story was even more exaggerated in the US where 10-year yields ended at 3.83%, an increase of 0.64% for the month.

Key developments

Stock markets fell as central banks ramped up their interest rate increases and markets realised rate hikes are likely to continue while inflation remains persistently high. An approximately 1 percentage point rise in real rates over the month was a key driver of the equity market sell-off. The increasing risk that policy tightening leads to an economic recession in 2023 contributed to earnings downgrades, weakness in commodity prices and a fall in the New Zealand and Australian dollars against the US dollar over the period.

The New Zealand fixed interest market showed an uncharacteristic resilience to global movements in September, with bond yields rising considerably less than the US market. This occurred for two reasons. The US Federal Reserve affirmed a shift to a more assertive approach towards tackling inflation, a stance already taken by the Reserve bank of New Zealand (RBNZ). In addition, New Zealand bonds had previously traded quite weakly, and some re-pricing was due. Policy changes by the UK government triggered liquidity and credit market concerns globally, with US BBB credit spreads increasing debt funding costs by 0.85 percentage points over the September month. As markets have been driven by central banks’ efforts to fight inflation, it was quite unwelcome to see a government proposing aggressive stimulatory policies, especially when funding plans were not fully developed.

The New Zealand economy is yet to show meaningful signs of weakness, encouraging the RBNZ to continue raising interest rates to return inflation to target. Tourism helped drive a solid bounce in Q2 activity and the labour market remains extremely tight, with net migration outflows adding pressure. Business surveys continue to suggest a weak demand outlook and declining profitability. But a recession doesn’t appear to be imminent and acute capacity constraints remain an inflationary force. Government spending continues to support economic activity. Recent exchange rate depreciation may add to inflation if weaker global demand is not a sufficient offset. All of this combines to bring about the ‘good news is bad news’ reactions from the market, with yields rising and equities falling on more positive news releases as the market prices in further rate rises.

What to watch

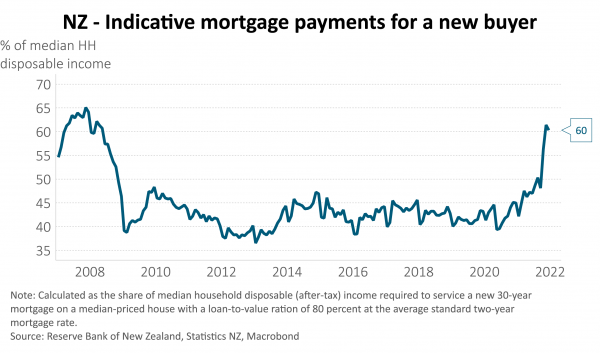

Households are feeling the pinch, however, and the hurt is far from over. Workers have job security but inflation, higher interest rates and falling asset values are weighing on consumption, which fell 3.2% in Q2. House prices fell 1.3% in August and are now 9.5% lower than their November 2021 peak. Further declines are likely, as 20% of mortgage borrowers will re-fix to much higher rates between now and March, and a further 25% in the 6 months after that (for further discussion of the pressures on New Zealand households, please see Harbour Navigator: Rough ride ahead for NZ households, 12 September 2022). These dynamics also hold negative implications for the construction sector, which contracted 2.4% in Q2.

Market outlook and positioning

The rapid increase in interest rates means that the yield available on government bonds and mid-grade corporate credits is now relatively attractive versus the earnings yield offered by equities for income-focused investors. For the first time since the GFC there are (now) reasonable alternatives (TARA) to equities to enhance returns for balanced investment portfolios. This change threatens the there is no alternative (TINA) strategy that has seen investors favour equities since the GFC. As a result, we have seen some investors switch allocation away from equities to fixed interest investments – a trend that may continue until interest rates stop increasing or until earnings growth expectations have found a base.

Equity valuations are well through absorbing a higher cost of capital impact (both via a higher cost of equity and cost of debt). But a further continued sustained period of real interest rate increases may suppress near-term returns from equities, while a significant slowing in economic activity will test earnings forecasts. We continue to see earnings sensitivity (pricing power and input cost exposure) as a challenge for equities sustaining positive returns near term. While market earnings forecasts continue to be trimmed, forecasts may not allow for a recession. Our research suggests we may be in an earnings downgrade cycle that may not see aggregate earnings trough until later in calendar year 2023. Profit margin estimates continue to roll over, raising the risk of further earnings downgrades. We see particular risks to earnings for some previous COVID and stagflation winners.

Within equity growth portfolios, we continue to seek safety in quality, growth (particularly healthcare) and defensive stocks that can sustain and grow returns through a period of slower cyclical economic activity. The portfolio also owns selected financial and resource stocks that have pricing power to deliver higher earnings in a period of higher inflation and increasing interest rates. We continue to favour stocks that benefit from structural tail winds that are not dependent on near-term economic activity including de-carbonisation, demographic change, digitisation, rapid technology change and the evolving theme of de-globalisation.

Within fixed interest portfolios, we hold a long duration position, based on an expectation that the RBNZ does not hike as far as the market expects, and that as we head into 2023 we will see more tangible signs of weakness in household spending. That may entice the market to anticipate an eventual easing in monetary policy. Within the credit sector there has been some variability in performance, and we are shifting exposures out of bonds and into high grade issuers, such as Transpower accordingly.

Within the Active Growth Fund, the combination of a softening in economic and inflation data is likely to cap the rise in yields of longer maturity (10-year and 30-year) government bond yields. However, the commitment by central bankers is likely to see short-term interest rates moving higher via official interest rates leading to flat or inverted (near term maturities higher than longer term maturities) interest rate yield curves. We see the balance of risks here being one where we can buy bonds with more confidence, and this has been recognised by recently increasing duration in the Fund to above benchmark levels. This also recognises that bonds are trading at a level where they can provide protection against unexpected market events and ’flight to quality‘ events.

Within the Income Fund, we favour bonds ahead of equities at present, holding an underweight allocation to equities. Looking ahead, we can envisage a phase where inflation risks are clearly subsiding, and markets can anticipate an end to rate hikes and the possibility of rate cuts in due course. That should enable equities to recover, and we would want to lift equity exposure in the Fund. At present however, momentum is negative and other downside risks persist, so we are being cautious about shifting to a more optimistic strategy.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.

This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.