Key points

- The MSCI All Country World Index returned 0.8% over the month in New Zealand dollar-unhedged terms, and 6.0% in New Zealand dollar-hedged terms.

- The New Zealand equity market (S&P/NZX 50 Gross with imputation) finished the month up 1.9%, whilst the Australian equity market (S&P ASX 200) rose 6.6% in Australian dollar terms in the month, and 4.4% in New Zealand dollar terms.

- Generally, bond yields fell over the month. In the US, 10-year government yields ended the month at 3.61%, a decrease of 44bps for the month. New Zealand 10-year government bond yields ended the month at 4.08%, representing an 11bps decrease for November.

Key developments

Evidence of peak inflation and slowing economic activity contributed to a fall in long-term bond yields over the month. The US Federal Reserve (Fed) noted that the rate of its interest rate increases may slow soon. This fall in bond yields provided valuation support for stock markets. In contrast the Reserve Bank of New Zealand (RBNZ) increased the official cash rate (OCR) by 75bps to 4.25% in response to persistently high local inflation data.

In local equities, the New Zealand November profit reporting season (by 24 companies) for the September period continued the trend of the last few quarters of better-than-expected actual results, but more post-result profit forecast downgrades were offered than profit upgrades. Company outlook statements were generally cautious with several ‘battening down the hatches for an economic storm’ type comments. Financial year 2023 and 2024 earnings forecasts were generally cut on higher costs (particularly labour and interest costs), but some companies also saw cuts to revenue expectations both from economic activity and companies reducing their own growth plans. In Australia, consensus market earnings per share forecast were trimmed by 2% in November with energy, healthcare and materials the key drivers for downgrades.

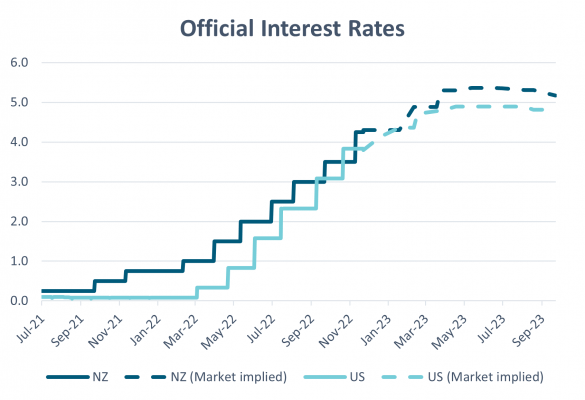

The RBNZ has become more concerned about a de-anchoring of inflation expectations and after hiking 75bps to 4.25% at the November MPS, now expects to take the OCR to 5.50%. This is 140bps above the August MPS peak OCR forecast of 4.10%. We don’t think recent data justify a revision of this size which suggests that either the RBNZ has become more aggressive in reacting to new information or its economic assumptions have changed. The RBNZ noted that the recent pick-up in inflation expectations imply a higher short-term neutral interest rate – the interest rate that neither adds nor detracts from economic activity or inflation. The RBNZ estimates this to be around 3.50%, 150bps above its 2.00% long-run neutral interest rate estimate. As the RBNZ wants to dampen activity, it must set interest rates above the neutral rate. In terms of its economic assumptions, it now forecasts high rates of wage growth, and therefore inflation, to persist for longer.

What to watch

Central banks have done a lot but there is still more to come. There has been a more constructive tone to markets in recent weeks as interest rates have declined on reduced inflation pressures and signalling from the US Federal Reserve that it is likely to slow the pace of rate hikes. However, inflation remains high and a long way from central bank targets. Fed Chair Powell has been at pains to emphasise that one lower inflation reading (October) does not make a trend and, while the Fed may be slowing the pace of rate hikes, it still anticipates further tightening is required to return inflation to 2%. (Chart shows market implied increase in official interest rates in next two years).

Source: Bloomberg, RBNZ

Market outlook and positioning

Tight monetary policy may push many economies into recession next year. The almost 400bps of Fed rate increases since March and market expectations of an additional 125bps, have seen both monetary and financial conditions tighten sharply this year. The impact will be felt most acutely next year and force the US economy to stall. Elsewhere, monetary tightening combined with the ongoing war in Ukraine, including the associated higher energy costs, is likely to push the euro area and UK into recession early next year. In contrast, while recent Chinese economic growth has been suppressed by the zero-tolerance to COVID, an increasing willingness to relax COVID restrictions, together with a further easing of monetary policy, may see a mild acceleration of Chinese growth in 2023. Overall, however, a big risk for global economic growth is that monetary policy may need to stay tight through 2023 if inflation doesn’t fall quickly enough.

Earnings risk for share markets is not directly correlated with economic activity. Companies that are sensitive to a cyclical slowdown are likely to see cuts to earnings forecasts. The risk is that revenue slows down faster than expected which impacts negatively on operating leverage and profit margins for cyclical companies that need a strong economic growth tailwind. We see potential for better returns from individual stocks that are executing well in their own businesses. In our view this earnings environment is likely to see businesses with strong franchises, strong economic ‘moats’ driven by intellectual property, and strong financial metrics begin to see their performance outpace companies that have overly benefited from unusual policy stimulus and geopolitical disruptions. If the recession is deep, a recession-induced collapse in the long-duration bond yield favours the longer-duration parts of the stock market with earnings certainty or those that can grow through a cyclical economic slowdown.

Within equity growth portfolios, we continue to maintain a mix of investments in enduring growth stocks (including quality defensive growth stocks in the healthcare sector that can sustain and grow returns through a period of slower cyclical economic activity), selected cyclical growth stocks (including financial stocks that have pricing power to deliver higher earnings in a period of higher inflation and increasing interest rates) and stocks that benefit from secular trends including demographic change, digitisation, industry disruption, de-carbonisation and de-globalisation.

Within fixed interest portfolios, over recent months our desire has been to hold large duration positions, relative to our benchmark index, only when we hold a reasonably high level of conviction in our view and see attractive levels. Tempering positions at other times, there is also a risk that the bond market gets ahead of itself. The Fed does not envisage rate cuts at all for some time. It is still hiking. Meanwhile quantitative easing is being unwound, with central banks selling bonds they had bought over previous years. It may be difficult for US 10-year bond yields to fall as far as 3.0%, which would also limit downside scope for New Zealand bond yields. Consequently, we have started to reduce the size of our long duration position, with what we have entirely focussed on the 0 -3-year maturity sector. In the credit sector, we are seeing scope for spreads to become more attractive in some sectors including bank debt. This may prompt us to reinvest in more credit, having spent the bulk of the year in a quite cautious mindset, with allocations well below normal.

Within the Active Growth Fund, we hold a neutral position to equities overall with a preference for growth stocks less exposed to the economic cycle. As the market's interest moves from valuation risk to earnings risk, we view these companies that have sold off markedly over the past 12 months, as being well-positioned to ride out a slowing global economy. The Fund is also overweight interest rate duration. This reflects a view that economies are starting to respond to tighter monetary policy and central banks may not need to hike rates to the extent that is currently embedded in market pricing.

Within the Income Fund, we have continued with a cautious approach to our investment strategy over recent months. We had been underweight equity allocation but added to that in October. In November we held our allocation steady, at around 28%, compared to a neutral weight of 32%. Equity markets outperformed fixed interest and cash, so there was a degree of missed opportunity over the period. Within the equity allocation, we raised our 'growth' style exposure, via both Australasian and global equities. This deviates from our typical core equity bias, which is for income-generating equities. We did this as investors have been preferring defensive positioning and the income-generating sector has become fairly richly priced. It is this aspect that primarily motivates us to remain underweight at present.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.