The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed interest, credit and equity markets.

- The US Election delivered a market friendly outcome - victory for Joe Biden and a split Congress. While the split Congress likely means less fiscal stimulus, corporate tax rises also seem unlikely.

- In November, we heard from both Pfizer/BioNTech and Moderna, both of whom used the experimental mRNA technology in formulating a COVID-19 vaccine. Preliminary findings showed the efficacy of these vaccines sat at 95% and 94% respectively. The Oxford University/AstraZeneca vaccine which relies on more traditional science showed solid, but less spectacular, efficacy in initial trials.

- The US earnings season continued strongly in November, with 82% of companies beating consensus earnings estimates. The NZ reporting and AGM season also came in above expectations delivering a continuation of ‘less worse’ results versus conservative expectations.

Key developments

Global equity markets were very strong over the month with the MSCI World returning 12.2% in US dollars. Positive vaccine trial outcomes from the key studies provided markets with a substantial lift as investors pre-empted the cyclical recovery that may come. Energy and financial stocks, which had been large laggards since COVID-19 emerged, were the key outperformers with their global sub-indices returning 18.7% and 26.1% respectively, while defensives lagged. The bounce back in financials and commodity prices helped the Australian equity market to its best month ever, up 10.2% while the S&P/NZX 50 was up 5.7%.

With the Reserve Bank of New Zealand (RBNZ) communicating a more balanced outlook in its Monetary Policy Statement (MPS), local fixed income assets weakened notably. Many investors were ill-positioned going into the MPS, with a negative Overnight Cash Rate (OCR) priced for 2021, and the sell-off in bond prices was aggressive. Further communication from Grant Robertson to the RBNZ expressing concern over rising house prices and seeking a change to the remit further reduced the chance of OCR cuts. As a result, we saw the NZ 10-year government bond yield increase by 0.3% to 0.84% and the NZ dollar increase 6.1% against the US dollar over the month.

The US election resulted in a split Congress that has materially reduced the prospect of significant additional fiscal stimulus. Most analysts now expect a package of USD500 - 900bn early next year (vs. the USD2.2trn the Democrats had passed in the House prior to the election). There remains a chance (c. 30% according to betting markets) that the Democrats can take the Senate if they win the two Republican seats up for election in the Georgia runoff on 5 January. A Democrat-controlled Senate would increase the prospect of larger fiscal stimulus and government bond issuance (implying higher bond yields), alongside possibly raising expectations of corporate tax hikes and greater regulation.

New Zealand’s economic recovery continues. The labour market is showing ongoing resilience to the expiry of wage subsidies. House prices have increased further and, while questions have been raised about the impact on inequality, higher house prices are helpful for economic activity by encouraging residential investment and consumption (via a housing wealth effect). The goods exporting sector is continuing to benefit from a recovery in trading partner demand and well-supported export commodity prices.

What to watch

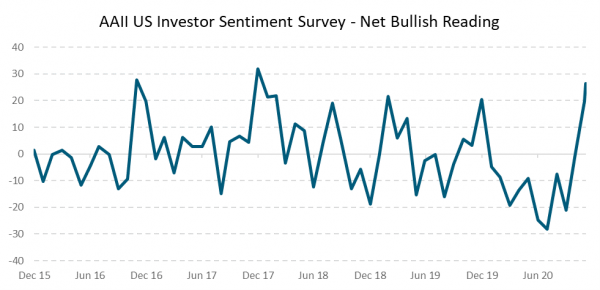

Sentiment starting to look stretched: While the bounce back in equity markets from the March lows has been sharp, many investors have remained on the sidelines until recently. The Bank of America Global Fund Manager Survey is closing in on “full bull” while the more retail-focussed American Institute of Individual Investors (AAII) Investor Sentiment Survey is showing similar investor optimism.

Source: Bloomberg. Net bullish reading is calculated by deducting bearish from bullish responses.

Market outlook and positioning

With a variety of risk events having passed in recent months, forces suppressing bond yields and risk appetite have lessened. Positive vaccine developments give us confidence to look through the near-term health challenges facing the U.S. with the COVID-19 second wave. As economic activity potentially normalises (at a new post COVID-19 normal) long term interest rates may rise reflecting higher inflation and the potential for tapering in central bank monetary stimulus. In this environment, defensive stocks may face some return head winds as income-focused investors increase capital allocation back to higher-yielding bonds.

Within fixed interest portfolios, when we look forward there are two substantial aspects to consider. Bond yields are very low and we now have working vaccines. Some form of recovery should be expected as evidenced by both local and global data strength (prior to the latest COVID-19 wave). We must also consider the skew of outcomes. The distribution of future yield outcomes is skewed higher, in our view. While yields are higher than the levels reached earlier this year, they are extremely low on a historical basis and inconsistent with longer-term growth prospects in most economies.

This approach leads us to question current, long term bond valuations and we believe there will be upward pressure on yields. Any increases will likely move in step with improving economic outcomes, however, and be orderly in the absence of central bank endorsements. For now, the current stimulus and the weight of money in the system (plus active buying) will continue to prove strong headwinds to any significant rise in bond yields. This view of the world drives a defensive positioning expressed by being underweight long-dated bonds in portfolios. Our strategy is to sell further longer-dated bonds into any strength.

Within equity growth portfolios, we are mindful that in the near-term equity returns remain supported by companies continuing to deliver better than expected returns and monetary and fiscal policy remaining stimulatory. An earlier than expected recovery in economic activity, the emergence of modest inflation (from a deflationary period), reflecting supply chain friction and the potential for higher interest rates as economic conditions improve, has triggered a rotation of capital into value/cyclicals. The valuation gap between growth and value styles may continue to decline as earnings from cyclical stocks improve, but the potential for value stocks to outperform over the medium term remains challenging while interest rates remain anchored at low levels by central banks. We remain alert to the potential for central banks to change this stance as economic activity improves but highlight that central banks want to see higher inflation and unemployment rates back to long run average levels.

The portfolios have progressively increased exposure to cyclical growth stocks, but the remain underweight relative to benchmark in cyclical stocks. At the margin, the portfolio will continue to increase exposure to selected cyclical growth stocks which are supported by sustainable improvements in fundamentals. We remain biased to selected growth stocks in sectors where long term secular (less economically sensitive) growth rates remain compelling.

In growth-focussed, multi-asset portfolios, exposure to share markets are near benchmark levels. Reflecting that, while we are not bearish, sentiment has reached more elevated levels which provides less of a cushion in the event of a drawdown. The existence of a strong equity risk premium prevents us from adopting more cautious positioning.

The Income Fund strategy is quite closely aligned with the multi-asset portfolios at present. It holds a modest overweight to equities, also reflecting the view that very supportive monetary policy can enable equities to outperform bonds and that the additional risk is acceptable. Equity positioning is not aggressive, reflecting the sense that the market already prices in a reasonable recovery. The Fund has a more aggressive view with regards fixed interest markets, where the duration risk on longer-dated bonds has been substantially hedged.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.