The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed interest, credit and equity markets.

Key points

- The world is learning to live with COVID-19 and economies are recovering faster than expected, demonstrated by, in aggregate, better-than-expected economic and earnings data in August.

- With the US Federal Reserve (the Fed) moving to an average inflation target, the Reserve Bank of New Zealand (RBNZ) confirming it is on the same page as the Fed and the Reserve Bank of Australia stating it "will maintain highly accommodative settings as long as is required”, central bank policy is likely to stay accommodative for longer.

- The dovish stance from the RBNZ has led to markets pricing the Official Cash Rate (OCR) at -0.20% in a years’ time.

Key developments

Equity markets firmed during August reflecting profit results generally beating conservative expectations, additional central bank accommodative policy changes, positive economic data and promising potential COVID treatments. The S&P/NZX50 rose 1.8%, the ASX200 was up 2.8% and MSCI World was up 6.5%; the latter buoyed by a strong rally in the shares of technology-related companies. These companies benefitted from the Fed’s move to an average inflation targeting approach, allowing it to keep interest rates lower for longer. Locally interest rates continued to fall with RBNZ stimulus and forward guidance leading to NZ 10-year government bonds falling from 0.74% to 0.63%. In contrast, US and Australian 10-year government bonds increased 0.17% each to 0.70% and 0.98% respectively, reflecting US Federal Reserve policy changes and improving global activity.

As has been the case in recent months, data have, in aggregate, printed better than expected. This was again the case in August, with US manufacturing and services PMIs and unemployment data beating consensus estimates. This trend has continued into September with a strong ISM Manufacturing PMI outcome of 56.0 (54.8 expected) with the forward-looking ISM New Orders Index at 67.6, well ahead of the 58.8 expected. Globally, we have seen earnings hold up much better than expected and positive earnings revisions have now seen consensus earnings expectations off their lows.

Domestically, although the earnings season is not quite complete as we await delayed reports from a handful of companies, the NZ market has delivered a better-than-expected 2020 June period profit result season. Of the 29 companies that have reported, 43% by number beat market earnings per share expectations, 25% reported in line and 30% missed expectations. Both higher sales and profit margins contributed to the better-than-expected results, with the degree of earnings decline coming in less than the market’s conservative expectations. While many companies reported higher-than-expected COVID-19 related costs, a number benefited from wage subsidies and rental abatements.

The RBNZ announced further stimulus in its August Monetary Policy Statement and emphasised continued health-related downside economic risks that may require additional policy tools to be implemented. Among these additional tools, the Monetary Policy Committee (MPC) expressed a preference for a negative OCR. Markets have since priced in an OCR of -0.20% in a years’ time.

What to watch

The continued improvement in COVID-19 health outcomes: We are six months on since COVID-19 was declared a global pandemic and there is still much to learn about the virus. What is becoming clear, however, is that we continue to see advancements to the standard of care of COVID-19 patients, which is helping reduce infection fatality rates. According to the Milken Institute, there are currently 315 treatments and 210 vaccines being developed for COVID-19, which gives us confidence that further incremental improvements can be made to help the world live with COVID-19.

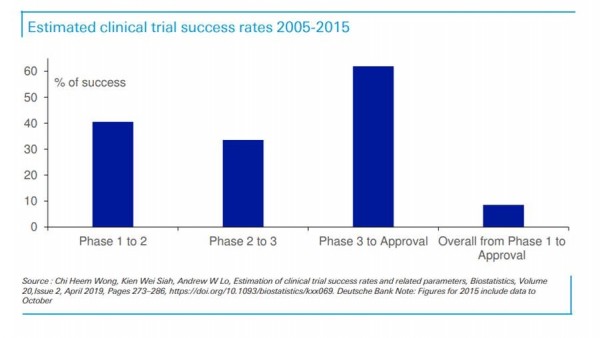

A vaccine has been touted by some as a “silver bullet”. An effective vaccine according to the Federal Drug Administration (FDA) needs only to be 50% effective and surveys show many people have some reluctance towards a COVID-19 inoculation, so it may not be the panacea that some expect, but will no doubt be another incremental improvement. There are currently seven vaccines in phase 3 trials and, with initial phase 3 results coming as early as September, it will not be long until we have a much clearer view on vaccine availability.

Market outlook and positioning

While there are concerns about the potential removal of fiscal stimulus (e.g. wage subsidies), we think earnings expectations are still conservative, providing potential for upgrades over the medium term. Equity market volatility may increase over the next few months reflecting COVID outcomes and politics, but earnings growth and extraordinary global liquidity may continue to drive equity market returns.

Equity growth portfolios are overweight versus their benchmarks in selected quality growth companies in the healthcare, information technology and consumer staples sectors, where the potential rate and sustainability of growth may not be fully reflected in share prices. Conversely, the portfolios are underweight in the NZ consumer discretionary and energy sectors where disruption risk remains high, and the utilities, communications and real estate sectors where valuations are high relative to their potential growth.

Within fixed interest portfolios, with such an uncertain medium-term outlook, we are reluctant to put a stake in the ground, even though we expect economies to recover and bond yields to rise at some stage. Our preference has been to focus on what is immediately in front of us. With that in mind, we had expected that in the August MPS, the RBNZ would acknowledge the improving data seen to date, especially considering the negative tone that permeated their prior assessment in May. The RBNZ did note the improvement, but quickly emphasised their view that risks were heavily skewed to the downside. We are less pessimistic about next year, but for the rest of 2020, the RBNZ may be right. The return to Level 2 (or 2.5), the end to wage subsidies and the absence of tourists pose some tough challenges in the immediate future. It seems likely that discussion of negative rates will continue into the New Year and we have re-established a long duration position, focussing on the 2-3-year maturity range which is sensitive to RBNZ decisions.

In growth-focussed, multi-asset portfolios, we have maintained a modest overweight position to equities. While the rally in equity markets has been strong, attractive risk premia remain over bonds and cash. In a year where we have seen wide divergence in the performance of equity market sectors and styles, we have added some exposure to global strategies that invest in areas of the market which have not fully participated in the market recovery. This reflects our view that economies are adapting and could continue to adapt to COVID-19 quicker than originally expected.

Within the Harbour Income Fund we lifted equity exposure to 31% of the Fund’s assets, with a new investment in a European equity index ETF, which provides low-cost access to a region that is under-represented in our more active global equity exposures. We have participated in new bond deals and taken some profit on long-dated inflation indexed bonds, which have performed well. We continue to assess opportunities in the private credit sector in Australasia, where attractive yields are available.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.