Key points

- At a headline level, stock markets appear to be in a “catch-22”, digesting lower inflation numbers while trying to assess how much of this inflation is down to lower growth, which may then flow through to earnings. See more under ‘what to watch’.

- New Zealand equities and bonds both delivered strong returns over the month, with the S&P/NZX 50 Gross index (with imputation credits) returning 1.1% and the Bloomberg NZ Bond Composite 0+ Yr Index up 1.0%.

- The MSCI All Country World Index (ACWI) returned 2.8% in New Zealand dollar terms, and 1.4% in New Zealand dollar-hedged terms. The theme of big cap tech leading the index advance continued in April, with Microsoft, Apple, Meta and Alphabet responsible for more than a third of the ACWI return (remarkable given the index is comprised of over 2,800 stocks).

- The US corporate earnings season kicked into gear over April. At the time of writing, 425 companies in the S&P 500 had reported earnings, with 78% beating consensus earnings expectations. Bottom-up consensus earnings expectations for next year have, in aggregate, increased.

Key developments

The US economy showed further signs of slowing over the month and recent banking stress is likely weighing on loan growth. Business surveys have generally surprised to the downside and suggest a greater pace of contraction in the manufacturing sector and a slower pace of expansion in services. This was confirmed by US GDP growing by an annualised rate of just 1.1% in the first quarter. This mixed economic data has encouraged markets to anticipate imminent Federal Reserve (Fed) rate cuts. At the end of April, markets anticipated 60bps (basis points) of rate cuts in the second half of this year, with another 140bps of cuts expected next year.

The global economy, however, remains in better shape than expected. Chinese activity is proving stronger than anticipated and prompting forecasters to raise their expectations for GDP growth this year to 5.5%, from 4.8% at the beginning of 2023. European business surveys are showing an increasing rate of expansion in the services sector, such that a euro area recession is no longer a base case. With labour markets still extremely tight and annual core inflation around 5-6% in most developed countries, the prospect of interest rate cuts anytime soon seems low. Instead, the case for rate cuts sooner rather than later seems based on sentiment related to ongoing financial stress.

Mixed global economic data had led to fears of earnings expectations being too high. However, US corporate earnings surprised to the upside in April with small upgrades to aggregate 2024 earnings expectations easing market concerns. New Zealand and Australian earnings seasons also kicked off in April, and the early signs are good with company updates generally in line or better than expected. In New Zealand, electricity generators/retailers (gentailers) continued to report constructive conditions for earnings (with some variance between gentailers). Expectations of Rio Tinto renewing its New Zealand aluminium smelter electricity contract also supported gentailer returns over the month. Retailers generally reported better quarterly updates, despite consumers showing trends of trading down. Listed real estate independent valuation updates were negative but not as bad as generally reflected in their current share prices.

The Australian equity market had a strong return over the month (ASX200 up 1.8% in Australian dollars), led by the real estate sector. Residential real estate shares were strong with high net migration and the Reserve Bank of Australia pausing its official interest rate programme boosting expectations of a stronger residential market. Australia's real estate fund managers also rallied strongly as bank stress risk reduced, which may have been weighing on sentiment in the sector.

What to watch – Inflation versus Corporate Earnings

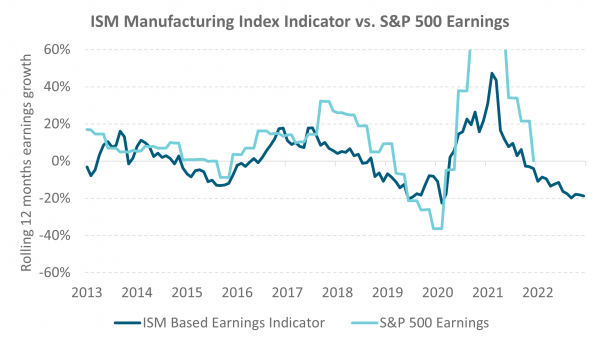

At a macroeconomic level stock markets appear to be caught in a catch-22 – a dilemma from which there is no escape because of mutually conflicting or dependent conditions. If inflation remains elevated, then central banks may have to hold rates higher for longer, placing pressure on equity valuation multiples (higher interest rates are associated with lower price to earnings valuation multiples). However, if inflation falls in response to a more rapidly slowing economy, corporate earnings forecasts may be too high. The below chart shows the relationship between the ISM manufacturing survey and earnings, reminding us that corporate earnings growth is scarce in a slowing economy.

Source: Harbour, T. Rowe Price, Bloomberg. ISM based earnings indicator is lagged by 12 months as it is a forward-looking measure.

Market outlook and positioning

Equity investors are increasingly moving their focus from inflation and central banks to the impact of a slower economy on earnings expectations. As central bank policy tightens at the beginning of cycles, the correlation between shares and government bond yields generally turns negative – i.e., good economic news is bad news for share market returns. Conversely, as the pace of tightening slows towards the end of cycles – as may be the case currently – that correlation rises back into positive territory – good news is good news, bad is bad, and the universe is back in alignment.

The economic reset in response to higher rates has been relatively normal so far. The key point is that the reset of equity valuations is quite progressed. The response to higher rates has been in line with the historic playbook. Housing markets have softened. Inventory levels are now being run down. Profitability may be set to fall - the March ANZ Business Confidence survey registered a sharp drop in profitability expectations for New Zealand companies. A drop in employment growth may be the next step in the economic reset. There is enough evidence pointing to disinflation in goods- and housing-related inflation. Hence markets are switching their focus to labour costs. Economies with more flexible labour markets, or where the release valve of immigration creates better labour mobility, are more likely to achieve better inflation news. The extent to which fiscal settings (government expenditure) also support central banks may also influence the path of interest rates.

Within equity growth portfolios our strategy remains to position for a range of scenarios and to be selective. We remain wary of the impact of a severe local economic slowdown or recession on the earnings for cyclical businesses. Our strong preference is for relatively higher exposure to Australian equities and companies exposed to the global market. History suggests long-duration equity risk (including the technology sector) may do relatively well in the period between the last central bank rate increase and first official rate cut. We remain selective – allocating capital to investments that benefit from secular trends and towards companies with specific return drivers. This is expressed in the portfolio's overweight versus its benchmark to healthcare, technology, and material sectors. The valuation of shares matters with investors crowding into a small number of shares given the catch-22-like setting. In our view, stock picking – focusing on non-market, company-specific returns – may be a key influence on equity fund returns in the current and near-term expected investment environment.

Within fixed interest portfolios, we expect the speed and degree to which rates decline to ebb and flow as data and events unfold. New influences are coming in the form of vanilla macroeconomic data, but also via the ongoing failure of regional banks in the US. Our approach to investing through this environment is largely tactical. When we assess that downside risks or the speed of rate cuts is excessive, we are likely to reduce portfolio duration, taking the opposite approach if risk pricing is too benign. Our judgement is also that the distribution of risks may be skewed to the downside, which is illustrated by the failure of the US banks. Lending standards in the US have been tightening for some time and we expect that to continue, with the impact of that to be felt over the next couple of years. A similar outlook applies to consumption in New Zealand as mortgage hikes are felt. With these risks in play, our bias is towards adding duration when yields rise, maintaining caution with regards to corporate bonds, and for now, we are also becoming more cautious about the near-term outlook for inflation-indexed bond returns.

The Active Growth Fund is defensively positioned. The rally in share markets has seen equities trade at a narrow forward-looking risk premium relative to history, even considering recent falls in bond yields. While this is not a short-term indicator, it does temper our medium-term outlook for equities. That said, we are excited about the prospects for growth equities going forward which were challenged in 2022 battling with yields which were up significantly. With central banks well into their tightening cycle, the headwinds for growth equities may shift from bond yields to more idiosyncratic drivers making the operational performance of companies the key driver of returns. We are overweight fixed interest duration relative to our benchmark.

Within the Income Fund our core view is also to remain defensively positioned. Equities still face enough challenges to continue with an existing underweight position. Similarly, we are somewhat cautious about chasing bonds down at yields that already price a quick reversal in policy from central banks. Our strategy essentially relies on patience. We have reduced our holding in inflation-indexed bonds but do expect to add again if inflation expectations ease further. Perhaps, most importantly, we are also staying cautious with regards to high-yield credit. Pricing of corporate bonds has improved in some sectors, but others are still subject to macroeconomic risks, and as we have seen with US banks lately, the market can be very quick to punish corporate credit valuations at firms with any balance sheet vulnerabilities.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.