Key market movements

- Global equities were marginally positive in unhedged New Zealand dollar terms in February, with the MSCI All Country World Index (ACWI) increasing 0.3%. With the NZD losing previously made ground, returns in hedged terms were -0.8% for the month.

- Locally, the New Zealand equity market continued to weaken with the S&P/NZX 50 Gross Index (including imputation credits) down 3.0% in February. Australian equities also struggled with the S&P/ASX 200 Index down 3.8% (-3.1% in NZD terms).

- NZ bond returns were positive in February (+0.6%), measured by the Bloomberg NZBond Composite 0+ Yr Index. Global bonds did better with the Bloomberg Global Aggregate Bond Index (hedged to NZD) up 1.2% as US 10-year Treasury yields dropped further in the month to finish at 4.21%.

Key developments

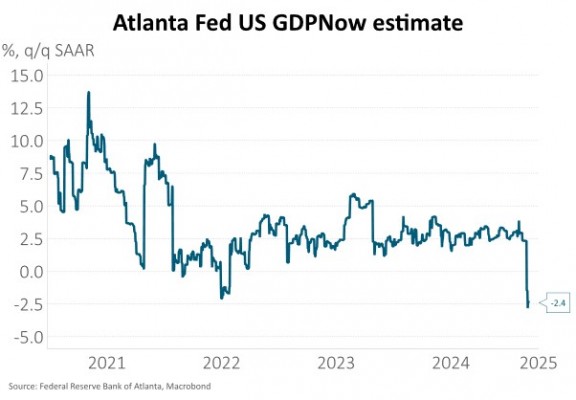

The US economy may finally be starting to crack. Business surveys suggest the services sector is now contracting and real-time measures of Q1 GDP suggest the economy is in retreat. Retail sales were unexpectedly weak, and consumer confidence has dropped. The housing market is also showing signs of strain with both housing starts and sales dropping.

US government policy uncertainty appears to be having an impact on the economy, in addition to high interest rates. Tariffs have been imposed on China but delayed for Mexico and Canada. Progress on extending tax cuts, for example, has slowed as the bill incorporates not just the tax cut extension, worth US$4trn over the next 10 years, but also significant changes in spending – an additional US$800mn of spending and US$2trn of spending cuts.

The RBNZ cut the OCR by 50bp to 3.75% and forecast a faster easing cycle than in the previous MPS, reaching 3.1% at the end of this year instead of 2027. This was well-anticipated by the market and, as such, reaction was limited. Governor Orr indicated in the press conference that further reductions of 25bp in April and May were likely – highlighting the central bank's confidence that inflation will remain well-anchored, despite a pickup in tradable inflation due to higher oil prices and a weaker NZD.

China’s upcoming National People’s Congress (NPC) is expected to set a 5% growth target, but structural challenges like an aging population and an over-leveraged property market pose headwinds. Japan continues to diverge from the global trend, reducing monetary policy stimulus as core inflation pressures persist.

What to watch

Real-time indicators of Q1 GDP suggest the US economy is in retreat, likely reflecting the impact of high interest rates and increased government policy uncertainty. However, some believe the weakness is overstated. Pantheon Macroeconomics, one of our external research providers, says the Atlanta Fed’s “GDPNow” model is unfairly extrapolating weak January trade and consumption data. Pantheon believes consumption was hit in January by unseasonably cold weather and should recover in February and March. On the trade side, Pantheon notes the weakness in net trade was partly driven by a large pickup in gold imports that are not included in the official GDP numbers, but the Atlanta Fed makes no adjustment for.

Market outlook and positioning

The investment landscape remains highly uncertain, driven by disruptive AI advancements and evolving US trade policies under Trump. The arrival of third-phase AI models like DeepSeek challenges conventional investment assumptions, while uncertainty around US tariffs could impact global trade, slowing growth and sustaining inflation. Despite turbulence, economic fundamentals (moderate growth and easing inflation) support share markets and AI’s rapid evolution, with lower-cost models improving accessibility, could accelerate growth in the sector.

The NZ share market's recovery hinges on sustained "green shoots" in earnings and lower long-term bond yields. While current valuations remain high and liquidity is challenged by recent capital raises, emerging profit margin expansion signals a potential earnings turnaround. Positive company feedback across sectors reinforces this trend. RBNZ rate cuts, though slow to impact, will initially support consumer-sensitive and real estate shares, with sustained yield drops benefiting utilities and infrastructure. NZ gentailer shares may need a period of more normal rainfall and lake storage levels to reflect the benefit of lower bond yields. Despite near-term earnings uncertainty, if economic indicators hold, a positive earnings trend should drive market growth.

The Australian share market anticipates slower earnings growth due to compressed post-COVID profit margins. The upcoming election and subsequent fiscal policy adjustments create near-term uncertainty, potentially impacting business expansion. However, falling inflation is supportive of anticipated RBA rate cuts, benefiting consumer-sensitive and real estate sectors. Chinese stimulus could bolster mining and materials, while sustained lower bond yields would support infrastructure. Despite this, APAC investors have been reallocating from Australian banks to Chinese shares, and there could be further pressure here if investors move back towards long-term neutral allocations.

Within equity growth portfolios, Harbour’s strategy remains to be patient, position for a range of scenarios and to be selective, focusing on quality growth. We continue to focus on companies delivering earnings per share growth, particularly where that earnings growth has the potential to be higher and last for longer than consensus expectations allow for. We continue to see the secular tailwinds of digitisation, disruption, de-carbonisation, and demographic changes as supporting company earnings. We hold overweight positions relative to benchmark in companies with secular tailwinds in the defensive-growth healthcare sector and the higher-growth information technology sector, where businesses are supported by strong cashflows. We are also overweight selected materials and consumer staples shares that benefit from structural change and have pricing power. We continue to have a bias towards quality, well-capitalised businesses that are well-positioned to fund value-adding growth opportunities. We remain underweight lower growth utilities, telecommunications, infrastructure and real estate sectors.

In fixed interest portfolios, we are treading carefully with investment strategy given heightened uncertainty, with most active positions being smaller than normal. Portfolio duration is modestly longer than benchmark, concentrated in the 7-year+ sector where we see a skew towards lower bond yields. We see some likelihood that growth in the US and elsewhere softens in reaction to tariffs and the uncertainty that firms face during times of policy uncertainty. We have also been taking a steady approach to our corporate bond holdings. We continue to hold a skew of being underweight the Local Authority sector, which is a very large part of the market. Instead we are keener on a broad range of other credit, nearly all of which has a lower credit-rating but does also offer a larger yield.

Within the Active Growth Fund, we continue to be mindful of relatively full valuations within global equity markets, particularly the US, and are minded to sell rallies more than buy dips, remaining underweight growth assets. Bond yields, particularly within global fixed interest are looking more attractive in a relative sense. Currency-wise, we are holding a higher level of hedging within our global equities; the NZ dollar’s plunge toward COVID lows has seen it undershoot our fair value models.

In the Income Fund, we have hedged our small holding in global equities with a short position in S&P500 Index futures. In Australasia, we have taken the opposite approach, particularly with more defensive equities. Last month we added to listed property and then, when the NZ market softened in late February we added to our income equity weighting. Our judgement is that with inflation still declining and with economic activity looking likely to pick up this year, we have a supportive backdrop for equities. We are positioned for the NZ Dollar to rise against the USD, which is overvalued and may decline if US growth does continue to soften. In the fixed interest arena, positioning is fairly light, but we have been increasing duration by adding to longer-dated securities.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.