- After declining between 1960 and 2020 due to growing working populations and decreasing productivity, neutral interest rates have stopped falling in recent years. This has prompted increased debate about where they go from here.

- Neutral interest rates matter for financial markets because they help assess the impact of monetary policy and affect the valuation of financial assets based on discounted cash flows.

- Future neutral interest rates may be higher due to de-globalisation, ageing populations, decarbonisation, and higher government debt. Ongoing declines in productivity may be a counter force, however, and neutral interest rate estimates will continue to have large degrees of uncertainty.

What is a neutral interest rate?

A neutral interest rate is one that is consistent with inflation and economic activity neither increasing nor decreasing. Put differently, it’s the interest rate that delivers economic equilibrium – resources in the economy are fully utilised and inflation is stable.

Why do neutral interest rates matter for financial markets?

They are a calibration tool to help assess the impact of monetary policy. Currently, for example, with inflation above target and the labour market tight, short-term interest rates need to sit above the neutral rate here in New Zealand. However, the interest rate market implies the Official Cash Rate (OCR) to be above 4.0% forever – well above most estimates of neutral. This is a key consideration in our current overweight duration position across fixed income funds.

Neutral interest rates are also a key component of long-term interest rates that are used to value financial assets on a discounted cash flow basis. A 10-year neutral bond rate, for example, would be made up of the neutral policy rate plus term premium, the necessary compensation provided to investors for parting with their money for 10 years. If neutral interest rates are likely to be higher in the future, for example, so too are long-term interest rates. This reduces the present value of financial assets.

Where are neutral interest rates now?

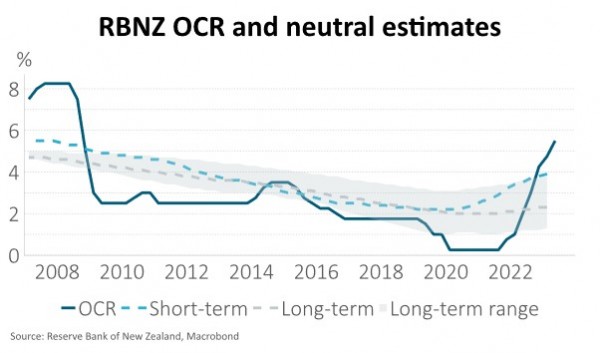

Neutral interest rates are unobservable, difficult to estimate and vary over time. As such, a normal approach is to employ multiple techniques and provide a range of results. For example, the Reserve Bank of New Zealand (RBNZ) uses five approaches to estimate the long-run neutral OCR and takes an average, which is currently 2.3%. The minimum estimate is 1.3% and the maximum of 3.8% (see chart above).

The RBNZ also acknowledges that neutral interest rates are a real - or post-inflation - concept. So, in higher inflation environments, the nominal neutral rate of interest needs to be higher, all else equal. This results in a short-term neutral interest rate estimate that incorporates 1- and 2-year ahead inflation expectations. The current average short-term neutral OCR estimate is 3.9%, versus an OCR of 5.5% (see chart above).

In the US, the Federal Open Market Committee members’ range for the long-term neutral Fed Funds rate is 2.4%-3.6% with a median estimate of 2.5%. This broadly aligns with estimates produced by the Federal Reserve of Bank of New York that consider GDP, inflation and Fed Funds rate data and then estimate trends in economic growth and other factors to determine the neutral interest rate.

What are the determinants of neutral interest rates?

Interest rates balance savings and investment in an economy. They represent the compensation required by households to delay their consumption so that capital is available to meet firms’ investment requirements.

The New Zealand Treasury recently noted that, as an open economy with a reliance on the rest of the world for funding, New Zealand’s neutral interest rates are a function of three things, in order of importance:

- Global demand for investment and supply of savings;

- A sovereign risk premium; and

- Domestic demand for investment and supply of savings.

In terms of the RBNZ’s estimation approach, two of the methods are theoretical and assume that the neutral interest rate is a function of trend economic growth and the savings rate. Higher trend economic growth is associated with higher lifetime household income, a portion of which households are likely to want to consume today, thus lifting the neutral interest rate. A lower household savings rate, perhaps due to lower real wage growth, will decrease the pool of available savings and place upward pressure on the neutral interest rate. Another approach the RBNZ uses is a market measure of long-term interest rates, which tries to abstract from near-term cyclical influences and removes term premia. The final two approaches use surveyed measures of long-term interest rates and long-term economic growth (see appendix for further details of the five approaches).

What have they done over time?

From the 1960’s to 2020, estimates of the neutral interest rate here and abroad had been in structural decline largely due to:

- A growing proportion of working age people, increasing savings to fund future consumption;

- Lower productivity, reducing lifetime income expectations and the amount of that households wish to consume today.

There are other factors that have likely contributed, such a deleveraging following the global financial crisis and increasing financial regulation increasing the demand for “safer” assets, but the above two factors are often shown to found to be the most important (see Grigoli, F., Platzer, J. and Tietz, R. (2023), for example).

In recent years, neutral interest rates have stopped declining. Recent research from the Federal Reserve Bank of New York, for example, suggests that neutral interest rates are close to the levels seen prior to Covid (see Holston, K., Laubach, T. and Williams, J. 2023 for further details).

What might they do in future?

We discussed last year factors that might cause the end of the “great moderation”, the period of benign economic cycles since the mid-1980s (see The end of the “Great Moderation”?, 10 June 2022). These same factors may place upward pressure on neutral interest rates:

- De-globalisation may accelerate after COVID-19 exposed the vulnerability of a “just-in-time” inventory cycle and increased the incentive for countries to develop local supply chains to minimise future disruptions. This will likely require increased investment and push neutral interest rates higher.

- Ageing populations in large parts of the world will likely switch from saving to spending as increasing numbers reach retirement. The associated reduction in savings may place upward pressure on neutral interest rates.

- Decarbonisation requires an increasing amount of investment in alternative sources of energy. This higher level of investment is likely to place upward pressure on neutral interest rates.

- Higher levels of government debt, potentially driven by increased geopolitical risk and therefore higher defence spending. This reduces the size of the global savings pool and likely places upward pressure on neutral interest rates.

There are two important caveats, however. Firstly, the declining productivity that contributed to the structural decline in neutral interest rates since the 1960’s may well continue to represent a downward force. For example, there are costs of adapting to a more climate resilient economic model, but, on the flipside, artificial intelligence may present an opportunity for productivity gains. Secondly, the large amount of uncertainty in estimating an unobservable variable such as the neutral interest rate will likely continue to be the case.

Appendix

The RBNZ’s five approaches to estimating neutral interest rates are:

• A neo-classical growth model where the neutral interest rate is assumed to be a function of productivity growth, population growth (key determinants of trend economic growth) and the savings rate. Higher productivity growth boosts the marginal product of capital and encourages investment – lifting the neutral interest rate, ceteris paribus. Higher population growth increases the size of the labour force and the necessary capital stock to employ this labour. This requires an increase in investment that places upward pressure on the neutral interest rate. If the savings rate in the economy falls, a higher neutral interest rate is needed to balance savings and investment.

• A small New Keynesian model of the New Zealand economy where the neutral interest rate is the trend estimate of the interest rate that solves the model;

• Implied market expectations of long-horizon interest rates. Specifically, a 5-year zero-coupon New Zealand government bond yield in five years’ time, adjusted for term premia. By choosing an interest rate that begins in five years’ time, the impact of near-term cyclical factors is largely removed. Because of volatility in this market measure, it is then smoothed using a Hodrick-Prescott filter;

• Analyst expectations of long-horizon interest rates. The specific question is ‘what will 10-year government bond yields average for the five years that begin in five years’ time’. This answer is then adjusted for term premia; and

• Analyst expectations of long-horizon annual nominal economic growth.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.

References

Reserve Bank of New Zealand Monetary Policy Statement, Special Topic number 1, November 2022.