- The growing importance of biotech companies has reflected the flood of lower cost equity and debt funding over the last 5-10 years together with large healthcare companies farming out some of the risk profile for developing new diagnostics and “drugs”. Whether this trend is sustainable will depend on how successful, and at what cost, new drugs and services can be delivered.

- Artificial Intelligence offers considerable opportunities for the healthcare sector. However, the regulatory burden inherent within healthcare, a publish and peer review process and the limited digitisation of the massive data bases throughout the sector point to a very “measured” adoption of AI, in the short term albeit there have been notable recent diagnostic biotech announcements in part accelerated by AI.

We continue to monitor the pace of change in the biotech sector, with clients also asking about the role of AI in biotech. One of our observations was the sheer number of biotech companies presenting at recent global healthcare conferences (for example, 150 out of 250+ companies), ranging from single pre-clinical concept private companies to large multiple product commercial public enterprises. Most recent biotech presentations devote a fair amount of airtime to discussing how AI is impacting their development pipes.

Growing importance of biotech companies

The recent growth in biotech companies can be attributed to two main factors: The first has been the practice of big pharma effectively partially stepping back from this market segment. Throughout our recent contacts with companies various big pharma companies have stressed their commitment to focusing on core competencies and commercial offerings. There was a widely held view that historically big pharma R&D “departments” experienced product drift, an inability to “fail” quickly, a tendency to humour scientists with pet projects, poor control both in cost and time in taking a concept through to full commercialisation, etc. In contrast big pharma today more often talk about de-risked opportunities, balanced risk profiles, concentrating on core expertise, leveraging expertise and platforms with third parties, etc.

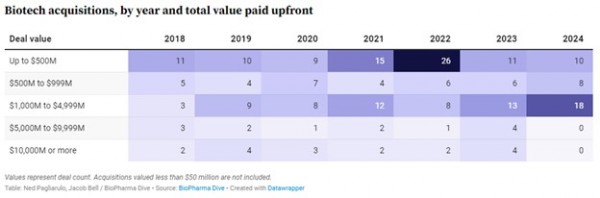

Having farmed out some of the drug discovery opportunities, large healthcare companies are increasingly more willing to engage with biotech companies approaching the commercialisation stage and effectively pay up to secure opportunities that have been largely derisked. This is highlighted in the table below, which summarises biotech acquisitions in the US over the last seven years. Clearly acquisitions have been increasing and increasing in value.

Secondly, has been the “free” money (assisted by the historic low cost of equity) that both the private and public markets have been willing to throw at the sector. The perceived exit opportunity for biotech plays provided by big pharma has also attracted venture capital and private equity players, as well as convincing other traditional players such as universities to progress further down the value chain than previously.

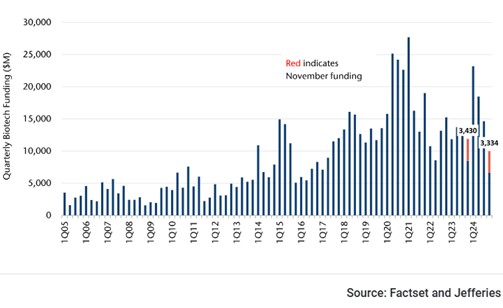

Whether the biotech attraction remains intact will depend on the ability to raise fresh equity and crystallise appropriate risk adjusted returns. Biotech, by its very nature is cash intensive and has a higher-than-normal level of risk. The associated cash burn to bring a new drug to market can easily run into hundreds of millions of dollars and therefore ongoing investor support is needed to support these pre-commercial operations. The following figure highlights the recent volatility in fund raising. Jefferies estimates the current raising profile in the last six months is just matching cash burn in the US (estimated at $4.5b per month for approximately 780 listed entities).

Another risk is an overconcentration on ‘hot’ sectors. A prime example is the current focus on obesity drugs. In addition to the considerable investment by big pharma, McKinsey pointed to over 70 non-GLP1 pre-commercial biotech companies chasing this opportunity. Time will tell if the last 5 years was the golden period for biotech companies or the start of a fundamental change on how drug discovery is funded going forward.

November Biotech Funding Down -3% YoY

Another consideration is the aging demographics across the western world and the impact this is having on the overall health budgets. One speaker at a recent conference claimed that 80% of the health spend in Europe was on over 75-year-olds. A natural consequence of living longer is that more “rare” and novel diseases are being experienced. These increasingly “interesting” diseases often require additional complications in populating clinical studies, structuring appropriate end points, validating conclusions, etc. These uncertainties often better lend themselves to a dedicated team with a single focus as opposed to a large multi-national pharma bureaucracy.

The growing biotech phenomenon is not unique to offshore markets. The Australian market now features a vibrant listed biotech sector, covering both drugs and medical devices. In 2010 the healthcare sector represented 2.5% of the ASX, with biotech companies representing around 1% of the market. Today the sector makes up roughly 10% of the ASX and biotech companies comprise nearly 5%.

Artificial Intelligence – What does it bring to healthcare?

At a London healthcare conference we attended at the close of 2024, speakers pointed to selective examples of AI being used within the healthcare sector. At that time there was a consensus that AI adoption would be slower than many other industries. We found those views counter to our expectations. Its clear that AI is being deployed, however there are many perceived hurdles particularly centering on the high bar of regulation and deep and lengthy processes for product adoption. The path to monetise AI in the biotech sector may be much longer than in other sectors.

Of most interest was how AI could enhance the value of data. Data, be it patient records, clinical pathways, drug discoveries, geonomics, treatment protocols, or procedure documentation, are the life blood of the healthcare sector. The increasing presence of biotech companies has further accelerated the data explosion. Accessing, analysing, tracking and storing all these forms of data demand a massive commitment across the sector.

Data privacy is a core principle that is embedded throughout the sector and together with the forementioned regulatory burden provide an additional level of complexity to introducing AI applications.

One of the major areas’ identified for AI focussed on diagnostic and “drug” discovery. At the model level, there are expectations that AI will help shorten this stage (which can take upwards to 3-4 years) and optimise early human studies. The ability to screen potential candidates for clinical studies is also seen as an area to enhance phase 2&3 clinical studies, assuming patient privacy considerations can be addressed. However, in drug discovery it is necessary to avoid closed models, i.e. internal bias towards existing solutions. New drugs by their very definition are often looking outside existing paradigms.

Another area that could be improved is the document trial necessary to bring a drug to market, which is both time consuming and arduous. The paper trail both from a clinical and regulatory perspective, as well as the ability to reuse data, is ideally suited to an AI overlay. Other areas of interest include monitoring safety, cross referencing other data bases, and optimising decentralised trials.

In the more established mainstream healthcare activities, a necessary precursor to AI is digitisation of the data. While progress is being made virtually, the sector generally believes there remains a lot more work to be done. The big names in tech such as AWS and Microsoft are actively engaging across the healthcare spectrum, but again entrenched business practices, disparate systems and the regulatory overlay all suggest progress will be “measured”.

The combination of the critical importance of healthcare, regulatory oversight, exploding demand, emerging technologies, and limited resources have all fuelled a dramatically changing healthcare landscape over the last ten years. While we have yet to see how the presence of biotech companies and artificial intelligence will eventually play out, it is fair to say the speed of change within the sector is unlikely to slow any time soon.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.