- A Trump victory and likely Republican congressional sweep could signal major shifts in US economic policy, such as tax and tariffs.

- Markets had partly leaned into a Trump win, with many strategists previously picking a Republican clean sweep as a 30-40% chance.

- However, the immediate reaction of markets suggests a further possible movement of asset prices as bond yields factor in potentially higher US inflation, larger US deficits, and equity markets consider the positive impact of lower taxes.

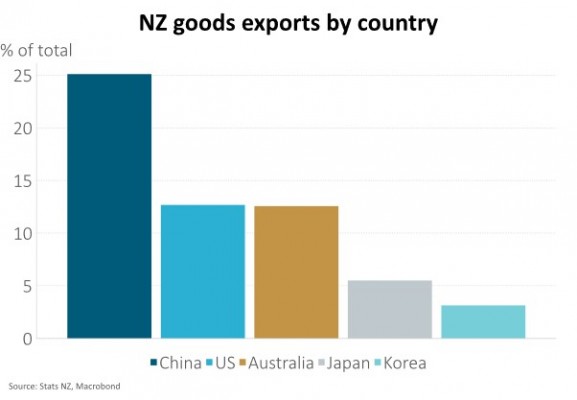

- For New Zealand, the negative impact of tariffs is a consideration for both economic growth and company profits. However, exports to the US are only a little over 10% of total exports. Overall, we find few reasons to change our positive stance on local equities.

- In the coming days, markets will also be impacted by the next US Federal Reserve interest rate decision and the Chinese National People’s Congress Standing Committee announcements.

With Donald Trump winning the 2024 US Presidential Election, the political and economic landscape of the United States is poised for significant change. More specifically, Trump's economic policies are likely to prioritise increasing tariffs, domestic deregulation and extending tax cuts. These measures aim to boost business investment and consumer spending, potentially leading to higher economic growth. Trump’s tariff and tax policies may have far-reaching implications for various asset classes and sectors given the market had been only leaning towards a Trump win, prior to yesterday.

Markets have not contended with such a twist in policy settings before. If history and the recent market price action are a guide, bond yields are likely to trade higher, the USD should further strengthen, and the US equity market rally may continue to broaden, perhaps led by financial and energy stocks.

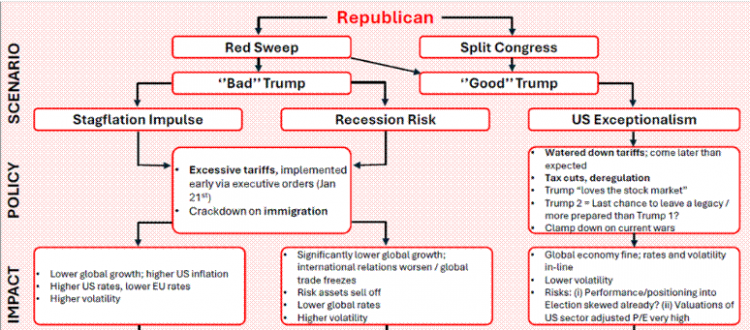

But market implications are still opaque and much depends on which version of Trump we end up with. For example, will the tax cuts and deregulation be more powerful spurs to growth than the possible drag from tariffs and higher interest rates? Does the US economy continue with exceptionalism or slump into a morass of stagflation or recession? The US market seemed to have been partly factoring in a Trump win, with pro-US growth portfolios adding value in recent months, while a bear steepening in the US yield curve has, in part, been linked to Trump policies likely lifting US inflation. Moreover, Vanda Research points toward complacency among US equity investors with equity positioning still much longer going into the election, relative to the last three elections, despite some profit-taking as Harris closed in and polling tightened to “too close to call” in the final week.

The other challenge for markets is that the US election result arrives amongst many other catalysts including the US Federal Reserve decision on rates, followed by the Powell press conference, and many US corporates have yet to report on their earnings. Investors are also glued to the second day of China’s National People’s Congress Standing Committee, where China may announce their latest stimulus package.

What Republican set-up do we get?

Source: UBS

At the time of writing, it seems likely that markets get a larger “Red Sweep” than expected. However, it’s worth noting that a Trump win and a Republican Congress was the most likely scenario painted by many strategists we follow. Leading into the election, US bond yields had already increased, the US dollar was already strengthening, and US sector returns were reflective of Trump pro-growth policies.

Two sectors worth highlighting are healthcare and renewable energy. Trump's healthcare policies are likely to focus on repealing and replacing the Affordable Care Act (ACA) with a system that promotes private healthcare options. This could lead to increased competition in the healthcare market and potentially lower prescription drug prices. Trump's environmental policies are expected to prioritise economic growth over environmental regulations. This includes rolling back regulations that may hinder business growth and energy production, supporting the fossil fuel industry, and reducing funding for renewable energy initiatives.

Trump’s economic policies may place further upward pressure on bond yields as inflation expectations and term premia expand. Higher tariffs and more expansionary fiscal policy are likely negative developments for bond markets. Trump's immigration policies also have some analysts concerned that lower immigration could keep the labour market relatively tight, supporting wage inflation. The US budget deficit is already running at 6% of GDP. Under Trump's Administration, the deficit is likely to increase due to tax cuts and increased spending on defence and infrastructure. This could lead to higher government debt levels over the next decade, which the US Congressional Budget Office already forecasts to be 116% of GDP, from less than 100% currently. It seems likely that the bond market has already partly factored in greater US Treasury issuance with 10-year term premia increasing to more than 50bp, from almost 0bp 2-3 months ago.

New Zealand implications: With respect to New Zealand, the global growth implications are likely the most important transmission mechanism to consider. Various economists have provided estimates of the downside to global growth from both first-round tariffs and second-round retaliation. Those estimates lower global growth by 0.4% to up to 1.0% in 2026 and by a little less in 2027. Our “ready reckoner” suggests 1% lower global growth reduces the RBNZ OCR forecast by 30bp. However, combined with likely higher inflation, the New Zealand asset class implications are difficult to assess. Higher US global bond yields could provide a headwind for the local bond market, while lower global growth is likely to impinge on corporate earnings and equity returns of companies that face into global growth. The offset for New Zealand could be a lower NZ dollar in response to higher US rates. Additionally, the direct impact on New Zealand of US tariffs may be more muted with only a little over 10% of New Zealand’s exports slated for the US market.

In summary, the Trump victory in the 2024 US Presidential Election is expected to bring significant changes to the US political and economic landscape. His economic policies will likely focus on deregulation and tax cuts, which should be good for economic growth and the equity market, but the imposition of tariffs may be a very strong offset, likely impacting global growth and perhaps bond markets.

With Trump, history tells us about needing to adapt to change with more volatility and unpredictability. Additionally, history provides a guide that businesses generally continue to adapt and innovate regardless of most US political governance arrangements. The evidence suggests that investors may be better served taking a wider view, focusing on broader trends of economic growth, inflation and corporate earnings.

IMPORTANT NOTICE AND DISCLAIMER

This article is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.