- Sustainability benefits for property owners: Research indicates that commercial properties with higher sustainability ratings have more consistent cash flow, higher occupancy rates, higher rents, and attract tenants with lower risk. Improving sustainability can enhance cash flow quality, reduce regulatory compliance risk, and improve market perception and brand value for listed property securities.

- Harbour Listed Property Sustainability Survey: To better understand how New Zealand listed real estate securities are approaching sustainability Harbour surveyed property and real estate securities listed on the New Zealand Stock Exchange. These securities own a range of commercial real estate from office towers, warehouses and shopping centres to hospital buildings and hotels.

- Sustainability Targets: All of the organisations we surveyed have sustainability targets with a focus on Green Star ratings. Some aim to have a significant portion of their portfolio achieve a minimum 4 Green Star rating by 2030, and most have net-zero carbon targets and a climate transition plan in place.

- Dedicated Capital Expenditure: Most organisations allocate capital expenditure budgets for climate and sustainability improvements, with varying percentages of their overall capex budgets dedicated to these initiatives. However, some organisations may be underestimating the benefits of enhancing sustainability credentials.

Local and global research highlights that more sustainable commercial property assets generate more consistent cashflow for their owners. Properties with higher sustainability ratings tend to have higher levels of occupancy, higher rents per square metre (net of leasing incentives) and often attract tenants with higher credit metrics (lower tenant risk). In Harbour’s opinion, listed property securities and real estate investment trusts that are improving their sustainability credentials have the potential to improve their cashflow quality, while reducing regulatory compliance risk and improving their overall market perception and brand value. Harbour’s research suggests, in some cases, capital markets may not be appropriately pricing sustainability risk for listed property securities.

Measuring real estate sustainability

Real estate assets and owner entities are not homogenous – it is often difficult to compare real estate assets against each other. As result, it is important to consider a range of different measures and recognise that comparing across differing real estate assets using the same measures may not give a true measure of risk. Many sustainability measures are evolving, and there are not sustainability models for all real estate assets, or the models are in early versions, which are subject to change.

There are a wide range of sustainability measures and standards used across the real estate industry. Some measure the attributes of individual physical property assets, including Green Star, NABERSNZ and Toitū net carbon zero ratings. Some measure the attributes of the broader commercial property entity such as Global Real Estate Sustainability Benchmark (GRESB) ratings, MSCI ratings and Carbon Disclosure Project (CDP) ratings.

Harbour’s Real Estate Investment Fund invests in publicly listed New Zealand and Australian real estate securities, and selectively in some real estate heavy equities such as infrastructure and retirement villages/aged care. With real estate being a long-life asset, lifting the sustainability of existing property asset portfolios can be challenging without capital transactions (e.g., selling low-rated, buying high-rated), developing more sustainable assets or bringing forward capital expenditure earlier in an asset’s cycle which impacts near-term returns. At Harbour, our focus is on supporting real estate entities to continuously improve the sustainability credentials of their real estate property portfolios and businesses, including advocating to bring investment in sustainability forward.

To better understand how New Zealand listed real estate securities are approaching sustainability, Harbour surveyed property and real estate securities listed on the NZX, New Zealand Stock Exchange[1]. These securities own a range of commercial real estate from office towers, warehouses and shopping centres to hospital buildings and hotels.

Survey findings – everyone has a target, but some targets may be better than others.

Tenants/clients and real estate organisations care about sustainability actions

All eight listed respondents to Harbour’s survey believe existing tenants/clients care about property owners’ sustainability actions. All eight respondent organisations believe sustainability actions will influence near term (1- to 3-years) and longer term (5-years plus) net property income and valuations positively.

Executive oversight and incentives had some degree of link to climate targets in all eight organisations.

Sustainability targets

Survey respondents focused on a range of sustainability targets. All eight survey respondents have a focus on Green Star ratings. Five out of the eight respondents focused on GRESB ratings. Four respondents are focused on CDP ratings and are currently providing CDP reporting.

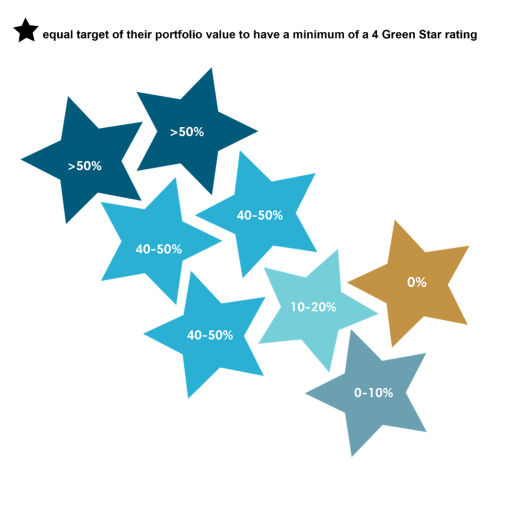

We asked respondents what proportion of their property portfolio, based on a property valuation basis, is targeted to be a minimum of a 4 Green Star rating by 2030.

- Two out of the eight respondents are targeting greater than 50% of their portfolio by value to have a minimum of a 4 Green Star rating.

- Three out of the eight respondents are targeting between 40% to 50% of their portfolio by value to have a minimum of a 4 Green Star rating.

- One of the eight respondents is targeting between 10% to 20% of their portfolio by value to have a minimum of a 4 Green Star rating.

- One of the eight respondents is targeting between 0%-10% of their portfolio by value to have a minimum of a 4 Green Star rating.

- Only one of the eight respondents did not have a target proportion of their portfolio to be a minimum 4 Green Star rated by 2030.

Our expectation is these targets will evolve over time as additional Green Star, asset-specific, rating models emerge and tenants demand Green Star ratings to manage their own carbon footprints.

Six of the eight respondents have a net zero carbon target. One respondent has already achieved this target. Four are targeting to be net zero by 2030. One respondent is targeting 2050.

Five of the eight respondents have a climate transition plan. Two of the organisations with a climate transition plan, have a science-based target initiative (SBTI)-approved target as part of transition plan capturing scope 1 and 2 emissions (but not scope 3). Three of the organisations with a climate transition plan, do not have a SBTI-approved target as part of transition plan. Our research indicates tenants/customers place a higher value on SBTI-approved targets.

Seven of the eight respondents will be undertaking TCFD reporting for the 2023 financial year.

Dedicated climate and sustainability related capital expenditure

Six of the eight respondents have a capital expenditure budget dedicated to climate and sustainability-related improvements.

We then asked "If your organisation has a capital expenditure budget dedicated to climate activities, what percent of your overall capex budget does it represent?” This was a tough question, with many sustainability investments wrapped up in business-as-usual works, so the results need to be considered with some caution.

- Two of the eight respondents are targeting more than 10%

- One of the respondents is targeting more than 5% but less than 10%, and

- Two of the eight respondents are targeting less than 5% but more than zero of their capital expenditure budgets towards climate and sustainability-related improvements.

Three of the respondents had no percentage of their capital expenditure budget targeted specifically towards climate and sustainability-related improvements (despite one saying it had capital expenditure budget dedicated to climate and sustainability-related improvements). We find this unusual – it may reflect that sustainability investment is caught in broader capital expenditure, or it could be these organisations are underestimating the benefits of lifting sustainability credentials.

Summary: On the journey, but more work to do

Commercial real estate is one part of the economy that can make a real difference in the energy transition, with that transition valued by property tenants/clients. Harbour’s survey shows that listed New Zealand real estate owners are on the journey, but there is more work to do to sustain and grow cash flows by investing in sustainability-related initiatives. In some cases, capital markets may not be appropriately pricing sustainability risk for listed property securities. Local and global research indicates real estate assets with more sustainable characteristics tend to have less volatile cash flows, but getting to more sustainable characteristics needs commitment, capital and time. It’s not the glamorous stuff people like to talk about - it’s bottom up, hard work – hard work that we at Harbour believe represents a good investment.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.

[1] The S&P/NZX All Real Estate has 10 constituents, and our survey sample included responses from 8.