After years of most of the world sharing the common sudden stop and recovery associated with COVID-19, there are now significant differences in economic prospects across countries. These differences have led to some central banks lifting policy rates (à la Bank of Japan) while others, such as the European Central Bank, US Federal Reserve and the Bank of England have hinted at cuts. The Swiss National Bank has gone one step further and recently started its easing cycle. These diverging economic prospects and policy responses are likely to hold important implications for global asset allocators over the coming years. Bonds are perhaps the least controversial. Sure, large amounts of government bond supply and sticky inflation may provide challenges, but most markets are offering decent yield. Most importantly, bonds can provide insurance to portfolios once again should a growth shock occur, or if rates fall quicker than anticipated.

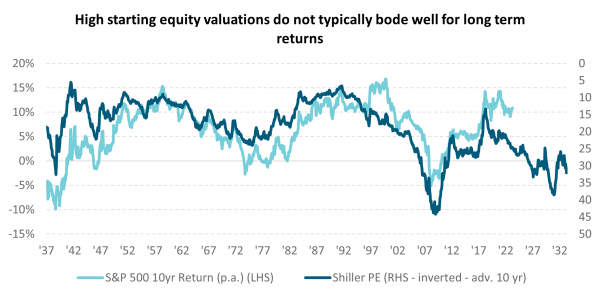

The outlook for equity markets is less clear. Valuations have reached levels which have historically preceded lower rates of return, particularly when viewed over longer time periods. While this is true in many jurisdictions, it is none more so in the US, where valuations have reached their top decile relative to the past two decades. However, this has not been without cause, the US economy, which was largely tipped to fall into recession in 2023, instead emerged as a clear outperformer, showing surprising resilience to the 525bp of Fed policy tightening. GDP growth is tracking at a healthy annualised rate of almost 3%. Households have continued to increase consumption by running down the large amount of savings accumulated in the COVID years and shielded from the full extent of monetary policy tightening by 30-year mortgages. Consumption has also been buoyed by growing household wealth, partly driven by all-time highs in the housing and stock markets.

Source: Bloomberg

It would also be unfair to mention the rally of the US equity market without acknowledging the superior earnings growth US companies have been able to generate: partly due to their economic outperformance and partly due to the advancement of Generative AI.

However, many investors have become concerned with the global equity market becoming more and more dominated by a narrow set of companies, listed primarily in the US (for example the MSCI All Countries World Index has a 62% weighting to US companies, a rise of 20 percentage points since the time of the global financial crisis in 2008). US superiority from the market’s perspective has partly been driven by the unattractiveness of other major investing jurisdictions. While we would not quite go as far as former United States Secretary of the Treasury, Lawrence Summers’ summation that “Europe is a museum, Japan is a nursing home, China is a jail”, there are structural challenges which have seen investors avoid some jurisdictions.

European equities seem to be offering decent forward earnings yields relative to local bond yields, but the economy is in a sorry state and there is skepticism around the ability for companies to achieve those earnings. The weakness in Europe is most pronounced in manufacturing, which partly relates to low Chinese demand for exports. In the case of China, it remains both cyclically and structurally challenged, with no sign that policy makers are interested in supporting an acceleration in growth. China’s recent National People’s Congress confirmed that meaningful policy stimulus remains off the table with the fiscal deficit target set at 3% this year, smaller than last year’s 3.8%. The consumer and property sectors in China remain particularly weak. Emerging markets outside of China are in better shape, particularly India which is likely to be a significant contributor to global growth this year. India grew by a whopping 8.4% y/y in Q4 2023, well above analyst expectations of 6.6%. The composition of growth is encouraging with both manufacturing and services expanding at solid rates. Political risk looks to be unusually low with the upcoming election expected to result in a stable government. However, most analysts note that the price of Indian equities already captures this positive story.

Enter Japan which, after decades of economic malaise, is experiencing a rare momentum of economic strength. This economic strength recently allowed the Bank of Japan (BoJ) to exit its negative interest rate policy for the first time since 2015 and abandon its Yield Curve Control (YCC) policy aimed at keeping 10-year Japanese Government Bond yields capped at 1%. After almost two years of inflation above the BoJ’s 2% inflation target and a year of solid economic growth, the final straw to motivate the policy tightening was a stronger-than-expected round of annual wage negotiations (“shuntō”). Initial surveys suggest wages may rise by around 5%, much higher than last year’s 3.6%. This has provided the BoJ with more confidence it will sustainably achieve its 2% inflation target and that ultra-loose monetary policy is becoming less necessary.

The story is a positive one for Japanese equities given the underlying drivers of the policy change are likely to be helpful for company earnings; strength in the domestic economy and greater increases in household income should support consumption growth. An additional source of encouragement for Japanese equities comes from the Tokyo Stock Exchange’s focus on enhancing shareholder returns. This has resulted in numerous examples of companies restructuring, stock buybacks and dividends, which have been viewed positively by the market. This has helped to address a perennial bugbear for foreign investors in the balance sheet management of Japanese companies, specifically the high levels of cash held on balance sheets.

Recent developments in Japan have caught the eye of global equity investors as they sit in the context of a Japanese equity market that has, for a long time, offered high forward-looking earnings yields relative to local bonds. Higher share prices and higher bond yields over the next 1-2 years may represent the beginnings of a normalisation in Japanese financial markets after decades of dysfunction. While it is hard to fight the demographics picture, which is still relatively grim, we can see why Japan is finding favour. Particularly in a world where others, China and Europe especially, are facing more grave challenges.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.