Since mid-July global equity market prices have fallen by around 5% as a range of risk factors have risen to the top of investors’ considerations. The drivers for a selloff are rarely perfectly clear and generally include broader economic, positioning and technical influences. When markets were travelling well in the first half of 2024, you could be forgiven for thinking that conditions were like a perfect winter’s day in Wellington.

However, it’s not quite true that the skies are clear. For some time, the combination of the Japanese ‘carry trade’ [1] and elevated US technology valuations have cast a shadow over investors grazing on momentum. It’s not usually just one thing that sparks an outsized move in cross-asset valuations.

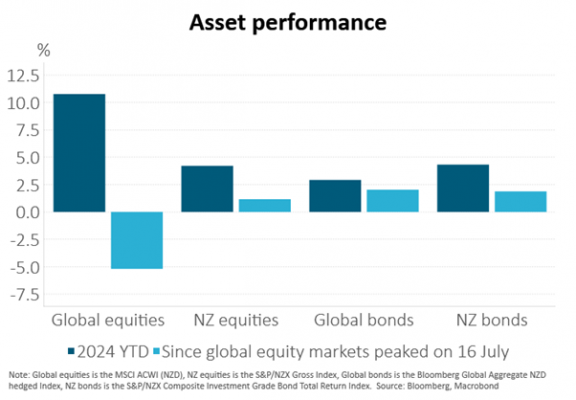

Many commentators have jumped in and provided context on the rise in volatility across markets. We shouldn’t lose sight of the fact that global equity markets are still well in positive territory year to date, and that likely reflects the fact that, in broad terms, corporate earnings are still performing well.

Nevertheless, an earlier-than-expected Bank of Japan rate rise of 0.15%, combined with a ‘shock’ at the magnitude of the increase, sent Japanese equity markets into a tailspin. The race to the other side seemed disproportionate to the rate shock. For example, the Bank of Japan abandoned negative rates in March, and markets didn't blink. This time the background was that global investors had been increasing their exposure to Japanese equities with Berkshire Hathaway, for instance, lifting weights to five of the largest financial stocks over the last year. As a result, Japanese stocks were likely a decent overweight among many global portfolios. Perhaps the financial earnings results released last Friday of Japanese companies like Daiwa Securities and index heavyweight, Mitsubishi UFJ Financial Group, had mildly disappointing outlooks albeit consensus earnings estimates have hardly budged. To our mind, the end of deflation in Japan, and signs of a normalisation in policy, might ordinarily be marked as better signals for investors. A recovery in Japanese equity prices was well established as this note went to print.

The rolling bout of perceived negative news last week made its way to the US where the labour market data for July showed a rise in non-farm payrolls of only 114,000, with a decline in aggregate hours worked across sectors. The unemployment rate increased to 4.3% from 4.1%. These data have been pored over by dozens of economists who dispel the evidence for the Sahm Rule implying a leading indicator of a recession.[2] For instance, the Vanda research team points out that a US recession is typically preceded by a negative non-farm payrolls print. Considering this, 114,000 new jobs is hardly a negative print, especially when adjusted for the impact of Hurricane Beryl. The subsequent July US services sector purchasing managers’ index gave a more sanguine tone to the US economy. The US economy tracker, called the Atlanta Fed GDPNow, is still running at 2.5%.

When we look at asset class returns year to date, performance remains positive across all the asset classes, and despite the sell-off (or perhaps profit-taking) in global equities since the recent peak of 16 July, New Zealand equities, global and New Zealand bond returns have all been positive.

The global equity and broad bond market response in recent days is not solely based on the Japanese equity market collapse or weaker US data, but possibly also on the complex tracking of the US election, geopolitical risks, the unwinding of global carry trades and the positioning of consensus longs in equities as risk parity investors exit. The sharp initial negative move in momentum factors indicated some leverage in these positions. However, more recent equity weakness was broader, signalling a general desire for risk off, as opposed to focussing on one or two factors.

It is hard not to respect the rise in equity volatility, especially if volatility falls back in coming weeks. However, examining the past seventeen periods when the equity market volatility indicator dating back to the 1980’s, the VIX, has touched these levels in the past, it has typically preceded periods of strong gains. Excluding the recession periods of 2000 and 2008, the skew in prospective returns has been quite positive. That likely highlights the market concern with US recession risks, which will continue to bring into question the prospect of Fed interest rate cuts.

Along with equity volatility signals, fixed income markets need some respect as well, providing a cushion to portfolios during this recent bout of volatility. The pulling forward of interest rate cuts in the US and in New Zealand has been very swift, and while the direction and magnitude of these fixed interest market moves are in line with our thinking, the speed of the shift likely means we could see some reflection on whether central banks will move that quickly. In a revealed preference we have reduced our long duration positions in New Zealand fixed income portfolios, although we remain slightly long. This decision reflects the observation that the market is now pricing in a fairly rapid and significant easing in monetary policy by the RBNZ, something we have been calling for over the last few months.

Ordinarily in a risk off environment we might expect weakness in the New Zealand dollar. This hasn’t eventuated, and again the market could be signalling that the kiwi dollar is already reasonably stretched on valuation grounds. We have removed our short position on the New Zealand dollar in what little weakness we have seen.

Turning to equities, in a risk-off, or higher volatility period, bond-equity correlations have typically broken down. While we may see a recovery in markets from oversold levels, based on previous high volatility periods, the reduction specifically in US technology stock valuations could also be telling investors something about the trade-off between continued high capital expenditure and uncertainty over the delivery of earnings. A high valuation world is sensitive to economic and earnings news. We have moved from an underweight to Australasian and global equities in multi asset portfolios to a more mild underweight, adding to our equity weightings, especially in New Zealand and Australia.

Australasian equity markets have had little very recent economic or earnings data to provide a local shock. In New Zealand, the equity market responded positively in July to the prospect of rate cuts, but now faces a continued challenge in earnings for cyclical companies. Perhaps more defensive growth companies - for instance in the healthcare sector and quality growth stocks - will perform well. We added at the margin in the turmoil of markets to our existing top-rated stocks, from cash.

Finally, it is possible that in the Northern Hemisphere summer holiday season, that light trading volumes continue to elevate volatility. With questions over economic growth, the US elections, geo-politics and the actions of central banks, markets will always have something to worry about. To our mind, recent developments continue to support diversified portfolios and longer-term investors are likely to review this period of volatility much like other periods over the last 30 years. Either as a time to add to portfolio positions or remain watchful with no need to stampede.

[1] A carry trade is where an investor borrows in a currency where interest rates are lower and invests in a currency where interest rates are higher.

[2] The Sahm rule, named after Federal Reserve Economist Claudia Sahm, indicates that the early stages of a recession are signalled when the 3-month moving average of the US unemployment rate is 0.5% or more above the lowest 3-month moving average unemployment rate over the previous 12-month period.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.