Key market movements

- MSCI All Country World Index (ACWI) posted another strong return in July, at 4.2% in New Zealand dollar-unhedged terms for the month. Returns in NZD-hedged terms were much lower due to further NZD weakness, coming in at 1.3%. Performance across sectors was mixed with a rotation away from the recent outperforming sectors of IT (0.1% m/m) and communication services (-0.7% m/m), in favour of utilities (8.6% m/m), financials (7.6% m/m) and industrials (6.8% m/m).

- Locally, market returns for the month were spectacular after a weak June, with the S&P/NZX 50 Gross Index (with imputation credits) returning 5.9%, and the S&P/ASX 200 Index returning 4.2% (4.6% in New Zealand dollar terms).

- Bond indices were also impressive over the month. The Bloomberg NZBond Composite 0+ Yr Index rose 2.3%, whilst the Bloomberg Global Aggregate Bond Index (hedged to NZD) rose 2.0% over the month. 10-year government bond yields in the US were 37bps lower on the month, ending at 4.03%, whilst in New Zealand the 10-year yield fell 33bps to end at 4.34%.

Key developments

In the United States, stronger-than-expected GDP growth of 2.8% annualised in Q2 raised hopes for a soft landing and delayed the Federal Reserve's potential easing cycle to September. This growth, driven by inventory investment and consumption, was double the pace of Q1. With core PCE inflation steady at 2.6% in June and CPI inflation falling to 3.0%, Fed Chair Jerome Powell expressed increasing confidence that inflation is nearing the 2% target. The moderation in core inflation, particularly in shelter costs, and a possibly peaking labour market have led to speculation that the Fed may soon begin easing, though there remains debate on the extent of future rate cuts.

Globally, the European Central Bank kept rates unchanged in July but signalled openness to cuts if economic data supports them, with markets predicting a high chance of a rate cut in September. The Bank of Canada also cut rates by 25 bps to 4.50%. In Australia, lower-than-expected Q2 core inflation led to a re-evaluation of future rate hikes, with markets now expecting cuts by year-end. In China, the 3rd Plenum focused on structural challenges and long-term reforms, despite the economy growing 4.7% y/y in Q2, at the lower end of the official target.

In New Zealand, the Reserve Bank of New Zealand (RBNZ) unexpectedly signalled a dovish shift at its July Monetary Policy Review, hinting at an earlier start to its easing cycle due to economic weakness. The RBNZ stated that, while policy needs to remain restrictive, the extent will be tempered as inflation pressures decline. The Q2 Quarterly Survey of Business Opinion showed a weakening economy and less labour constraint, aligning with a drop in headline inflation to 3.3% y/y and core inflation to 3.6%. These factors suggest the RBNZ could begin cutting rates soon, possibly as early as August, depending on further economic developments.

What to watch

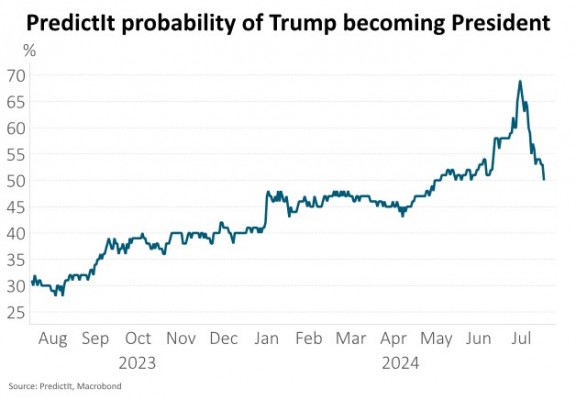

Trump’s probability of becoming the next US President dropped significantly last month after current President Joe Biden dropped out of the election race. Sitting Vice President, Kamala Harris, is now the Democratic nominee to replace Biden. According to PredictIt, odds of Trump winning the 5 November election have dropped to c.50%, from c.70% prior to Biden’s withdrawal. As such, market prices have moved to reduce the risk of more inflationary fiscal policy, including an extension of the 2018 Trump tax cuts (part of the Tax Cuts and Jobs Act of 2017), increased trade tariffs and greater immigration restrictions.

Market outlook and positioning

The New Zealand share market may have the potential to stand out in a globally slowing economic environment. With the country already likely in recession, there is hope for economic growth over the next three years as interest rates normalise and policy adjustments provide a more supportive business environment. However, there is a risk that conservative outlooks from companies, particularly cyclical ones, could temper expectations, especially as economic activity remains weak in New Zealand and peaks in Australia.

The broader outlook remains cautiously optimistic, with interest rate cuts and an economic policy reset expected to boost productivity and market performance. Despite potential short-term volatility, including the impact of mixed profit results and geopolitical risks, the medium-term prospects for New Zealand shares appear brighter. Companies with strong earnings growth potential are likely to be key drivers of market returns, especially as the market adjusts to new economic realities.

In Australia, the outlook for equities over the next 12-18 months remains positive, though there may be near-term challenges. Recent earnings revisions indicate a possible peak, especially in sectors like materials and energy. As markets consolidate, there is anticipation of a rotation, with expectations of interest rate cuts potentially affecting valuation multiples, particularly for banks. Overall, while the near term may bring volatility, the disinflationary backdrop, lower rates, and increased liquidity are expected to support medium-term share market returns. The focus remains on companies with sustainable earnings growth, as they are best positioned to capitalise on the evolving market conditions.

Within equity growth portfolios, Harbour’s strategy remains to be patient, position for a range of scenarios and to be selective, focusing on quality growth. We continue to see the secular tailwinds of digitisation, disruption, de-carbonisation, and demographic changes as supporting company earnings. Within the portfolio we are selectively overweight growth at a reasonable price (GARP) shares in the healthcare, information technology, financial services and materials sectors given they offer the potential for compound growth. While the healthcare sector may remain dynamic and face further disruption from innovative technology, the reset in investor expectations and valuation multiples provides us with the confidence to sustain a relatively large but share-specific investment in this proven compound growth, wealth-creating investment sector. The IT sector’s secular growth potential is underscored by the runway remaining in generative artificial intelligence (GenAI), improving IT budgets, and expectations for improving margins but we are mindful of share price valuations. We favour businesses with productivity and efficiency ‘self-help’ programmes, particularly where business reengineering introduces technology that improves both revenue and cost structures. We continue to have a bias to quality, well-capitalised businesses that are well-positioned to fund value-adding growth opportunities. The portfolio remains underweight in the lower-growth utilities, telecommunications, infrastructure and real estate sectors.

Within fixed interest, our investment strategy in July continued to focus on the perceived opportunity to profit from a more rapid easing in monetary policy in New Zealand than had been priced into markets. The rapid slowdown in the economy and diminishing inflation pressures coming from softness in the labour market suggested that the evidence exists for a clear shift in the strategy employed at the RBNZ. We are now seeing this happen, although just how quickly, and to what extent, the OCR is cut remains to be seen. As at the end of July, the market is pricing a fall in the OCR below 4% by mid-2025 and to 3.25% by mid-2026. A significant repricing has now occurred, arguing for our strategy of positioning for lower rates to be dialled back. To some extent we have done so. From here, we still see scope for even lower rates, taking policy into genuine neutral territory, but this would be conditional on the economy suffering a more protracted recession, or for global risks to arise. At present, we see these as possible scenarios, rather than strong likelihoods. Accordingly, strategy shifts to other areas of focus. These include increasing exposure to NZ Government Stock, at the expense of high-grade credit and interest rate swaps, which have both been strong outperformers. We assess that risks associated with heightened supply of government bonds are now largely priced in. In addition, with much easier monetary policy now anticipated, longer-dated bonds are looking more attractive than previously, but this may be a strategy to be patient with.

Within the Active Growth Fund, we have used the strength in fixed income markets to reduce our overweight towards more neutral levels. Within equity markets, we see scope for the New Zealand market to further close the performance gap vs. global equities. This is based off three key factors, firstly the valuation picture is more favourable. Secondly, the earnings cycle seems to be closer to the bottom. Lastly, there could be more of a bid tone to some of the more defensive sectors which are more prevalent in the New Zealand market, with many companies’ dividend yields starting to look more attractive relative to falling bond yields.

Throughout most of 2024 the Income Fund strategy has been focused on the perceived opportunities and risks that we identified as the New Zealand economy started to slow down in response to the tight monetary policy set by the RBNZ. Our expectation was that inflation would fall and that the RBNZ would shift towards rate cuts, something that the market was not fully pricing in, in our view. Over recent months the market has shifted towards our view and, in July, the RBNZ indicated that they were now seeing enough to make a similar judgement. We still await the Monetary Policy Statement due to be released on 14th August, where a full set of fresh forecasts will be released.

We have seen both bond yields and the New Zealand dollar decline, with appropriate investment positioning in the Fund enabling investment returns to exceed the benchmark. In both of these markets we consider that there is scope for further, but rather limited, additional falls in the near term. We have trimmed fixed interest positions for now. There is a reasonable possibility that the New Zealand economy persists in a weak state for some time, in which case it may be necessary for the OCR to be lowered towards 2%. However, it would likely take some time for that prospect to pan out and we want to see further evidence before positioning for that.

In credit markets, default risk is climbing but not yet to a worrying degree. Here, there is a likelihood that things get worse before they get better, and we are retaining a fairly cautious approach towards investments. In equity markets, the pivot by the RBNZ, encouraged investors to reduce their fears of an ongoing, deep recession that would knock corporate earnings, especially at cyclically exposed firms such as those in the building and hospitality sector. In the Fund we have added to equity exposures likely to benefit from a less dire economic outlook, mindful that they do not have the stable characteristics that we typically seek to invest in. This decision has been beneficial, but still only made up about a third of overall equity exposure. With the defensive equities being eschewed in favour of cyclical ones, Fund performance did suffer during July. We plan to continue to hold this mix of equities while the market responds positively to the RBNZ's change in direction, before reverting to norm at some stage in the future. That could well be some time away.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.