Key market movements

- MSCI All Country World Index (ACWI) posted a strong return in June, at 3.1% in New Zealand dollar-unhedged terms for the month. Returns in NZD-hedged terms came in at 2.6% after New Zealand dollar weakness. Performance was again mixed from a sector perspective. Information technology surged ahead by 10.0%, followed by communication services at 4.6%. Utilities and materials were the worst performing sectors at -3.8% and -2.8% respectively. Reflecting the narrowness of this recent market rally – three companies (NVIDIA, Microsoft and Apple) each delivered larger contributions to the total index return than the entire communication services sector over the month.

- Locally, market returns for the month were mixed with the S&P/NZX 50 Gross Index (with imputation credits) returning -1.2%, and the S&P/ASX 200 Index returning 1.0% (2.1% in New Zealand dollar terms).

- Bond indices were also positive over the month. The Bloomberg NZBond Composite 0+ Yr Index rose 1.0%, whilst the Bloomberg Global Aggregate Bond Index (hedged to NZD) rose 0.9% over the month. 10-year government bond yields in the US were 10bps lower on the month, ending at 4.4%, whilst in New Zealand the 10-year yield fell 14bps to end at 4.7%.

Key developments

The global economic landscape has been marked by a series of notable events over the past month. In the United States, the economy has shown signs of resilience despite mixed signals. Inflation rates have come in lower than expected, which has led to speculation about potential rate cuts by the Federal Reserve within the year. However, this optimism is tempered by disappointing retail sales figures, indicating that consumer spending—a key driver of economic growth—is not as robust as hoped.

In contrast to the US, the Reserve Bank of Australia (RBA) is grappling with persistent inflation pressures, which may necessitate an increase in interest rates. This hawkish stance is somewhat at odds with the global trend among central banks, many of which have begun easing monetary policy. For instance, the Swiss National Bank has implemented rate cuts and, while the European Central Bank (ECB) has been more cautious, it too is considering a more accommodative stance.

New Zealand's economic indicators have been sending mixed signals as well. Forward activity indicators point towards a potential contraction in GDP for the second quarter, with a notable decline in GDP per capita and a contraction in the services industries. The labour market is showing signs of loosening, with a decrease in job advertisements and an anticipated acceleration in unemployment rates. The Reserve Bank of New Zealand (RBNZ) is thus faced with the delicate task of balancing the risks of inflation against the possibility that inflation may decline more rapidly than expected over the medium term.

What to watch

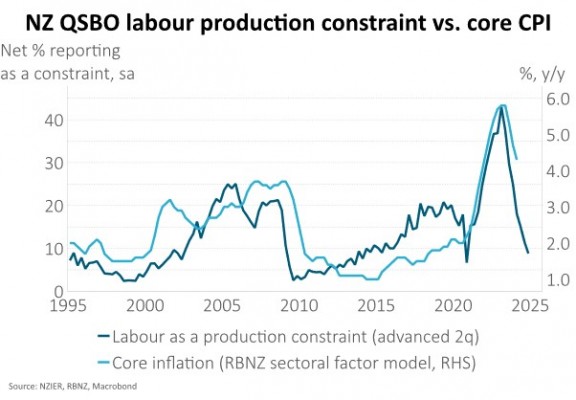

One of the most important parts of the recently released New Zealand Institute of Economic Research’s Quarterly Survey of Business Opinion (QSBO), in our view, was the further decline in reports of labour as a constraint to production, with just 9% of businesses citing this a major constraint. This is likely to get the RBNZ’s attention after it recently found this “less conventional” measure of economic slack has a better relationship with inflation than the unemployment rate[1] and implies inflation should soon return to target.

Market outlook and positioning

While mixed, the global economic framework remains broadly positive for share market returns with lead economic indicators suggesting solid but not spectacular global growth for the coming year and inflation continuing to slow. The disinflationary trend means some central banks, including the RBNZ, may be edging their way to less restrictive monetary policy, but stubborn inflation means others such as the RBA may still lift rates, or maintain restrictive settings for longer. This macro backdrop may be constructive for equity returns but capital markets might continue to walk the tightrope of disinflation and growth. Investors should be cautious of relying on continued momentum from secular market themes.

Globally, investors' positions are fully committed with minimal risk margins, which may prove reasonable if profit growth continues to beat projections. In contrast, domestic investment in New Zealand stocks remains below long-term targets. Geopolitical risks, including major elections in the US, France, and the UK, might lead to greater political unpredictability for market participants.

In New Zealand, after three years of downward forecast revisions, the earnings cycle for the share market might be approaching a turning point. The New Zealand share market currently stands at a high valuation, with its price to next twelve-months earnings (PE) ratio at 22x, compared to a five-year historical average of 20.8x (COVID period excluded). For the New Zealand market to deliver better returns, there will need to be a shift in earnings momentum from negative to consistently positive.

Within equity growth portfolios Harbour’s strategy remains to be patient, position for a range of scenarios, be selective and focus on quality growth. We continue to see the secular tailwinds of digitisation, disruption, de-carbonisation and demographic changes as supporting company earnings. Within the portfolio, we are selectively overweight growth at a reasonable price (GARP) shares in the healthcare, materials, information technology and financial services sectors, given they offer the potential for compound growth. While the healthcare sector may remain dynamic and face further disruption from innovative technology, the reset in investor expectations and valuation multiples provides us with the confidence to sustain a relatively large but share-specific investment in this proven compound growth, wealth-creating investment sector. The information technology (IT) sector’s secular growth potential is underscored by the runway remaining in GenAI, improving IT budgets, and expectations for improving margins but we are mindful of share price valuations. We favour businesses with productivity and efficiency ‘self-help’ programmes, particularly where business re-engineering introduces technology that improves both revenue and cost structures. We continue to have a bias to quality, well-capitalised businesses that are positioned to fund value-adding growth opportunities.

Within fixed interest, we remain overweight interest rate exposure over the medium-term. Our investment strategy continues to focus on our assessment that inflation will fall quickly enough and meaningfully enough to drive the RBNZ to cut the Official Cash Rate (OCR) considerably in 2025, with a feasible start in November this year. An even earlier start is possible, but not our base case. The basis of our judgement relies on two aspects. Firstly, with the economy operating below par and the labour market in sharp reversal from previous tight conditions, we see inflation falling inside the 1% to 3% band around the end of this year. This will make the existing tight monetary conditions unnecessary. Secondly, given the lags that apply to monetary policy, and with fiscal policy also becoming more restrained, the forward-looking prospects for an economic recovery look to be some time away. That suggests that 2025 could also be a soft year, taking inflation pressures even lower. Under that scenario, we could see the OCR be lowered to near a 'neutral' level, around 3%, while the market at present only anticipates the OCR getting to 4%. The risks around this scenario are that the economy proves to be more resilient and/or that core inflation proves sufficiently sticky to cause the RBNZ to take a very gradual path towards rate cuts. We know that some aspects of inflation (e.g. council rates and insurance) are likely to stay elevated. There is very little that monetary policy can do about these aspects. However, the RBNZ's mandate is also to avoid undue volatility in the economic cycle and we expect that ongoing tight policy could do more damage to the jobs market and the broader economy. At some point this could become a consideration for the RBNZ. Our core view, which we have with some conviction, is that the fixed interest market is priced with a skew towards offering scope for strong returns over the next 12 months.

In the Active Growth Fund we remain cautiously underweight equities, as we continue to believe that valuations are stretched. The breadth of valuation expensiveness has broadened in recent months, though this is partly due to strong positive earnings revisions. It is a good reminder that valuations can remain stretched as long as there is confidence in earnings numbers. With valuations pointing to below average 12-month returns, sentiment remaining on the wrong side of neutral and equity earnings yields below bond yields, we still think it is prudent to hold less equities relative to benchmark. This partly reflects our higher conviction view in New Zealand bonds which is covered in the previous section.

The Income Fund remains positioned for interest rates to fall. The New Zealand fixed interest market performed well in June, as data continues to point to falling inflation pressures. The weakness in the economy, particularly in the labour market, is seen as the driver for lower inflation and this has led the market to anticipate cuts in the OCR from November this year, despite the RBNZ projecting no cuts until 12 months later. This enabled the Fund return to be quite solid, despite an essentially flat performance from the Australasian share market. The bias of Australasian equity holdings is not focused on cyclically exposed companies and it has been these that have mostly held the share market back. However, the Fund does have a 2.5% weight to listed property, which is where some of the impact of the weakening economy has been felt. There has been a larger benefit gained from the fixed interest positioning, especially as we have extended the duration of securities held, thereby locking in the high yields that are currently available. The portfolio gross return for the month was 0.78% and has been 8.50% over the last 12 months.

[1] See RBNZ Analytical Note - The resurgence of the New Zealand Phillips curve, 19 June 2024.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.