Key market movements

- MSCI All Country World Index (ACWI) was stable in May with a return of 0.2% in New Zealand dollar-unhedged terms for the month. Returns in NZD-hedged terms were considerably better at 3.7% after a combination of US dollar weakness, and New Zealand dollar strength on the back of supportive Chinese policy. Performance (unhedged) was mixed from a sector perspective, with only information technologies, utilities, and communication services sectors in positive territory. This is a further continuation of the phenomenon we are experiencing where Big-Tech style companies with high earnings are being treated as a defensive play, alongside the traditional defensive sector of utilities.

- Locally, market returns for the month were also weak with the S&P/NZX 50 Gross Index (with imputation credits) returning -0.7%, and the S&P/ASX 200 Index returning 0.9% (-0.6% in New Zealand dollar terms).

- Bond indices were also positive over the month. The Bloomberg NZ Bond Composite 0+ Yr Index rose 0.9%, whilst the Bloomberg Global Aggregate Bond Index (hedged to NZD) also rose 0.9% over the month. 10-year government bond yields in the US were nearly 20bps lower on the month, ending at 4.5%, whilst in New Zealand the 10-year yield fell 10bps to end at 4.8%.

Key developments

The New Zealand economy is currently navigating through a period of adjustment, with the Reserve Bank of New Zealand (RBNZ) focusing on reducing non-tradable inflation, which is running close to 6% year-on-year. Despite recognizing that factors such as rents, insurance, and rates are near-term influences that monetary policy can do little about, the RBNZ's hawkish outlook is supported by changes to technical assumptions like lower productivity and a higher assumed neutral Official Cash Rate (OCR). This suggests that a rate cut in November is more likely than in August, although interest rates are expected to decline as the economy slows, inflation continues to drop, and the labour market loosens more quickly than the RBNZ assumes. Additionally, the government's tax cuts, effective from 31 July, alongside a weaker economic outlook leading to reduced tax revenue, have resulted in a $12 billion increase in the government bond program over the next four years. This fiscal policy is anticipated to contribute to economic growth over the coming year.

Over the last month, global markets and economies have experienced significant movements. The US economic data has shown mixed results, with minimal expected rate cuts and a resilient economy, as real-time indicators suggest an annualized Q2 GDP growth of 1.8%. The Federal Reserve has indicated a cautious approach towards rate adjustments, emphasizing the need for sustained confidence in inflation moving towards the 2% target.

In Europe, economic prospects have brightened, with the economy emerging from recession and the European Central Bank (ECB) initiating an easing cycle in response to stable inflation and employment growth. Conversely, China's growth remains subdued due to cautious consumer spending and a struggling property sector, despite a boost from strong US consumer demand.

The Reserve Bank of Australia (RBA) has downplayed recent inflation surprises, with expectations of easing towards the year's end, while the Reserve Bank of New Zealand (RBNZ) has taken a surprisingly hawkish stance, forecasting a higher peak Official Cash Rate (OCR) and delaying rate cuts to the second half of 2025.

What to watch

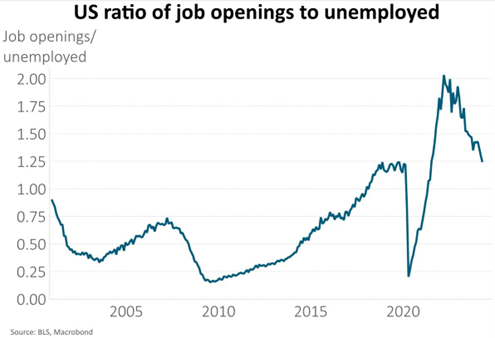

US Fed Chair, Jerome Powell’s, favoured measure of labour market pressure – the number of job openings per unemployed person, returned to pre-COVID levels last week. The Fed is likely to be pleased with Powell noting in the May decision press conference that the drop in job openings was evidence of labour demand cooling and helped to give the Fed confidence that policy is sufficiently restrictive to get inflation back to 2%. Friday’s labour market data, however, may provide the Fed with some further food for thought!

Market outlook and positioning

Looking ahead, the global and New Zealand financial markets present a complex outlook. Share markets are grappling with the rate of economic slowdown and potential central bank policy shifts. New Zealand's share market has lagged behind in recent years but showed signs of resilience in the latest earnings season, suggesting a potential shift from negative to positive earnings trends.

The New Zealand Aluminium Smelter (NZAS) contract outcome has provided New Zealand's electricity generators/retailers with greater cash flow certainty, which may catalyse a green energy revolution akin to the US post-Inflation Reduction Act (IRA). Australian market earnings are seeking a trough, with the Fair Work Commission's recent wage increase announcement potentially easing inflation pressures and allowing for a gradual easing cycle in late 2024.

Valuation multiples in New Zealand and Australia remain full, but underlying disinflation and the possibility of increased merger and acquisition activity could offer opportunities for income-focused investors. A constructive view on share markets is retained, with moderate economic growth and reasonable liquidity supporting returns, albeit with caution towards cyclical companies.

Within equity growth portfolios Harbour’s strategy remains to be patient, position for a range of scenarios, be selective and focus on quality growth. We continue to see the secular tailwinds of digitisation, disruption, de-carbonisation and demographic changes as supporting company earnings. Within the portfolio we are selectively overweight growth at a reasonable price (GARP) shares in the healthcare, materials, information technology and financial services sectors, given they offer the potential for compound growth. While the healthcare sector may remain dynamic and face further disruption from innovative technology, the reset in investor expectations and valuation multiples provides us with the confidence to sustain a relatively large but share-specific investment in this proven compound growth, wealth-creating investment sector. The information technology (IT) sector’s secular growth potential is underscored by the runway remaining in GenAI, improving IT budgets, and expectations for improving margins but we are mindful of share price valuations. We favour businesses with productivity and efficiency ‘self-help’ programmes, particularly where business reengineering introduces technology that improves both revenue and cost structures. We continue to have a bias to quality, well-capitalised businesses that are positioned to fund value adding growth opportunities.

Within fixed interest, we remain overweight interest rate exposure over the medium-term. Rhetoric by the RBNZ Monetary Policy Committee members post the May MPS did not indicate OCR rises from 5.5% are likely. However, given revised assumptions of productivity and potential growth drove a lift in the OCR track, investors are left to digest what fundamental adjustments their economic research process may adopt in the future and how the committee will process them. The other interesting aspect to consider is the effect of fiscal policy on interest rates. The budget, released after the RBNZ meeting, produced a fiscal path that is less contractionary for the July 2024-2025 year as a result of income tax cuts. Markets can debate the extent of consequent spending or saving, but there is uncertainty over how much detail was captured in Treasury briefings to the RBNZ and incorporated by the MPC. August will reveal their complete interpretation. We believe that market pricing of a c. 4.0% OCR low in a few years’ time is insufficient for this economic cycle and weak growth will eventually require more cuts by the RBNZ.

The Active Growth Fund is defensively positioned, being overweight bonds and underweight equities. Despite the recent pullback in global share markets, the current risk/return proposition remains far less than compelling, and we may see a continued period of consolidation in global equity markets. At a headline level, global equity markets (measured by the MSCI ACWI Index) are trading at their 90th percentile valuation when compared to the past 20 years, which is expensive in absolute terms. However, when we look at the forward-looking risk premium relative to bonds, we see an even more extreme outcome, trading at 100th percentile (i.e. expensive relative to history). These valuation levels have historically preceded below-average returns in the following 12 months, which makes us wary of holding a higher weight to equities.

The Income Fund remains positioned for interest rates to fall but the position has been moderated. In our view, the NZ economy is in poor shape and doesn’t need the degree of monetary policy restriction that is currently being imposed. While the RBNZ’s pivot at its May OCR decision makes it clear the central bank isn’t interested in entertaining such a thought with inflation still meaningfully above target, we expect in the second half of this year the RBNZ will pivot and recognise the degree of economic weakness and become more forward looking. It is acknowledging the RBNZ’s viewpoint that this position has been moderated. Additionally, NZ rates are also impacted by global bond markets and here the US doesn’t look like an economy that needs help and consequently we think Fed rate cuts this year are likely to be minimal, versus market pricing of 35-40bp of cuts, further reinforcing our decision to manage risk and reduce exposure to interest rates. We continue to remain broadly comfortable with the credit worthiness of the issuers in New Zealand credit markets, but we are unenthused by pricing, which perhaps doesn't fully compensate investors for this stage of the cycle and have consequently not replenished lower credit quality maturities.

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.