Key developments

It was a strong month for absolute returns in New Zealand asset classes in August, with the NZX50 sharemarket index rising around 4.4% and the NZ Government bond index generating a return above 1.2%. This strong performance of financial markets sat in sharp contrast to the continued weakness of New Zealand business confidence, which is shaping the political and policy-making environment.

As usual there was a laundry list of global developments highlighting the ongoing risks to the global backdrop: heightened US trade tensions, this time with Canada; wobbles in the Italian banking sector and sovereign bond market; emerging market strains in Turkey and Argentina; and political changes in Australia generating the 5th prime minister in five years. Despite these developments and headlines, global macroeconomic data, particularly in the United States, continued to show a picture of solid actual economic activity running near economists’ expectations.

However, in New Zealand, as with recent months, domestic factors dominated.

The first domestic event was the August Monetary Policy Statement (MPS). The RBNZ surprised markets by shifting the projected start date of any hiking cycle a full 12 months into 2020, and publishing a relatively aggressive alternative scenario that would see the RBNZ cutting 100 basis points if GDP growth disappoints. With a new Governor and new Policy Targets Agreement (PTA), it turned out to be the first real chance to gain a read on the new regime at the RBNZ.[1] In our view, the MPS illustrated the RBNZ’s willingness to use the full width of the 1-3% inflation target range; take a broad interpretation of the new dual mandate; and encourage a lower New Zealand dollar to assist in the transition in growth from the domestic economy to export-oriented sectors. The market is now pricing a 50% chance of a 25-basis point cut in 12 months’ time, and the 2 year swap rate is below 2%.

The second event was the New Zealand company reporting season. This produced sales results broadly in line with consensus, although, if anything, underlying earnings results were a little weak. Earnings guidance seemed to be negatively skewed for the average stock with earnings estimates for the next 12 months slightly lower. With that as a back drop, the strong performance of the New Zealand market was rather surprising and reflected idiosyncratic factors with a number of the larger-cap stocks, such as a2 Milk, Ryman and Fisher & Paykel Healthcare, driving the market ahead. The fall in the New Zealand dollar also probably assisted sentiment for some exporting stocks.

What to watch

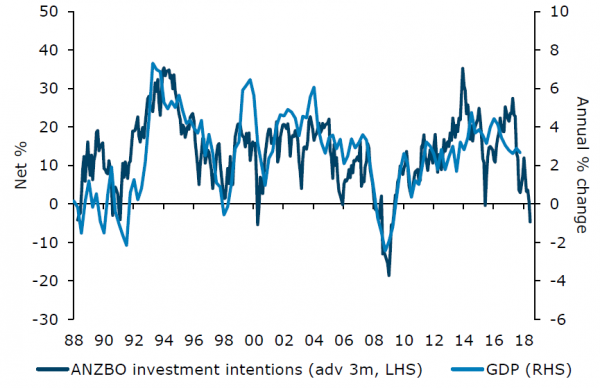

A key part of the RBNZ’s decision to move to a more dovish stance on monetary policy, and signal the chance of interest rate cuts, was the recent fall in business confidence. While the initial reduction in business confidence around the time of the election in late-2017 could be discounted as a political hangover or protest vote, the more recent fall in mid-2018 suggests the heightened chance of a slowdown in actual economic activity. ANZ’s monthly Business Outlook Survey, when combined with the ANZ Consumer Confidence Survey, corresponds with GDP growth slowing from in excess of 4% to below 2%. The investment and employment components of the ANZ survey suggest a more material contraction. NZIER’s more comprehensive Quarterly Survey of Business Opinion (QSBO) released in early October will provide an important cross check.

Chart 1. ANZBO investment intentions and GDP

Source: ANZ, Statistics New Zealand.

As well as well as the RBNZ showing a willingness to step in and support the economy if GDP growth falters (as illustrated in RBNZ’s aggressive alternative scenario that would see the OCR cut by 100 basis points), they have also been acting as a cheerleader, encouraging other commentators to look beyond low business confidence as an aberration and focus on other positive aspects of the economy.

Interestingly, in late September, Statistics New Zealand will release the Q2 GDP growth outturn, which will provide a backward-looking gauge on the starting point for the economy. In the August MPS, the RBNZ projected a 0.5% outturn for the quarterly Q2 GDP release; whereas estimates from bank economists range from 0.7% to 1.0% for the quarter, based in part on strong component indicators such as the 1.1% outturn for quarterly retail sales. So, there may be some scope for Q2 GDP to exceed the RBNZ’s published projection, illustrating that all is not doom and gloom.

Market outlook and positioning

In fixed interest portfolios, we can see that the new RBNZ regime is likely to be more proactive, taking the dual mandate (of employment and inflation) seriously. Looking ahead, we expect OCR decisions will become more data dependent – hinging in part on whether the fall in business confidence flows into actual economic activity. Our strongest view is that the implied market pricing of future inflation at 1.1% is too low, and should rise either through a recovery in business confidence or if the RBNZ acts by cutting the OCR aggressively to lift inflation and employment growth. As such, we see New Zealand government inflation-indexed linked bonds at very attractive valuations, with these bonds providing very cheap protection against inflation rising back to the mid-point of the RBNZ’s inflation target.

In equity portfolios, our strategy is to be overweight versus benchmark in selected quality growth companies in the financials, consumer staples and information technology sectors, where the potential rate and sustainability of growth may not be fully reflected in share prices. Conversely, we are underweight in the New Zealand consumer discretionary and energy sectors where disruption risk remains high, and real estate, utilities and telecommunications sectors where valuations are high relative to their potential growth.

[1] Harbour Navigator: “Regime Change at the RBNZ?”, 14 August 2018.

This column does not constitute advice to any person.

www.harbourasset.co.nz/disclaimer/

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.